QQQM: Cheap Or Not, The Nasdaq-100 Index Is Vulnerable

Luis Alvarez

Ahhh yes. The NASDAQ 100-Index (NDX). The cool kid on the block. The one everyone falls in love with. The part of the stock market where all the action has been. I know - more people think of Invesco QQQ Trust ETF (QQQ), but did you know that the same Invesco created another NASDAQ 100 ETF with the ticker QQQM? Yes, that's right, folks. The same issuer has two funds that track the same index. Invesco NASDAQ 100 ETF (NASDAQ:QQQM) seeks to follow the NASDAQ-100 Index, which includes 100 of the biggest non-financial firms listed on the NASDAQ Stock Exchange…just like QQQ.

You might be confused. Why would Invesco have two of the same fund? In short - fees. QQQ has a net expense ratio of 0.2%, while QQQM is cheaper technically at 0.15%. Otherwise, both funds are the same. Why do this? Why not just lower the expense ratio on QQQ? Because there's a lot of long-term investment locked in that would incur a huge tax liability if they exchanged QQQ for QQQM. So why not keep generating the relatively higher fees on that capital and attract new money in the cheaper QQQM? As an issuer from a fee revenue perspective, it makes a lot of sense.

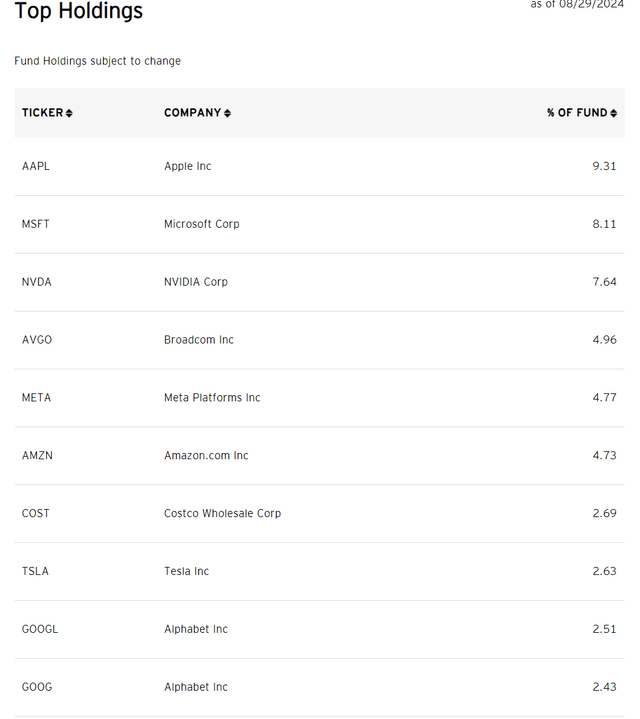

A Look At The Holdings

Now that we've gotten that out of the way, let's look at this fund like any other. Exploring the fund's investments, QQQM's portfolio has a strong focus on tech giants, mirroring the makeup of the NASDAQ-100 Index.

invesco.com

As we can see, all the hits are here. These are the biggest companies in the world you hear about daily in the financial media. These are all the stocks that have driven stock market momentum for the better part of a year and a half. And these are all the stocks where, if a correction does occur in my lifetime, the selling pressure will likely be most accentuated.

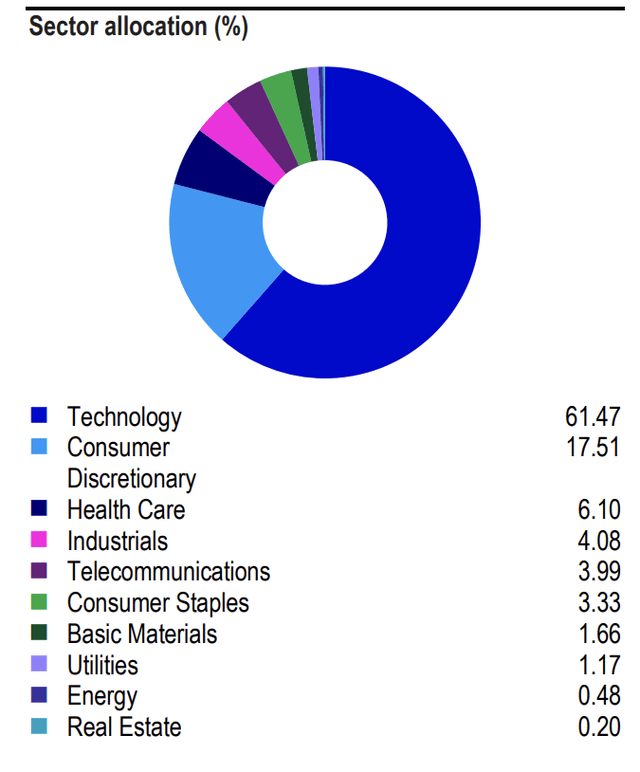

Sector and Global Allocation

QQQM's sector makeup leans toward Information Technology, which comprises about 60% of the portfolio. Consumer Discretionary and Health Care come next, completing the top three. But make no mistake about it. This is a Tech fund. Pure and simple. It's why the fund has done so well. It's why it's also most vulnerable to whatever comes next for markets, given just how extended Tech has gotten relative to every other part of the marketplace.

invesco.com

Peer Comparison

When you compare QQQM to QQQ, it's purely about fees, and QQQM over time would come out on top from that standpoint alone. So let's instead compare the fund to the Vanguard Growth Index Fund ETF Shares (VUG) since both funds lean towards growth and the Tech sector being a major weighting contributor. When we look at the price ratio of QQQM to VUG, we find that QQQM has outperformed since inception, but the more balanced large-cap growth VUG has shown some better relative behavior as of late. Personally, I'd prefer VUG over QQQM here, as I suspect the large-cap tech names that so dominated the NASDAQ-100 are quite vulnerable, and the concentration there is going to at some point prove to be painful for investors.

Pros and Cons

Putting money into QQQM has some positives. Its low fees mean you keep more of what you earn, which helps if you plan to buy and hold for a long time. QQQM tracks the NASDAQ-100 Index, giving you a stake in fast-growing tech firms that tend to do well when markets are up. But be careful - this focus on tech also brings risks. Most of the fund's money is in tech stocks, which can be a problem if that sector takes a hit. You need to be ready for the ups and downs of that sector in particular, which can get worse when markets go south. It's volatile and cheaper than QQQ. But there are better momentum plays out there now, in my view.

Conclusion

Overall, the Invesco NASDAQ 100 ETF offers a way to invest for those who want to tap into the tech-driven growth of the NASDAQ-100 Index. Its low-cost setup and focus on industry big shots make it a good pick for investors looking at the long term. That's the key here. The long term. Personally, I wouldn't touch this now at this point in the cycle, no matter how cheap the fund is. Still - a good fund, and a better way to play the NASDAQ-100 than QQQ…from the same issuer.

免责声明:投资有风险,本文并非投资建议,以上内容不应被视为任何金融产品的购买或出售要约、建议或邀请,作者或其他用户的任何相关讨论、评论或帖子也不应被视为此类内容。本文仅供一般参考,不考虑您的个人投资目标、财务状况或需求。TTM对信息的准确性和完整性不承担任何责任或保证,投资者应自行研究并在投资前寻求专业建议。

热议股票

- 1

- 2

- 3

- 4

- 5

- 6

- 7

- 8

- 9

- 10