ORCA and ACX Skyrocket Upon Binance Listing Announcement

- Orca (ORCA) and Across Protocol (ACX) will begin spot trading on Binance with zero trading fees on December 6.

- Binance will remove MAVIA, OMG, and BOND perpetual futures contracts on December 16, prompting to settle positions.

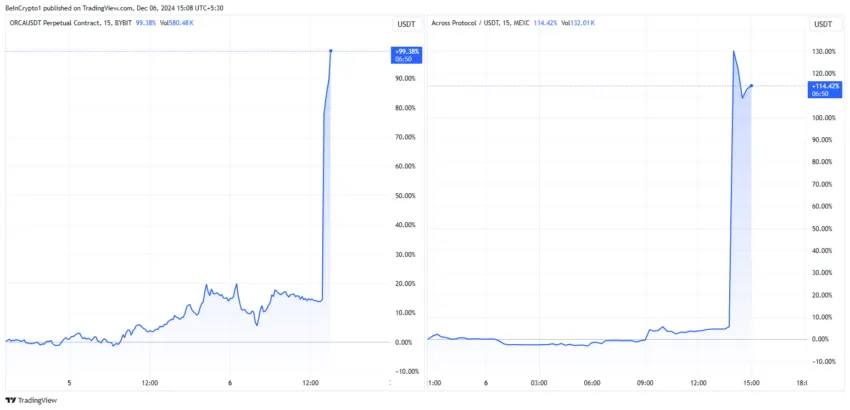

- ORCA and ACX surged after the listing announcement, while delisting news triggered declines for MAVIA, OMG, and BOND.

Binance announced plans to list Orca (ORCA) and Across Protocol (ACX) and to open trades for multiple spot trading pairs.

The trading platform periodically adds or removes tokens from its product suite as part of its routine operations review to ensure it meets industry requirements sufficiently while delivering a high level of standard.

Binance New Listings: ORCA and ACX

According to an official announcement from Binance, ORCA and ACX tokens will be available for trading against the USDT stablecoin beginning December 6 at 13:00 UTC. Withdrawals will be open 24 hours after listing.

“New Spot Trading Pairs: ACX/USDT, ORCA/USDT, users can now start depositing ACX, ORCA in preparation for trading,” Binance said.

Notably, the listing has zero fees, which means users can trade the token on the platform without incurring any trading fees. Zero fee features among the promotional strategies exchanges employ to attract more users.

Binance exchange will also apply a seed tag for ORCA and ACX, a special identifier to help distinguish them from other tokens. It is precautionary given the relative newness of the new Binance listings in the market, making them susceptible to higher-than-normal risk and, therefore, expected price volatility.

Trading of the aforementioned new trading pairs is subject to eligibility based on the user’s country or region of residence. Meanwhile, data on TradingView shows that ORCA and ACX have both recorded exponential growth since the Binance listing announcement.

Binance to Delist MAVIA, OMG, BOND

Alongside the latest series of Binance listings, the largest exchange by trading volume will also close all Heroes of Mavia (MAVIA), Omisego (OMG), and BarnBridge (BOND) perpetual contracts. This means the tokens will no longer be available for futures trading starting December 16.

“Binance Futures will close all positions and conduct an automatic settlement on the USDⓈ-M MAVIAUSDT, OMGUSDT, and BONDUSDT USDⓈ-M perpetual contracts at 2024-12-16 09:00 (UTC).The contracts will be delisted after the settlement is complete,” the announcement read.

Binance has urged users to close any open positions before the delisting deadline to prevent automatic settlement. Additionally, the Binance Funding Rate Arbitrage Bot will terminate all arbitrage strategies and settle positions on the MAVIAUSDT, OMGUSDT, and BONDUSDT pairs. After delisting, these pairs will no longer support new arbitrage strategies.

In the immediate aftermath of this announcement, MAVIA, OMG, and BODND values declined. The outcome was expected as token delistings from prominent exchanges tend to inspire massive sell-offs. Of note is that neither of these tokens is available for spot trading on Binance

免責聲明:投資有風險,本文並非投資建議,以上內容不應被視為任何金融產品的購買或出售要約、建議或邀請,作者或其他用戶的任何相關討論、評論或帖子也不應被視為此類內容。本文僅供一般參考,不考慮您的個人投資目標、財務狀況或需求。TTM對信息的準確性和完整性不承擔任何責任或保證,投資者應自行研究並在投資前尋求專業建議。

熱議股票

- 1

- 2

- 3

- 4

- 5

- 6

- 7

- 8

- 9

- 10