What is Bitcoin halving?

The Bitcoin halving is a fundamental aspect of the Bitcoin protocol, occurring roughly every four years to curb Bitcoin's supply and create scarcity.

Following a halving event, miners receive half the previous block reward for mining, effectively reducing the reward from 50 bitcoins per block initially to 3.125 bitcoins after four halvings. This adjustment is made by halving Bitcoin's rate of issuance - a contractionary policy in view that Bitcoin is a means of payment. Having this at Bitcoin's inception, this mechanism underlies Bitcoins for a potential bullish market narrative.

Bitcoin blocks

Here is what the historical data reveals

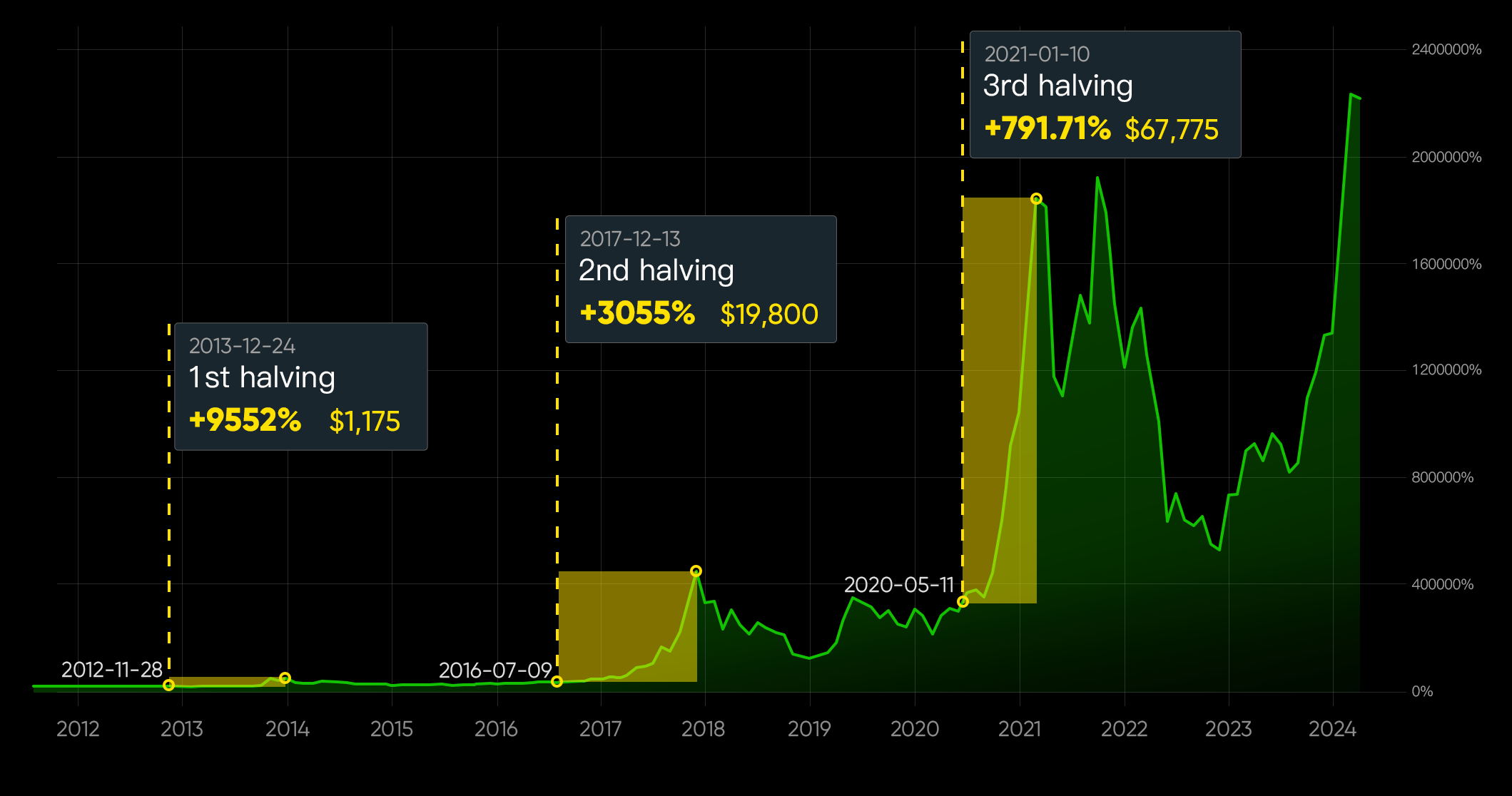

History doesn't merely repeat itself but often presents itself in familiar patterns. Following the first three Bitcoin halvings, the market witnessed different degrees of bull runs.

Post the initial halving, Bitcoin surged by 9552%.

Subsequent to the second halving, the price rose by 3055%.

After the third halving, the price increased by 791.71%.

These statistics undeniably heighten anticipation for the forthcoming fourth halving.

Reviewing past halvings and their price trends

* Reference:TradingView、Gate.io

Institutional viewpoint

Historical data suggest that each halving event tends to trigger a bull market. Analysts anticipate that following the next halving, boosted by an increased investment interest and advancements in regulatory frameworks like the European Union's cryptocurrency market (MiCA), coupled with potential cryptocurrency regulations in the US, Bitcoin's price could surpass US$100,000.

Research firm Bernstein suggests that Bitcoin's recent decline from its all-time high of over US$73,000 to around US$63,000 presents a favourable buying opportunity on dips ahead of the April halving event.

Prior to this, Cathie Wood, CEO of Ark Investments, maintained an optimistic stance, forecasting Bitcoin's price to range between $650,000 and $1.5 million by 2025.

Though halving may boost prices, it's vital to acknowledge market risks. Understanding Bitcoin's price dynamics helps avoid overlooking potential risks for short-term gains. Be cautious and don't succumb to excessive speculation.

*Reference:https://abmedia.io/bernstein-see-bitcoin-dip-buying-opportunity

Trading special

*Please go to the Tiger Trade APP - "Rewards Center" to view the instructions and requirements for using rewards.

Not financial advice. All investment involves risk.

Unlocking Opportunities

Concept

BTC ETF

*T&Cs apply. Capital at risk. See FSG, risk disclosures, PDS, TMD, and T&Cs via our website before trading. Tiger Brokers (AU) Pty Limited. ABN 12 007 268 386 AFSL 300767.