Against the backdrop of highly interconnected global markets, the announcement of economic and political events as well as key data always triggers market fluctuations rapidly — even if some markets are in a closed period.

Investors can closely monitor international market dynamics, including the trends of global stock markets, fluctuations in commodity prices, and the release of important economic data. That may directly or indirectly affect the prices of A50, H50, and MSCI A50 futures.

Thus, the differences in trading hours and holiday schedules among various markets may provide a window of opportunity for investors: before certain pieces of information can be priced in by closed markets. In light of the upcoming Chinese Spring Festival, we want to look at a few Chinese market-related futures contracts that are tradable almost all year round.

Trading special

*Please go to the Tiger Trade APP - "Rewards Center" to view the instructions and requirements for using rewards.

Not financial advice. All investment involves risk.

A50 Index Futures

The A50 Futures listed on the Singapore Exchange (SGX) takes the FTSE China A50 Index as its underlying asset. Its trading hours are from 9:00 to 16:30 (Beijing Time) from Monday to Friday, while the night session runs from 17:00 (Beijing Time) to 4:45 the next day. This time frame covers the major trading sessions of Asia, Europe, and the Americas, meaning that the A50 Futures remains active even when the Chinese mainland market is closed.

For instance, when China observes long holidays such as the National Day Holiday and the Spring Festival Holiday, the A-share market is closed, but the A50 Futures market operates normally. During these periods, factors like the international economic situation and policy changes still affect the price of A50 Futures. If, on the eve of a long holiday, the market expects the release of a major economic indicator during the holiday—one that may have a significant impact on China's economy and stock market—the A50 Futures becomes a key venue for market participants to express their views on this expectation while the A-share market is shut.

H50 Index Futures

Similarly, the H50 Futures listed on the Singapore Exchange (SGX) is linked to 50 of the largest Chinese-funded stocks listed in Hong Kong. It also features a nearly 20-hour trading window, allowing investors to respond to market changes through H50 Futures even when the Hong Kong market is closed.

MSCI A50 Index Futures

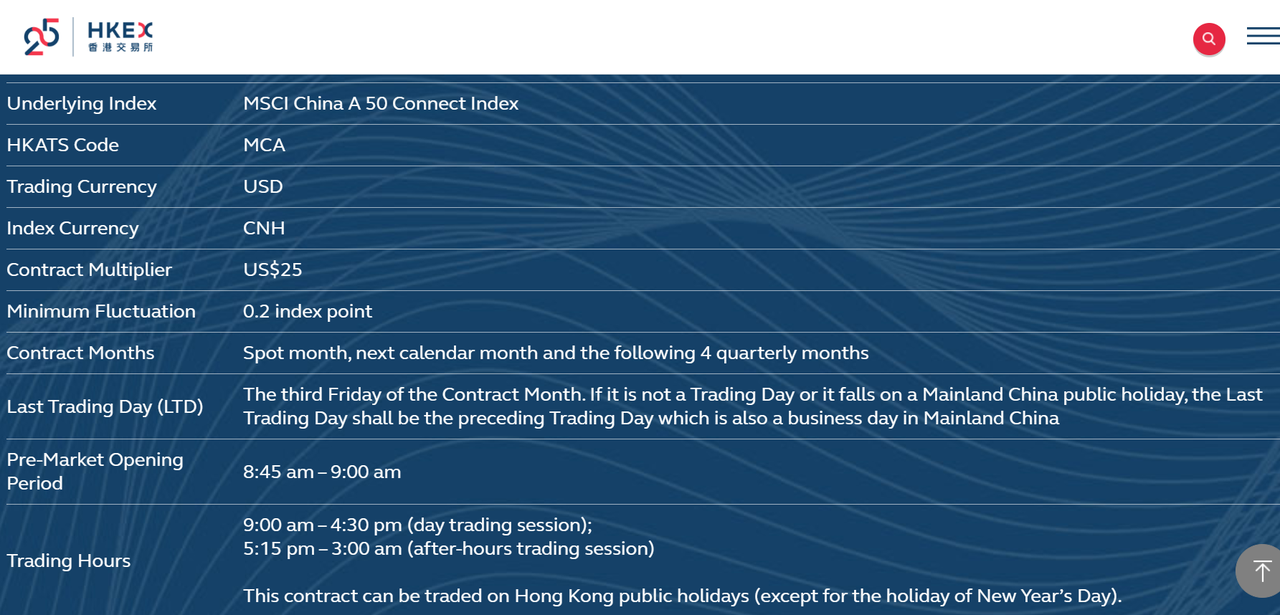

Compared with the A50 Index Futures on the Singapore Exchange (SGX), investors might be relatively less familiar with the MSCI A50 Index Futures on the Hong Kong Exchanges and Clearing Limited (HKEX). The difference between the MSCI A50 Index and the A50 Index lies in the fact that the former has a more balanced industry distribution: for its constituent stocks, 1-2 "leading stocks" are first selected from each of 11 industries (including finance, consumption, technology, and industrial), and then the top 30 stocks by market capitalization from the Stock Connect underlying securities are added to supplement. This ensures that each industry is represented and no single industry dominates. In contrast, the latter takes market capitalization as the primary consideration and emphasizes "market capitalization priority", which results in a more skewed industry distribution.

The above-mentioned index futures all trade normally during Mainland China's holidays, providing a reference for investors. If investors find that changes in the international situation during holidays deviate from their pre-holiday expectations, they can promptly adjust their positions during the trading hours of A50, MSCI A50, or H50 Futures.

Relevant Futures Contracts:

Selections criteria: China-related index futures tradable during Chinese holidays on Tiger Trade.

*T&Cs apply. Please refer to our website at https://www.itiger.com/sg/commissions for other applicable fees. Trading of Futures can carry a high level of risk, and may not be suitable for all investors.

The information expressed herein is current and does not constitute an offer, recommendation or solicitation, nor does it constitute any prediction of likely future performance. Investment involves risk. The price of investment instruments can and do fluctuate, and any individual instrument may experience upward or downward movements, and under certain circumstances may even become valueless. Past performance is not a guarantee of future results. In preparing this information, we did not take into account the investment objectives, financial situation. Before making an investment decision, you should speak to a financial adviser to consider whether this information is appropriate to your needs, objectives and circumstances. Tiger Brokers (Singapore) Pte. Ltd. assumes no fiduciary responsibility or liability for any financial consequences or otherwise arising from trading in investment instruments if opinions and information in this document may be relied upon.

This advertisement has not been reviewed by the Monetary Authority of Singapore.