CLSE: Robust Long Short Equity ETF

Monty Rakusen

Thesis

Long/Short equity ETFs are supposed to be more conservative builds that outperform long only names in choppy markets. Convergence Long/Short Equity ETF (CLSE) is such a name, with the fund's literature stating its goals:

The Convergence Long/Short Equity ETF seeks alpha from a net long portfolio. The ETF goes long positions in fundamentally strong equities and short positions in broken and declining business models.

The ETF has a net long positioning, rather than a dollar neutral stance. A dollar neutral fund is one which has the same amount of long and short exposure in dollar terms, with the fund's performance coming from the relative value between the two legs of the trade.

CLSE is an outperformer in the long/short ETF category, with the fund having managed a stellar 2024 within a robust historic total return. What is very commendable regarding this name is its ability to mitigate negative bear market returns while retaining the upside in bull markets.

In this article, we are going to explore in detail the fund structure and holdings and articulate why the name represents a conservative way to gain exposure to the equity market.

Portfolio construction - net long positioning

CLSE takes long positions in certain names, while shorting others:

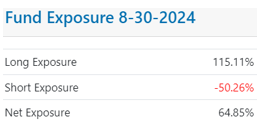

Exposure (Fund Fact Sheet)

As of August 30, 2024, the fund had a 115% long position and a -50% short exposure, for a net exposure of 64%. The fund does pay some fees in terms of margin debt and short sale fees, with the total amount coming up to 60 bps. The regular management fees for the ETF come up to 95 bps, therefore taking the total expenses for the name to 155 bps.

The fundamental view of a long/short fund is that certain equities in a sector are overpriced, while others have significant upside potential. By shorting the weak ones and going long the undervalued names, a fund can benefit from valuation normalization. However, the manager is cognizant of the pitfalls associated with shorting certain meme equities, thus ensure the names present in the portfolio have all the adequate metrics in line with a conservative positioning:

Position sizes for short holdings are reduced to mitigate idiosyncratic risk. Stocks with lower borrowing costs are favored over more controversial names with higher borrowing costs. Short holdings are monitored to minimize exposure to names that have a high percentage of short float. These measures help to mitigate risks as part of the process of shorting companies with weak or declining fundamentals.

These steps ensure the ETF does not short 'GME-like' cult names which can squeeze out shorts via idiosyncratic moves. On the long side the ETF managers employ both quantitative and fundamental methods in stock selection. The managers utilize a dynamic process to rank stocks within each industry group and then look to pick the most attractive ones from a risk/reward perspective.

We like the disclosures this fund makes because the managers are very transparent regarding the risk they are running:

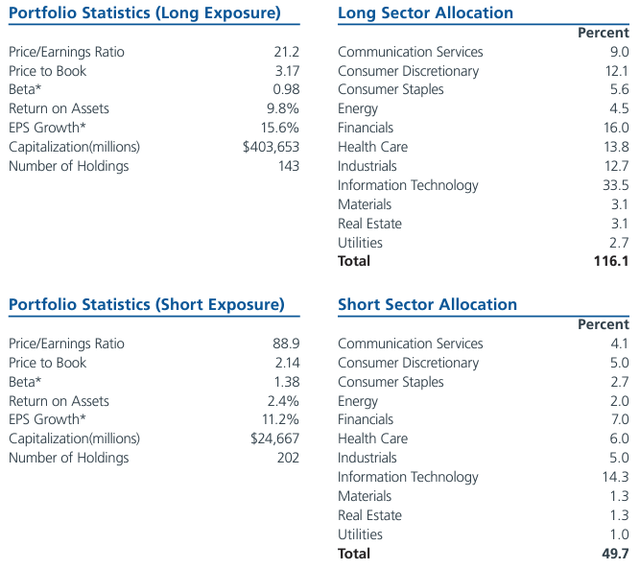

Stats (Fund Website)

Currently, the fund is net long Information Technology with a 33.5% long position and a -14.3% short as its top allocation. The fund is net long in each and every sector it lists as per its disclosures. The long portfolio has an average P/E ratio of 21x and a P/B ratio of 3x, while the short portfolio has an average P/E ratio of 88x and a P/B ratio of 2x.

We can clearly see the general trend of the fund here in shorting speculative high P/E names, while going long names with lower beta figures and high EPS growth.

Via its build and net long position the name will retain upside in a bull market, but minimize the downside in a bear market, especially in markets where extremely speculative stocks are squeezed out.

Strong historic performance

A long/short strategy is very much dependent on the manager and the individual names and sectors it chooses to go long and short. Historic performance, especially the one during down cycles, is very important in highlighting the manager's ability to choose undervalued companies. CLSE excels in this regard:

Historic Performance (Author / Morningstar)

Firstly, let us take a look at how the ETF does during down markets. The name has had very shallow drawdowns, with only a -7.25% negative return in 2022 when the S&P 500 was down -18%. During up-markets, the fund has been able to match and even outperform the index at times, with CLSE up +27% this year. The fund has been able to obtain these results with a low standard deviation of 12.5% and a Sharpe ratio of 0.84.

These are very enviable figures, and they highlight a robust fund that has been able to meet its objectives in terms of blunting the downside while retaining most of the upside in bull markets. An investor needs to understand that the risk/reward ratio is very important for a fund like CLSE, and for investing in general. If a certain ETF delivers a 27% return but during down years can post -30% return then the risk/reward is not very compelling. As an investor never discount the feeling of panic when you see a portfolio name in the red by -30%. Many retail investors tend to panic sell at the bottom in these instances. A name like CLSE will ensure such scenario is a very remote one in a normalized bear drawdown.

Kindly note that some data platforms will show history only back to 2022 for the name, since it was converted from a mutual fund into an ETF on February 22, 2022. From a historic performance standpoint the structure is not relevant since it has more to do with unit creation/redemption than true structural issues as the ones exhibited by closed end funds (discounts to NAV).

Conclusion

CLSE is an equity ETF. The fund falls in the long/short category, and is a leader in that cohort as per Seeking Alpha. The fund has very robust historic returns with attractive risk/reward ratios, obtained via a long and a short sleeve. The ETF will aim to always run a net long position, thus will accrete value over long periods of time. The fund is a conservative equity expression in a choppy market via its ability to have shallow drawdowns while retaining most of the upside. We prefer this name over an outright S&P 500 exposure at this macro juncture.

免责声明:投资有风险,本文并非投资建议,以上内容不应被视为任何金融产品的购买或出售要约、建议或邀请,作者或其他用户的任何相关讨论、评论或帖子也不应被视为此类内容。本文仅供一般参考,不考虑您的个人投资目标、财务状况或需求。TTM对信息的准确性和完整性不承担任何责任或保证,投资者应自行研究并在投资前寻求专业建议。

热议股票

- 1

- 2

- 3

- 4

- 5

- 6

- 7

- 8

- 9

- 10