Falcon Minerals Corporation's (NASDAQ:FLMN) Stock Going Strong But Fundamentals Look Weak: What Implications Could This Have On The Stock?

Falcon Minerals' (NASDAQ:FLMN) stock is up by a considerable 26% over the past three months. However, in this article, we decided to focus on its weak fundamentals, as long-term financial performance of a business is what ultimatley dictates market outcomes. Specifically, we decided to study Falcon Minerals' ROE in this article.

Return on equity or ROE is a key measure used to assess how efficiently a company's management is utilizing the company's capital. In short, ROE shows the profit each dollar generates with respect to its shareholder investments.

View our latest analysis for Falcon Minerals

How To Calculate Return On Equity?

The formula for return on equity is:

Return on Equity = Net Profit (from continuing operations) ÷ Shareholders' Equity

So, based on the above formula, the ROE for Falcon Minerals is:

2.3% = US$5.3m ÷ US$232m (Based on the trailing twelve months to December 2020).

The 'return' refers to a company's earnings over the last year. Another way to think of that is that for every $1 worth of equity, the company was able to earn $0.02 in profit.

What Is The Relationship Between ROE And Earnings Growth?

So far, we've learned that ROE is a measure of a company's profitability. We now need to evaluate how much profit the company reinvests or "retains" for future growth which then gives us an idea about the growth potential of the company. Assuming everything else remains unchanged, the higher the ROE and profit retention, the higher the growth rate of a company compared to companies that don't necessarily bear these characteristics.

Falcon Minerals' Earnings Growth And 2.3% ROE

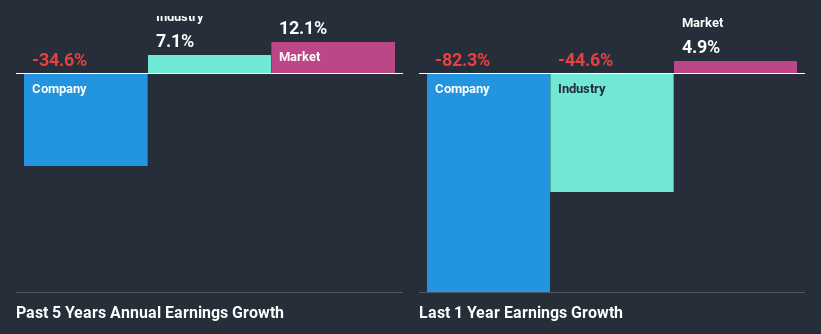

It is quite clear that Falcon Minerals' ROE is rather low. Not just that, even compared to the industry average of 12%, the company's ROE is entirely unremarkable. Given the circumstances, the significant decline in net income by 35% seen by Falcon Minerals over the last five years is not surprising. We reckon that there could also be other factors at play here. Such as - low earnings retention or poor allocation of capital.

So, as a next step, we compared Falcon Minerals' performance against the industry and were disappointed to discover that while the company has been shrinking its earnings, the industry has been growing its earnings at a rate of 7.1% in the same period.

Earnings growth is an important metric to consider when valuing a stock. What investors need to determine next is if the expected earnings growth, or the lack of it, is already built into the share price. Doing so will help them establish if the stock's future looks promising or ominous. If you're wondering about Falcon Minerals''s valuation, check out this gauge of its price-to-earnings ratio, as compared to its industry.

Is Falcon Minerals Efficiently Re-investing Its Profits?

With a three-year median payout ratio as high as 185%,Falcon Minerals' shrinking earnings don't come as a surprise as the company is paying a dividend which is beyond its means. Its usually very hard to sustain dividend payments that are higher than reported profits. Our risks dashboard should have the 3 risks we have identified for Falcon Minerals.

In addition, Falcon Minerals only recently started paying a dividend so the management probably decided the shareholders prefer dividends even though earnings have been shrinking. Our latest analyst data shows that the future payout ratio of the company is expected to drop to 131% over the next three years.

Conclusion

In total, we would have a hard think before deciding on any investment action concerning Falcon Minerals. The low ROE, combined with the fact that the company is paying out almost if not all, of its profits as dividends, has resulted in the lack or absence of growth in its earnings. With that said, we studied the latest analyst forecasts and found that while the company has shrunk its earnings in the past, analysts expect its earnings to grow in the future. To know more about the latest analysts predictions for the company, check out this visualization of analyst forecasts for the company.

This article by Simply Wall St is general in nature. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

免责声明:投资有风险,本文并非投资建议,以上内容不应被视为任何金融产品的购买或出售要约、建议或邀请,作者或其他用户的任何相关讨论、评论或帖子也不应被视为此类内容。本文仅供一般参考,不考虑您的个人投资目标、财务状况或需求。TTM对信息的准确性和完整性不承担任何责任或保证,投资者应自行研究并在投资前寻求专业建议。

热议股票

- 1

- 2

- 3

- 4

- 5

- 6

- 7

- 8

- 9

- 10