Trump-Tied SPAC Surges nearly 200% Over A Six-Day Winning Streak

Former president’s status as Republican frontrunner fuels jump

‘The market has gone full bonkers’: Accelerate Financial CEO

Investors are swarming back into the blank-check firm seeking to take Donald Trump’s social media company public, as the former president cements his place as the Republican frontrunner for the party’s 2024 nomination.

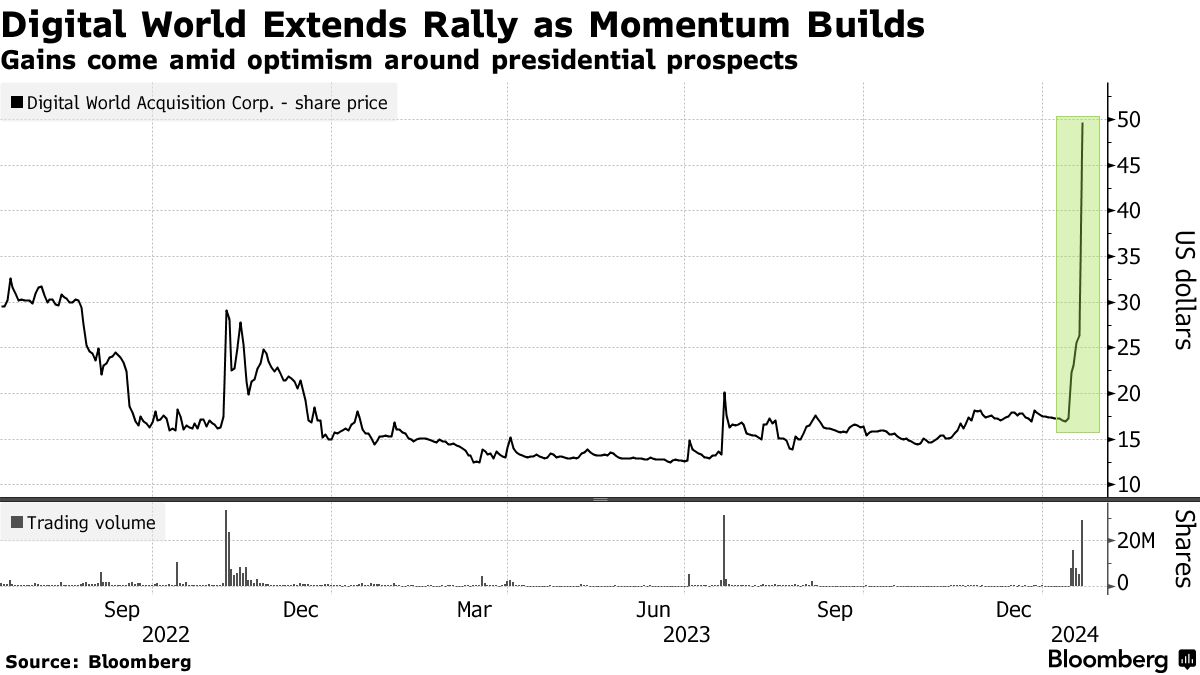

Digital World Acquisition Corp. has surged nearly 200% over a six-day winning streak as shares power to the highest level since May 2022. Monday’s 88% rally, after Trump’s rival Ron DeSantis quit the primary race, marked the special purpose acquisition company’s best day since its meme-stock heyday in October 2021.

The SPAC’s surge was kickstarted when the former president cruised to victory in the Iowa caucuses ahead of Tuesday’s New Hampshire presidential primary. After more than two years and regulatory issues, the deal to take Trump Media & Technology Group, the nascent media company behind Truth Social, is still being worked through.

“The market has gone full bonkers,” says Julian Klymochko, chief executive officer of Accelerate Financial Technologies Inc., which has a SPAC-focused fund. In his view the current stock price implies an “excessive” valuation of $8 billion. “Shares do not reflect any fundamental intrinsic value of Truth Social, but they are more of a ‘trading sardine,’ or tool of speculation,” he said by email.

The latest spike came as investors flipped out-of-the-money call options, a favorite strategy of retail traders and driver of many previous meme stock rallies. Options for the stock to trade above $55 — a level it hasn’t topped since April 2022 — are the most active. The ticker saw an increase in mentions on Reddit’s WallStreetBets and trader chatroom StockTwits in recent days.

免责声明:投资有风险,本文并非投资建议,以上内容不应被视为任何金融产品的购买或出售要约、建议或邀请,作者或其他用户的任何相关讨论、评论或帖子也不应被视为此类内容。本文仅供一般参考,不考虑您的个人投资目标、财务状况或需求。TTM对信息的准确性和完整性不承担任何责任或保证,投资者应自行研究并在投资前寻求专业建议。

热议股票

- 1

- 2

- 3

- 4

- 5

- 6

- 7

- 8

- 9

- 10