Tech

ASX Tech Stocks: Underwater app for scuba divers and Silex successfully tests first full-scale laser system

| Emma Davies

Link copied to clipboard

Insurance player Ensurance has just posted its maiden annual profit of $273,745 for FY22 – and says there’s real room to grow in the specialist insurance sector.

It’s a strong result for the company, after four consecutive cash flow positive quarters, and a $1.3m loss in the previous corresponding period (PCP).

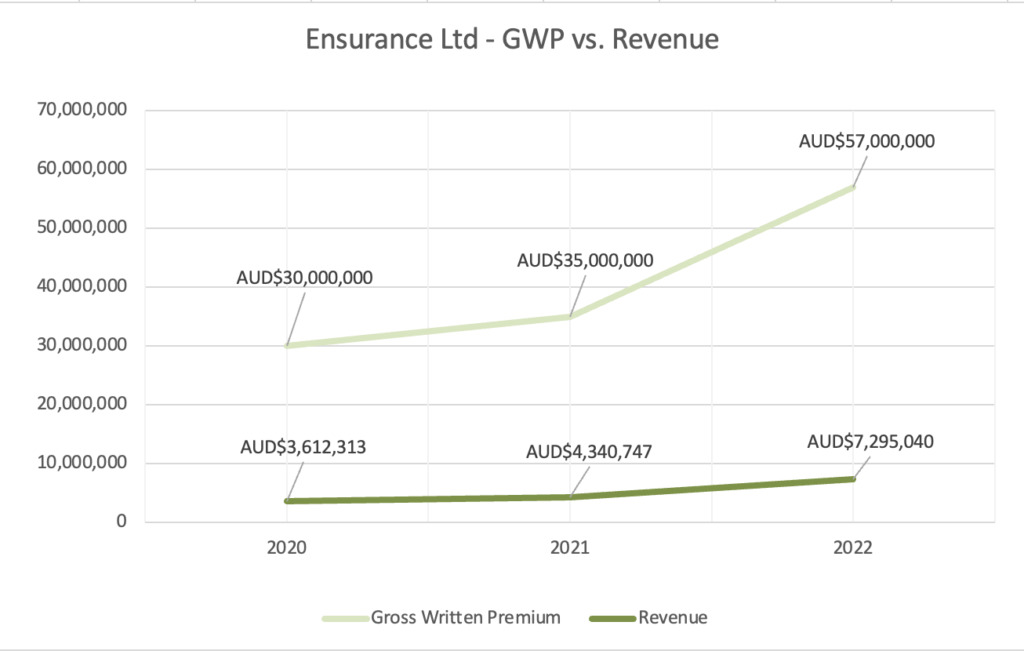

Ensurance (ASX: ENA), which is one of very few up-and-coming junior players in the multi-billion industry, also reported revenue of $7.3m, a 68% increase from $4.34m in the PCP, and Gross Written Premium (GWP) under management of $57m, up 38.5% from $35m.

The company reckons this strong FY22 performance confirms the commitment to its strategy in establishing a national Australian office network, backed by strong underwriting agreements with leading insurers – which means it does not carry the risk.

Ensurance’s expanding broker network gives it the ability to provide insurance underwriting on behalf of larger insurers in niche sectors.

The company generates revenue by being paid commissions by the large insurer in return for managing the portfolio.

In Australia, this comprises 100 per cent annually renewable revenues.

“The growing risks posed by cyber-attacks and fraud, terrorism and ever-increasing legal threats requiring professional indemnity and commercial liability protection amount to vast opportunities for our business,” CEO Tom Kent said.

“By being nimble, highly competitive and backed by some of the biggest underwriters in the world, Ensurance can offer this critical risk protection.”

During the course of FY22, the company has focused on expanding its footprint across Australia in order to distribute its Professional Risks insurance product set, signing a non-binding agreement to sell its UK operations to PSC Insurance (ASX: PSI) for A$8.2 million.

Kent says that, once complete, the sale will bolster Ensurance’s cash position, allowing it to focus on the immense growth opportunities available in Australia.

“The decision to sell the company’s UK operations reflects a strong belief in the opportunities awaiting us in the Australian market,” he said.

“We want to ensure the company takes full advantage of what is a fast-growing market for niche insurance products in Australia.

“Importantly, 100 per cent of our revenues in Australia are from policies which

“The sale of the UK operations will enable us to focus solely on this opportunity, redeploying capital into growing our Australian business, including through new hires and new product lines.

“We believe this gives us a huge runway for growth into the future.”

This article was developed in collaboration with Ensurance Limited, a Stockhead advertiser at the time of publishing.

This article does not constitute financial product advice. You should consider obtaining independent advice before making any financial decisions.

Link copied to clipboard

Get the latest Stockhead news delivered free to your inbox.

"*" indicates required fields

It's free. Unsubscribe whenever you want.

Read our privacy policy

Tech

| Emma Davies

Tech

| Special Report

Tech

| Special Report

免责声明:投资有风险,本文并非投资建议,以上内容不应被视为任何金融产品的购买或出售要约、建议或邀请,作者或其他用户的任何相关讨论、评论或帖子也不应被视为此类内容。本文仅供一般参考,不考虑您的个人投资目标、财务状况或需求。TTM对信息的准确性和完整性不承担任何责任或保证,投资者应自行研究并在投资前寻求专业建议。