MSD: Very High, Fully-Covered Yield But No EM Currency Exposure

Alistair Berg

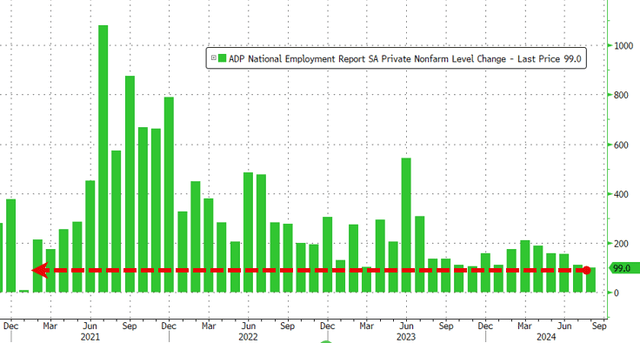

The MS Emerging Markets Debt Fund (NYSE:MSD) is a closed-end fund, or CEF, that income-focused investors can purchase as a method of achieving a very high level of current income from the assets in their portfolio. The fund also provides diversification benefits for most American investors, as the majority of people who are invested in American markets are overly exposed to the United States. The current economic environment reveals how risky this can potentially be, as there are signs that the United States may not be able to avoid a recession. Earlier today, the ADP employment data came out, and it delivered a considerable miss to expectations:

Zero Hedge/Bloomberg

Analysts and economists were expecting that there would be 145,000 jobs created in August 2024. However, the reported figure from ADP was just 99,000 job creations, which is the lowest figure that has been seen since January 2021. In addition to this, the Institute for Supply Management reports that the manufacturing sector has contracted in 21 of the past 22 months. Thus, a good case could be made that the risks of a recession in the United States are very real, and so it could be a good idea to have sufficient international diversification to protect your assets. The Morgan Stanley Emerging Markets Debt Fund invests in bonds issued by entities in emerging markets, so clearly it is one way through which this can be achieved.

Investors do not need to sacrifice their incomes to achieve this diversification, either. This is because the Morgan Stanley Emerging Markets Debt Fund yields an impressive 11.44% at the current share price. This compares quite well with the fund’s peers:

Fund Name | Morningstar Classification | Current Yield |

Morgan Stanley Emerging Markets Debt Fund | Fixed Income-Taxable-Emerging Market Income | 11.44% |

Templeton Emerging Markets Income Fund (TEI) | Fixed Income-Taxable-Emerging Market Income | 10.16% |

Virtus Stone Harbor Emerging Markets Income Fund (EDF) | Fixed Income-Taxable-Emerging Market Income | 13.16% |

Western Asset Emerging Markets Debt Fund (EMD) | Fixed Income-Taxable-Emerging Market Income | 10.33% |

Morgan Stanley Emerging Markets Domestic Debt Fund (EDD) | Fixed Income-Taxable-Emerging Market Income | 11.02% |

As we can see here, the Morgan Stanley Emerging Markets Debt Fund does not have the highest yield available in the sector. However, it is certainly competitive with most of the other funds in the emerging market debt category. We generally want a fund to have a similar yield to its peers as income investors. If it is substantially lower than other funds in the category, then we are leaving income on the table. However, if it is substantially higher than the other funds in its category, then that is a sign that its distribution may not be sustainable. This fund appears to strike a good balance between the two extremes, and as such it should be reasonable for most investors who are seeking a high level of income.

As regular readers can likely remember, we previously discussed the Morgan Stanley Emerging Markets Debt Fund in early June of this year. The global bond markets since that time have mainly been fairly strong, as prices have risen and yields have declined. This has been mostly driven by interest rate cuts by the Bank of England, Bank of Canada, and the European Central Bank, as well as expectations that the Federal Reserve will cut later this month. There have been monetary easing efforts in some emerging markets as well. As Reuters explains:

Five of the Reuters sample of 18 central banks in developing economies cut interest rates in March – matching the December tally which was the highest number in at least three years.

Policy makers in Mexico embarked on their easing cycle as expected, while Brazil, the Czech Republic, Hungary, and Columbia doubled down on their easing efforts.

But it was outlier Turkey which stunned markets with an unexpected 500 basis point rate hike, citing a deteriorating inflation outlook and pledging to tighten even further if price pressures were to worsen significantly.

Across the Reuters emerging markets sample, 12 central banks held rate setting meetings in March. The year-to-date tally of rate hikes across emerging markets stood at 750 bps – all of which were delivered by Turkey. This compares to 675 bps of cuts.

As Turkey is the only emerging market not actively reducing rates, we can see that the environment for emerging market bonds has also generally been favorable for rising prices and falling yields. Thus, we can expect that the Morgan Stanley Emerging Markets Debt Fund has performed reasonably well since our previous discussion.

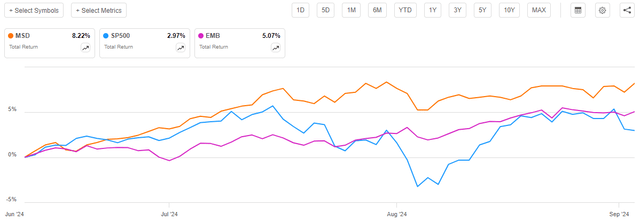

This expectation turns out to be correct, as shares of the Morgan Stanley Emerging Markets Debt Fund have risen by 5.05% since our previous discussion:

Seeking Alpha

As we can clearly see, the performance of the fund has been quite a bit better than the J.P. Morgan EMBI Global Core Index (EMB), which tracks U.S. dollar-denominated emerging market bonds. The Morgan Stanley Emerging Markets Debt Fund also outperformed the S&P 500 Index (SP500) over the period, but admittedly, large-cap common stocks are not really a good performance benchmark to use for this fund. Overall, this performance will likely be pleasing to any investor in this fund.

Investors in this fund have another reason to be satisfied with its performance, and that is the fact that it actually did a bit better than the above chart shows. As I stated in my previous article on this fund:

A simple look at a closed-end fund’s share price performance does not necessarily provide an accurate picture of how investors in the fund did during a given period. This is because these funds tend to pay out all of their net investment profits to the shareholders, rather than relying on the capital appreciation of their share price to provide a return. This is the reason why the yields of these funds tend to be much higher than the yield of index funds or most other market assets.

The Morgan Stanley Emerging Markets Debt Fund only pays a quarterly distribution, rather than a monthly one like many of its peers. As such, it requires a longer period of time for the total return boost to be realized by investors. However, it was still able to deliver a higher total return during the period than its share price alone indicates:

Seeking Alpha

As we can immediately see, the Morgan Stanley Emerging Markets Debt Fund delivered an 8.22% total return to its shareholders over the past three months. This was quite a bit better than emerging market bonds (even when including their coupon payments), and surprisingly, it still managed to beat the S&P 500 Index. The fact that this fund’s performance managed to beat common stocks is surprising, since we ordinarily expect common stocks to outperform bonds. That was clearly not the case over the summer of 2024, though.

As approximately three months have passed since our last discussion on the fund, it is reasonable to assume that several things have changed. Perhaps most importantly, the fund released its semi-annual report for the first half of 2024. As is always the case, we will want to pay special attention to this document, as it will provide us with a great deal of insight into the fund’s recent performance and its ability to cover its current distribution.

About The Fund

According to the fund’s website, the Morgan Stanley Emerging Markets Debt Fund has the primary objective of providing its investors with a very high level of current income. This objective makes sense for a bond fund, and the description provided on the website makes it apparent that this one is a bond fund. Here is the description:

We seek as a primary investment objective to produce high current income and as a secondary objective to seek capital appreciation by investing in a range of sovereign, quasi-sovereign and corporate debt securities in emerging markets, which may include U.S. dollar-denominated, local currency, and corporate debt securities. We believe that emerging markets experiencing positive fundamental change may present attractive investment opportunities for investors. To help achieve its objective, we combine top-down country allocation with bottom-up security valuation.

This description makes it quite clear that the Morgan Stanley Emerging Markets Debt Fund invests primarily, if not exclusively, in bonds. Bonds by their nature are an income investment, as I pointed out in a previous article:

Bonds by their very nature are income securities, as they do not deliver any net capital gains over their lifetimes. This makes sense, as an investor will purchase a bond at face value and receive face value back when the bond matures. The only investment return for a bond held over its entire lifetime is the coupon payments made to the bond’s owner. Thus, bonds do not deliver capital appreciation over their lifetimes.

Bonds do not deliver net capital gains over their lifetimes, which does make the fund’s capital appreciation secondary objective a bit harder to understand. However, there are two things to keep in mind here. The first is that bond prices do move in response to interest rate changes before maturity, which provides the opportunity to earn some capital gains if a bond is not held to maturity. The second important point here is that the fund’s description states that the Morgan Stanley Emerging Markets Debt Fund may invest in local currency bonds. This gives it the opportunity to earn some capital gains if the emerging market currency in which the bond is denominated rises against the U.S. dollar. That could be a possible outcome over the long term, given the fiscal problems of the U.S. Federal government.

On the first point – the Morgan Stanley Emerging Markets Debt Fund appears to do a great deal of trading in an attempt to lock in capital gains. For the first half of 2024, the semi-annual report states that the fund had a turnover of 86%. This figure is not annualized, so if it continues trading bonds at its current rate, it will have a whopping 172% annual turnover in 2024. That is enormously high for a bond fund, as we can see by looking at the levels that its peers possess:

Fund Name | Annual Turnover |

Morgan Stanley Emerging Markets Debt Fund | 172% |

Templeton Emerging Markets Income Fund | 48.95% |

Virtus Stone Harbor Emerging Markets Income Fund | 76.00% |

Western Asset Emerging Markets Debt Fund | 54.00% |

Morgan Stanley Emerging Markets Domestic Debt Fund | 56.00% |

(All figures from the most recent annual report for each fund, except for the Morgan Stanley Emerging Markets Debt Fund, which is the annualized turnover from the semi-annual report.)

This is a continuation of fairly high portfolio turnover rates that the fund has had since 2022:

FY 2023 | FY 2022 | FY 2021 | FY 2020 | FY 2019 | |

Portfolio Turnover | 116% | 77% | 26% | 38% | 39% |

As we can see, the Morgan Stanley Emerging Markets Debt Fund had a pretty high turnover in both 2022 and 2023, but its turnover was much lower than that in prior years. If the fund’s trading activity continues at its current level over the remainder of 2024, this year will come in significantly higher than it has in any of the last five years.

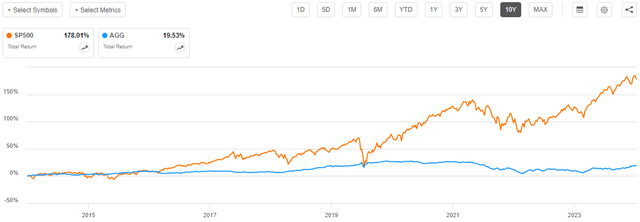

It is curious how the fund’s annual turnover was much lower in 2019 to 2021 than it is today. The opposite is true for many bond funds, due simply to the fact that interest rates in many countries were significantly lower in those years than they are today. It is very difficult to make a profit using a buy-and-hold strategy with bonds when interest rates are very low. This is why, for example, the Bloomberg U.S. Aggregate Bond Index (AGG) only delivered a 19.53% total return over the past decade:

Seeking Alpha

Investors were basically forced to go into common stocks because that was the only asset class where profits were reasonably profitable. Bond funds did not have that option, so they had to resort to trading price movements to earn any sort of return.

However, emerging market bonds have had a higher yield than most high-quality developed market bonds over the period, so it was possible to earn a better return with those. Even so, the J.P. Morgan EMBI Global Core Index only delivered a 28.86% total return over the past ten years:

Seeking Alpha

The index was performing better before the 2020 and 2022 collapses, though.

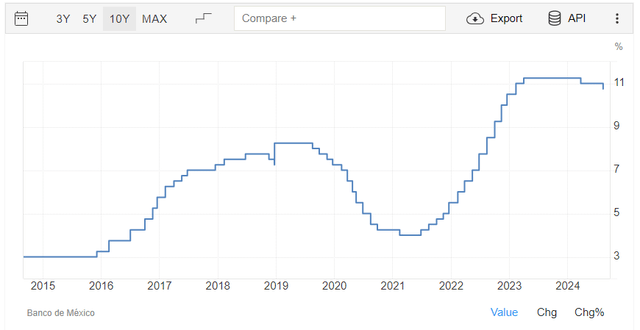

In short, though, it is difficult to see why this fund’s trading activity spiked recently. While interest rates in emerging markets are typically higher than those in most developed market nations, they were still lower than that available today during the low-interest-rate years. For example, here is the Mexican central bank’s benchmark interest rate over the past ten years:

Trading Economics

This actually suggests that a buy-and-hold strategy would make more sense today than before 2022, but the increase in the fund’s portfolio turnover rate says that its management disagrees.

The second point that I made above is that the fund may be able to earn capital gains through currency movements. It is fairly easy to understand how this works. If, for example, the fund held a bond that pays its coupon in Mexican pesos, then the fund would receive a set and unchanging number of pesos on a given payment date. However, when it goes to convert the pesos back into U.S. dollars, then it would receive more dollars if the peso appreciated against the U.S. dollar (and vice versa). As I showed in a recent article, though, that has not been the case for the Mexican peso over the past year. It is still nice to know that the fund has this option, as there may be opportunities to take advantage of it in the future.

With that said, it does not appear that the Morgan Stanley Emerging Markets Debt Fund has much exposure to local currency bonds right now. Its semi-annual report does not explicitly state the percentage exposure that it has to this asset class, but we can attempt to determine it by looking at its holdings. The schedule of investments in the semi-annual report states that the fund had the following asset allocation on June 30, 2024:

Asset Type | % of Net Assets |

Fixed-Income Securities | 98.1% |

Warrants | 0.0% |

Money Market Fund | 1.4% |

U.S. Treasury Bills | 0.2% |

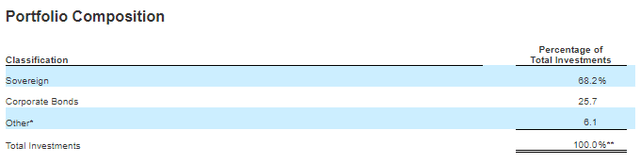

The semi-annual report also provides this split between sovereign debt and corporate debt:

MSD Semi-Annual Report

Therefore, we can see that the majority of the fund’s assets are invested in sovereign debt, with a much smaller allocation to corporate bonds and other things.

The schedule of investments lists every bond held by the fund as of June 30, 2024, as well as the currency that they use to pay their coupons. Every bond on the list is denominated in either U.S. dollars or euros. The bond’s currency denomination is the same currency that will be used to pay the coupon to the bond’s holders. Thus, it appears that as of today, the fund has no local currency bonds but instead only receives payments in U.S. dollars or euros.

Over the past year, the euro has been reasonably stable against the U.S. dollar:

MacroTrends

We can see that the exchange rate was around $1.09 per euro over the past year. It did fluctuate a bit, providing some opportunities for the fund to earn some trading profits over the exchange rate, but there is no long-term trend here. This might partially explain the high turnover, as the long-term stability of the two currencies against each other resulted in the unrealized gains during certain weeks being wiped out in a later week, resulting in it all being a wash. However, by trading bonds, the fund might have been able to lock in some currency trading profits.

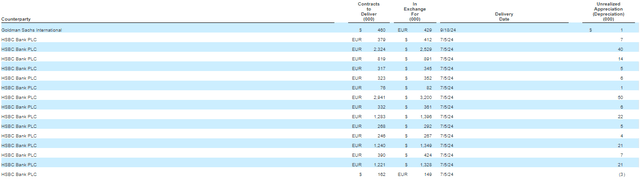

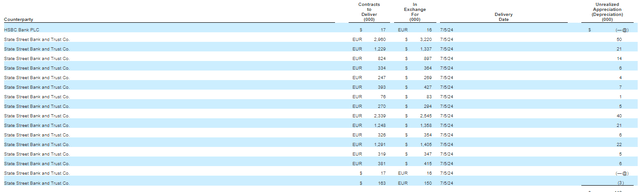

It is important to note though that this fund is at least partially hedging its currency exposure. The semi-annual report provides two tables showing its forward contracts:

MSD Semi-Annual Report MSD Semi-Annual Report

We can see that these are all contracts for euros and U.S. dollars. Some of them require that the fund sell euros at a specific price, and others require that it sell U.S. dollars at a specific price. It seems unlikely that these contracts will completely wipe out the fund’s ability to earn profits from currency trading, but it does all suggest that the only opportunity for currency trading profits comes from the EUR/USD exchange. As we have seen, that has been generally a wash over the past year.

This situation does prevent the fund from profiting from the currency appreciation of an emerging market currency against the U.S. dollar. This is unfortunate because most emerging markets have lower debt loads than either the United States or Europe, and many of them have balanced government budgets or even a surplus. Thus, a case could be made for emerging market currencies to appreciate against both the U.S. dollar and the euro over the long term. Emerging market currencies can be very volatile, though, and some conservative investors may not want to take the risk. Thus, this fund may be a better choice than something like the Virtus Stone Harbor Emerging Markets Income Fund (which does have local currency bonds) for someone who is highly risk-averse. Investors who actually do want to play the declining U.S. dollar theme might be happier with another fund, though, as currently this one does not appear to have much emerging market currency exposure.

Distribution Analysis

The primary objective of the Morgan Stanley Emerging Markets Debt Fund is to provide its investors with a very high level of current income. To this end, the fund pays a quarterly distribution of $0.2200 per share ($0.88 per share annually). This is actually a higher distribution than the one that the fund was paying the last time that we discussed it, which is quite nice. This gives the fund an 11.44% yield at the current price. As we saw in the introduction, this is a very reasonable yield for an emerging market debt fund.

Unfortunately, this fund has not been particularly consistent regarding its distribution over the years:

CEF Connect

As I stated in my previous article on the Morgan Stanley Emerging Markets Debt Fund:

As we can see, the fund’s distribution has changed in every quarter dating back to 2022. That is something that is likely to reduce the fund’s appeal in the eyes of many income investors. After all, many of us are trying to invest in things that will provide us with the income that we need to pay our bills and support ourselves. However, the website implies that all the fund is doing is paying out its net investment income. This is generally what we would like to see from a fixed-income fund, even if it does result in a variable distribution. However, it is difficult to see how an unleveraged fund can have such a high yield if its distributions are entirely financed by net investment income, so let us have a look at its financial statements.

As of the time of writing, the most recent financial report that is available for the Morgan Stanley Emerging Markets Debt Fund is the semi-annual report for the six-month period that ended on June 30, 2024. A link to this document was provided earlier in this article. This is a much newer report than the one that was available to us the last time that we discussed this fund, so it should work pretty well to provide an update.

For the six-month period that ended on June 30, 2024, the Morgan Stanley Emerging Markets Debt Fund received $9.643 million in interest and $192,000 in dividends from the assets in its portfolio. This gives the fund a total investment income of $9.835 million for the six-month period. The fund paid its expenses out of this amount, which left it with $8.856 million available for the shareholders. That was sufficient to pay the $8.682 million that the fund paid out in distributions during the period.

This actually confirms the claim that is made on the website that the Morgan Stanley Emerging Markets Debt Fund is simply paying out its net investment income to the shareholders. This is generally what we want to see from a bond fund, as it verifies that the fund is not destroying its net asset value. It also means that the distribution should be sustainable as long as the fund continues to bring in the same amount of money via the coupons paid by the bonds in the portfolio.

For the first half of 2024, the Morgan Stanley Emerging Markets Debt Fund also had $1.452 million of net realized capital gains. It will need to distribute these to the shareholders in addition to its net investment income, so that explains the increase in the distribution back in July. We will want to revisit this fund later in the year to see if it can actually sustain the payout. If interest rates continue to drop, then that will drag on the fund’s net investment income and could force a cut in the absence of sufficient capital gains from falling interest rates.

Valuation

Shares of the Morgan Stanley Emerging Markets Debt Fund are currently trading at a 2.78% discount to net asset value. This is a much more attractive price than the 0.65% discount that the shares have had on average over the past month. The current entry price is therefore reasonable, but due to the narrow discount, it is important to check the price before buying shares. After all, the small discount means that it could swing to a premium and then a purchaser would be overpaying for the fund’s assets.

Conclusion

In conclusion, the Morgan Stanley Emerging Markets Debt Fund is one of the best emerging market debt funds available in the market today. Its very high yield is fully covered by net investment income alone, and it just raised the distribution, which anyone can appreciate. The fund is also trading discounted, but it is not much of one.

The biggest disappointment here is that the fund does not have any local currency bonds in its portfolio at the moment. This works against someone who is hoping to play the long-term decline of the U.S. dollar (and possibly the euro) caused by the poor fiscal policies of the nations that are the stewards of those currencies. This is something that may change in the future, though, as the fund is not prohibited from buying local currency bonds.

免责声明:投资有风险,本文并非投资建议,以上内容不应被视为任何金融产品的购买或出售要约、建议或邀请,作者或其他用户的任何相关讨论、评论或帖子也不应被视为此类内容。本文仅供一般参考,不考虑您的个人投资目标、财务状况或需求。TTM对信息的准确性和完整性不承担任何责任或保证,投资者应自行研究并在投资前寻求专业建议。

热议股票

- 1

- 2

- 3

- 4

- 5

- 6

- 7

- 8

- 9

- 10