Why is crypto down today? 6 seconds ago

Crypto markets are down on the latest inflation numbers, as traders take profit from the recent market rally, which pushed BTC above $100,000.

Profit-taking and inflation data have pushed the crypto markets down today. On Tuesday, May 13, the total crypto market cap fell by 0.48% to $3.32 trillion, while Bitcoin (BTC) was down 0.21% to $103,228. Despite this, several signs show that the markets remain strong.

The market decline coincided with the release of the latest U.S. inflation figures, which showed the lowest inflation rate since 2021. In April, consumer prices rose at a yearly rate of 2.3%, down from 2.4% in March. Low inflation can indicate slowing consumer demand due to recession concerns.

As of April, new tariffs from the Trump administration hadn’t hit consumers yet. Still, low figures will likely not prompt the Federal Reserve to lower interest rates, despite pressure from President Donald Trump. Lower interest rates are also something that the crypto markets have been hoping for, due to their effect on market liquidity.

With interest rates likely to remain steady, traders opted to take profits as Bitcoin held above $100,000. Still, there are signs that the market is in a bullish state, especially with altcoins.

Crypto markets remain strong

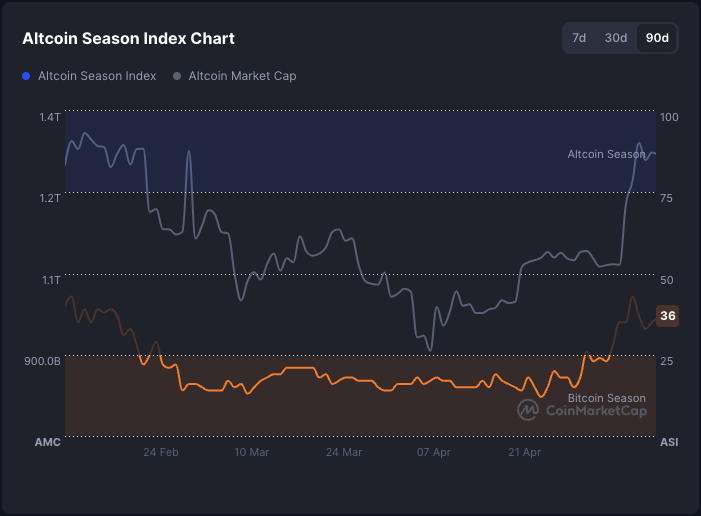

Over the past few weeks, altcoins have seen improved performance, with the altcoin index reaching the highest value since February. In the past 90 days, 36 out of the 100 altcoins have shown better performance than Bitcoin. What is more, over the past week, the altcoin market cap rose from $1.1 trillion to $1.35 trillion.

The strength of the altcoin market suggests bullish momentum for crypto and risk assets in general. Still, continued growth in the market will depend on what the Fed decides to do in the coming months. Notably, the Fed may decide to wait with rate cuts until September, to see what the effects of the new trade agreement between the U.S. and China will be.

Disclaimer: Investing carries risk. This is not financial advice. The above content should not be regarded as an offer, recommendation, or solicitation on acquiring or disposing of any financial products, any associated discussions, comments, or posts by author or other users should not be considered as such either. It is solely for general information purpose only, which does not consider your own investment objectives, financial situations or needs. TTM assumes no responsibility or warranty for the accuracy and completeness of the information, investors should do their own research and may seek professional advice before investing.

Most Discussed

- 1

- 2

- 3

- 4

- 5

- 6

- 7

- 8

- 9

- 10