JMHI: A First Look At JPMorgan HY Muni ETF

designer491

Introduction

Interest rates, at least at the short end of the curve, should start dropping if the FOMC cuts the FFR at their next meeting. Despite what one party claims, personal income rates either have to climb in the near future or Federal spending needs to decline, an unlikely situation with the campaign promises being made, especially as spelled out in the DNC platform. Add in the fact that some state budgets are running large deficits, state income tax rates might increase too.

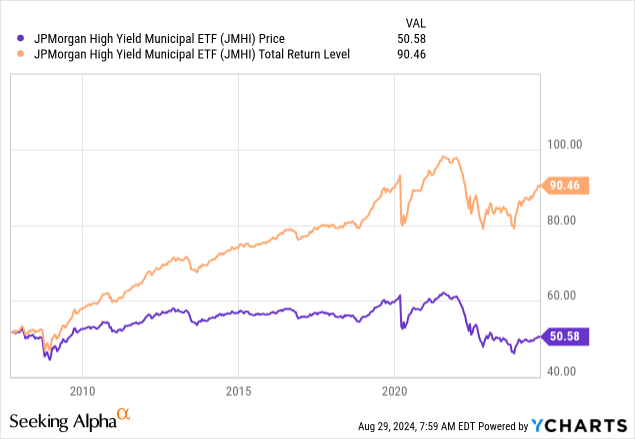

Since this might then be a good time to consider a federal tax-free, long duration investment like the Jpmorgan High Yield Municipal ETF (NYSEARCA:JMHI). Depending on where you live and the portfolio’s state allocations, some of the interest received might avoid state taxes, too.

Jpmorgan High Yield Municipal ETF reviewed

Seeking Alpha describes this ETF as:

JPMorgan High Yield Municipal ETF is an exchange traded fund launched and managed by J.P. Morgan Investment Management Inc. It invests in the fixed income markets of the United States. It primarily invests in municipal securities, the income from which is exempt from federal income tax. It invests in the investment grade securities that are rated as BBB- or higher by S&P and Fitch and Baa3 by Moody’s. The fund invests in securities of issuers that are deemed socially conscious in their business dealings and directly promote environmental responsibility. The fund benchmarks the performance of its portfolio against the Bloomberg US Municipal Index, the Bloomberg High Yield Municipal Bond Index and the Bloomberg 65% High Grade/35% High Yield TR Index. The ETF was formed on September 17, 2007.

Source: seekingalpha.com JMHI

The ETF has $175m in AUM and charges 35bps in fees. The recent yield is 4.9%. The managers state the following on the ETF’s homepage:

- Seeks a competitive yield and higher after-tax returns by focusing on high-yield municipal bonds

- May invest up to 100% in securities rated below investment-grade, which offer a higher yield than investment-grade securities but involve a greater degree of risk

Holdings review

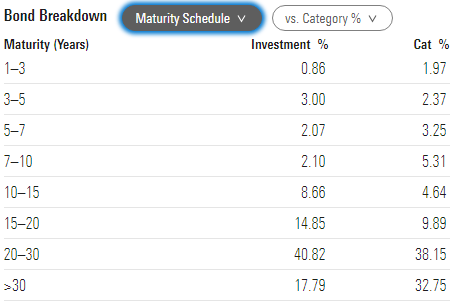

Currently, JMHI has its assets 86% in municipal bonds, 11% on short-term assets, and 3% in Daily Demand Notes. The maturity allocation results in a duration of 7.3 years; maturity of 15.3 years.

Morningstar maturity schedule

With under 1% maturing within three years, there is little opportunity to automatically roll the portfolio into today's high interest offerings.

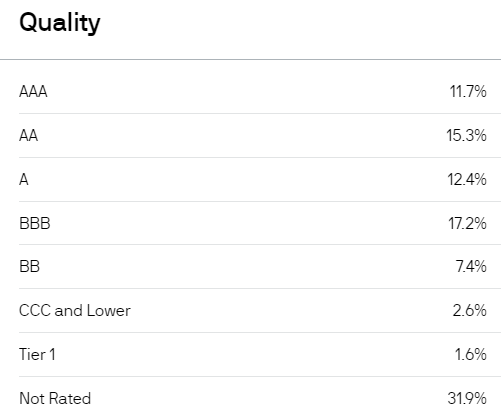

The ratings allocation is a head-scratcher, since most bonds held are investment-grade; not an allocation I consider for an ETF classified as "High Yield".

JPMorgan ratings schedule

Only 10% are rated below investment grade. Unlike most managers, JPM did not provide what sectors or the home state of the issuers, a large negative in my eyes.

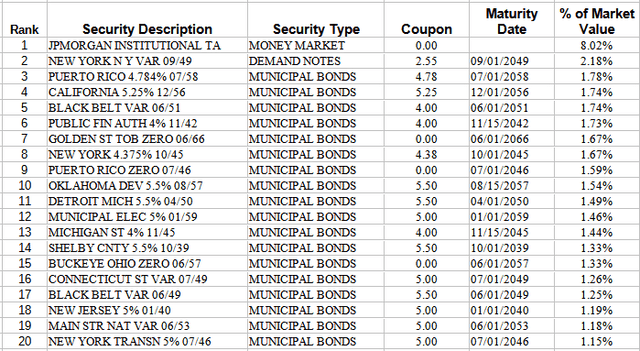

Top holdings

JPMorgan; compiled by Author

The ETF holds 133 bonds and several interest-rate futures, both long and short contracts. Only counting the municipal bonds, the rest of the above list comes to 26% of the portfolio.

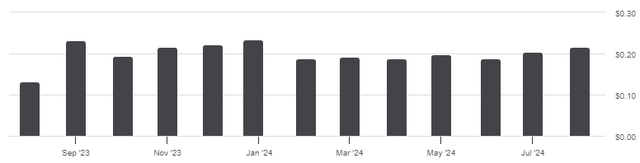

Distributions review

Seeking Alpha DVDs

I will contribute it to a lag effect, but payouts have been increasing the last two months whereas interest rates have held steady. Investors should expect payouts to start retreating if the FOMC does start cutting rates in September. JMHI has not distributed any capital gains since the end of 2020.

Competitor analysis

To know how good this ETF does, here I will compare some features and performance of ETFs operating in the same HY Muni space. More aggressive investors would include leveraged CEFs as part of their due diligence. ETFs chosen are:

- BlackRock High Yield Muni Income Bond ETF (HYMU) which I reviewed here.

- VanEck High Yield Muni ETF (HYD) which I own

- SPDR® Nuveen Bloomberg High Yield Municipal Bond ETF (HYMB) from a major player in municipal bond funds, mostly CEFs

For consistency purposes, portfolio data is from Morningstar

| Factor | JMHI | HYMU | HYD | HYMB |

| AUM | $175m | $181m | $3.1b | $2.7b |

| Fees | 35bps | 35bps | 32bps | 35bps |

| Yield | 4.89% | 4.32% | 4.28% | 4.15% |

| Average Coupon | 4.86% | 5.20% | 4.91% | 4.91% |

| Effective Duration | 7.52 yrs | 8.08 yrs | 6.58 yrs | 7.00 yrs |

| YTM | 5.43% | 4.80% | 4.99% | 5.15% |

| Average Price | $94.40 | $99.02 | $96.83 | $96.56 |

| Holdings | 133 | 292 | 1471 | 1862 |

| Non-IG Weight | 13.5% | 20.9% | 26.1% | 23.0% |

| 1Yr CAGR | 9.43% | 14.22% | 8.23% | 10.54% |

Analysis

- Both JMHI and HYMU are much more concentrated than the other two ETFs, with their smaller bond counts.

- Maybe being the newest ETF, HYMU has the highest WA Coupon by almost 30bps. That said, it offers investors the lowest yield. JMHI currently has the best yield.

- Duration wise, HYMU is the longest by over 6 months, with HYD over 1.5 years shorter. If long rates drop along with short rates, longer duration ETFs should do the best.

- Despite their names, none of the ETFs hold a majority of their portfolio in non-investment-grade bonds, with JMHI being the highest quality portfolio.

- Not sure how much YTM counts with long duration ETFs, but JMHI is tops there.

Conclusion

While I will continue to keep my HYD exposure, I would give a slight edge to JMHI as the one to Buy now based on yield, duration, and the lowest percentage below investment-grade.

Portfolio strategy

Fidelity posts the following data for municipal bonds rated higher than most held by these ETFs but it gives readers an idea of what the yield curve looks like.

Fidelity

It shows a curve with bumps and little upward slope. Also, that some time periods show the AA bonds yielding more than the A bonds, and that is not normal.

Investors experiencing high marginal rates in their home state should see if there is a fund that only invests in bonds issued from within that state; Nuveen offers over a dozen spread across nine states.

Final thought

With the passing of my wife, in 2025 I will file as a Single for the first time since 1987. With little decrease in my reportable income, I believe my marginal tax rate will go up at least one bracket and more will be exposed to that rate. If Congress doesn't extent the current rates next year, after which they expire, I'm sure my tax bill will be even higher. While we marginally benefited from owning municipal bond funds, I suspect I will be moving some of my taxable bond funds over once the dust settles.

免责声明:投资有风险,本文并非投资建议,以上内容不应被视为任何金融产品的购买或出售要约、建议或邀请,作者或其他用户的任何相关讨论、评论或帖子也不应被视为此类内容。本文仅供一般参考,不考虑您的个人投资目标、财务状况或需求。TTM对信息的准确性和完整性不承担任何责任或保证,投资者应自行研究并在投资前寻求专业建议。

热议股票

- 1

- 2

- 3

- 4

- 5

- 6

- 7

- 8

- 9

- 10