SPYD: Can Be Beaten On Yield And Total Return

MicroStockHub

While there are many dividend focused ETFs, standard equity funds with a yield between 4-6% are few and far between. One of the best of these appears to be the SPDR® Portfolio S&P 500® High Dividend ETF (NYSEARCA:SPYD) with a forward yield of 4.07%. However, as this article will highlight, its composition is too basic to set it apart and there are better funds in this space.

Introducing SPYD

SPYD is a passively managed fund launched in 2015. As per the fund page,

The S&P 500 High Dividend Index is designed to measure the performance of the top 80 high dividend-yielding companies within the S&P 500® Index, based on dividend yield.

Clearly, the selection process isn't very complex. According to the prospectus, the only real filter is a company must have "unadjusted market capitalizations of at least $14.5 billion and float-adjusted market capitalizations of at least $7.25 billion at the time of inclusion." The fund then selects the 80 remaining stocks with the highest dividends and equally weights them. The portfolio is rebalanced semi-annually, in January and July.

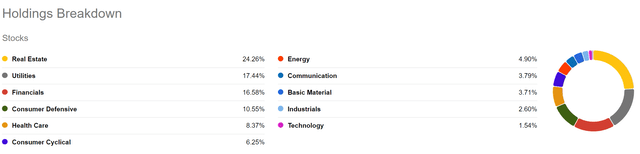

As might be expected, the fund holds a lot of REIT stocks, utilities and financials.

Sector Breakdown (Seeking Alpha)

This differs greatly from one of SPYD's peers, the Invesco High Yield Equity Dividend Achievers™ ETF (PEY) which excludes REITs. If you want to avoid this sector, or have enough REIT exposure as it is, perhaps PEY is a better option and I wrote about it recently here.

One of the off-putting facets of the selection and weighting process is there is no scan for quality. Beaten-down stocks such as Walgreens Boots Alliance (WBA) have high dividends due to price declines and are therefore included equally.

There are several ways around this. For example, PEY filters for quality by only including stocks which have "experienced an increase annual regular dividend payments for at least the last ten consecutive calendar or fiscal years." This simple rule eliminates some of the poorly performing stocks.

At the other end of the spectrum, SPYD's lowest yielding stocks such as Kellanova (K), with a FWD yield of just 2.83%, may have performed well this year, but weigh on the fund's overall yield. Indeed, there are only 44 stocks in the S&P500 (SPY) with a yield of over 4% and SPYD holds 80 stocks. In other words, the fund is forced to buy and equally weight stocks with yields below 4%. Holding less stocks would be a way to boost the dividend yield, although this would obviously be at the expense of diversification.

SPYD Dividend and Peers

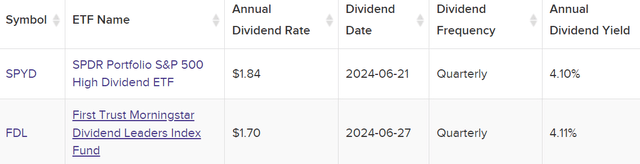

SPYD has a FWD dividend yield of 4.07% and a 30 Day SEC Yield of 4.25%. This is attractive when coupled with a very low expense ratio of 0.07%. As mentioned in the intro, SPYD has few peers and a scan of US-focused equity dividend funds with a dividend yield of 4-6% and expense ratio of less than 0.5% produces just two results.

Dividend Scan (ETFdb.com)

If the net is widened by allowing in larger expense ratios, there are more results.

Widened Scan (ETFdb.com)

However, we can overlook QDPL as it uses a complex strategy involving derivatives. This leaves only the lower-yielding DEW and higher yielding PEY as additions.

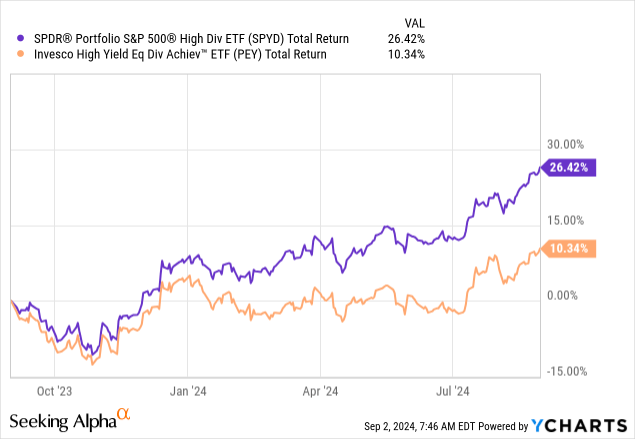

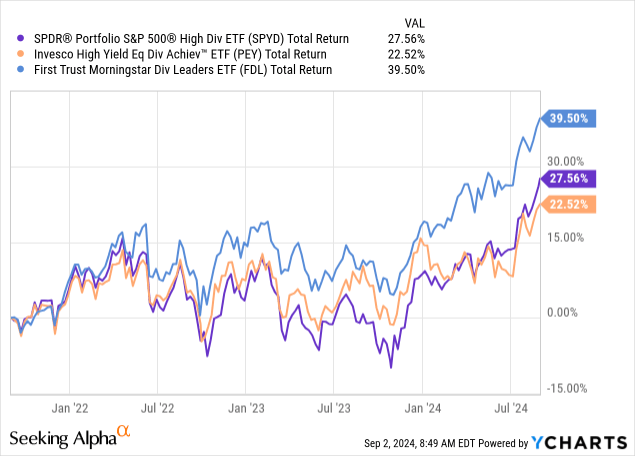

PEY has already been mentioned and is a good fund for income as it has a high yield of over 5% and pays out monthly. However, SPYD offers much better total returns, which is especially evident recently.

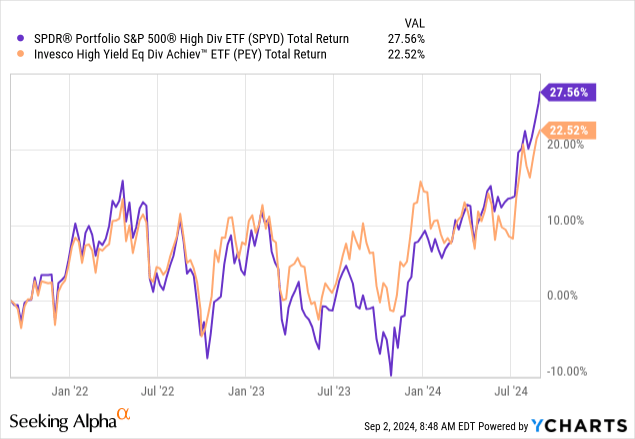

I know which fund I would have rather owned over the last year. On a longer timeframe, the outperformance narrows but is still superior.

That all said, neither SPYD or PEY can compare to the returns offered by the First Trust Morningstar Dividend Leaders Index Fund ETF (FDL).

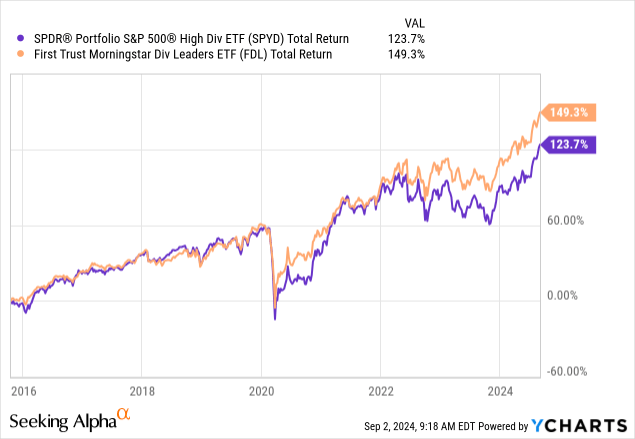

FDL outperforms on most timeframes and the last year is the only period SPYD leads. Long-term, the returns really add up.

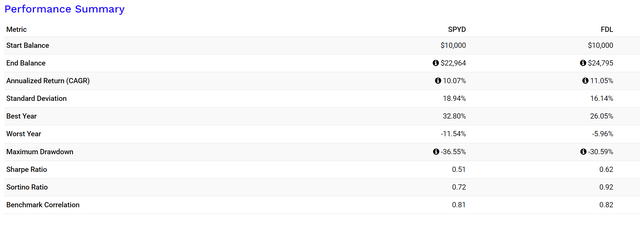

FDL has no holdings in REITs, and is relatively concentrated with 55% of the portfolio in the top 10 stocks. This concentration leads to better returns, and FDL still offers a similar dividend yield to SPYD. Indeed, the statistics since 2016 show FDL wins on most metrics.

SPYD v FDL (Portfolio Visualizer)

More reward for less risk makes FDL a more desirable fund.

Conclusions

SPYD is part of a small group of ETFs focused on equity dividends and providing yields of over 4%. Unfortunately, its simple selection process and equal weighting system doesn't produce anything particularly attractive. PEY is better for income, while FDL offers better total returns. SPYD may be the better option if you particularly want exposure to REITs as neither PEY or FDL have any exposure to that sector.

免责声明:投资有风险,本文并非投资建议,以上内容不应被视为任何金融产品的购买或出售要约、建议或邀请,作者或其他用户的任何相关讨论、评论或帖子也不应被视为此类内容。本文仅供一般参考,不考虑您的个人投资目标、财务状况或需求。TTM对信息的准确性和完整性不承担任何责任或保证,投资者应自行研究并在投资前寻求专业建议。

热议股票

- 1

- 2

- 3

- 4

- 5

- 6

- 7

- 8

- 9

- 10