Summary: Best Buy will release its fiscal 2026 third-quarter earnings before market open on November 25. Market focus centers on robust consumer electronics demand and profit improvements driven by cost optimization.

Fiscal Q2 Review

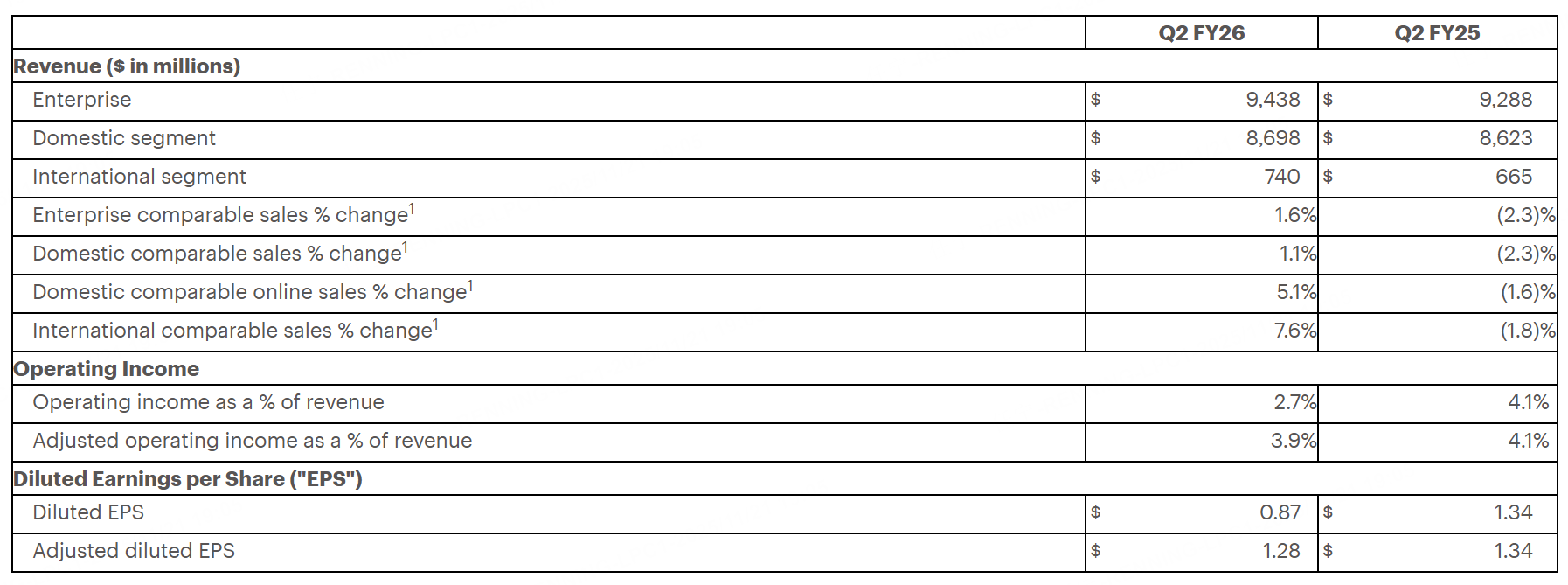

In fiscal Q2 2026, Best Buy reported revenue of $9.438 billion, up 1.6% year-over-year and exceeding market expectations. Non-GAAP EPS reached $1.28, also surpassing forecasts. Comparable sales grew 1.6% during the period.

Additionally, Best Buy reaffirmed its fiscal 2026 guidance for adjusted EPS between $6.15-$6.30 and revenue in the $41.1-$41.9 billion range.

Fiscal Q3 Expectations

According to Tiger Trade, analysts currently project Best Buy's Q3 total revenue at $9.590 billion, EPS at $1.308, and EBIT at $358 million.

Key Highlights

Impact of Store Traffic and Online Sales Mix on Profit Structure

This quarter's performance hinges on shifts between in-store and online sales. Physical stores typically drive higher attachment rates for extended warranties and add-on services, while increased online penetration may pressure overall gross margin. Given last quarter's 23.25% gross margin and ongoing industry promotions, sustained high online traffic would require balancing gross margins through service revenue streams and retail media initiatives.

While continuing SG&A optimization through workforce and process adjustments historically improved expense ratios, non-recurring factors like legal settlement benefits can't be replicated. This quarter's expense leverage depends more heavily on operational efficiency and economies of scale. Should revenue slightly trail prior-year levels, expense deleveraging presents a key risk focus.

Considering market demand forecasts for core categories, computing devices and gaming-related products—driven by new product cycles—should demonstrate relative resilience. This could offset pressure from weaker home-related durable goods (appliances, TVs), potentially containing gross margin and EBIT erosion.

Resilience in Computing Devices and Smartphone Upgrade Cycles

As the largest revenue contributors (approximately $4.436 billion, 47% share last quarter), computers and smartphones will directly influence quarterly revenue quality through new product launches and enterprise/household refresh cycles. Sustained penetration of high-ticket items, coupled with complementary services and accessories, could elevate per-customer value.

Amid macroeconomic uncertainty, consumers increasingly prioritize value and availability certainty. Best Buy's coordinated pricing and promotional strategies with suppliers may stabilize comparable store sales. Complementary financing and installation services could enhance overall margin structures, mitigating profit impacts from hardware discounting.

Should industry tariffs or cost fluctuations reemerge, the company's portfolio management and channel pricing tactics provide hedges. Current consensus EPS estimates around $1.308 reflect market recognition of operational resilience.

Promotional Pressure and Structural Recovery in Appliances and Home Entertainment

Appliances and home entertainment face greater sensitivity to macroeconomic housing transactions and consumer confidence. Last quarter's promotional intensity in these categories significantly pressured net margins. Continued promotions this quarter may keep net margins in lower ranges.

Gross margin improvements could emerge through SKU rationalization, supply chain cost controls, and cross-category bundled solutions to boost conversion rates. Enhanced service warranties and installation offerings may counterbalance weaker hardware margins.

Market expectations for total revenue and EBIT remain relatively conservative. Should promotional intensity moderate sequentially from last quarter, gross margins might find some recovery room—though this remains contingent on new product mix and customer traffic quality.

Institutional Views

This quarter, institutions focus primarily on consumer electronics demand, promotional environment, and expense efficiency. Some maintain relatively positive outlooks on computing devices and gaming-related demand, suggesting EPS could see modest upside with effective cost controls. Others caution that high online penetration and appliance promotions may suppress gross and net margins.

Target price opinions diverge: certain institutions maintain or raise targets citing expense discipline and structural growth drivers (e.g., retail media and platform businesses), while others reduce or maintain cautious targets over concerns that tariffs and promotions may slow profit margin recovery below expectations.

Full-year and second-half guidance expectations remain stable. The market emphasizes fiscal 2026's potential for margin recovery through new product cycles and service revenue expansion. Should core categories rebound, operating margin improvements appear achievable.