ECAT: One Of The Dirty Dozen CEFs Now Yields 20% And Is A Buy Before The Discount Closes

Tom Werner/DigitalVision via Getty Images

When I first wrote about the Dirty Dozen CEFs from 2021 back in November 2023, I was describing the miserable performance of the twelve closed end funds that did IPOs in 2021. In fact, at the time of writing, all 12 CEFs had delivered negative total returns since inception. The average discount of those 12 funds was -12.5% and each offered a high-yield distribution, with the highest at 12.9%. I had compiled a table of those dozen funds and included it in that article. I am pasting a copy of it here for your reference.

author/Seeking Alpha

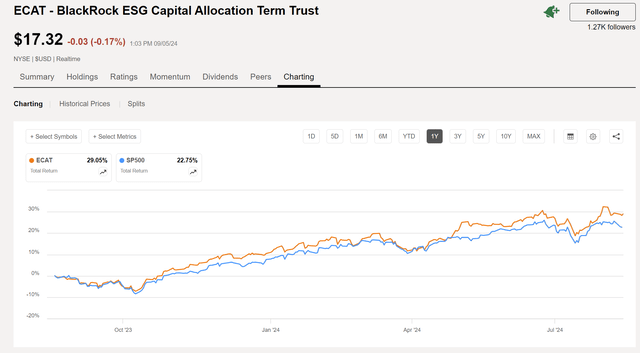

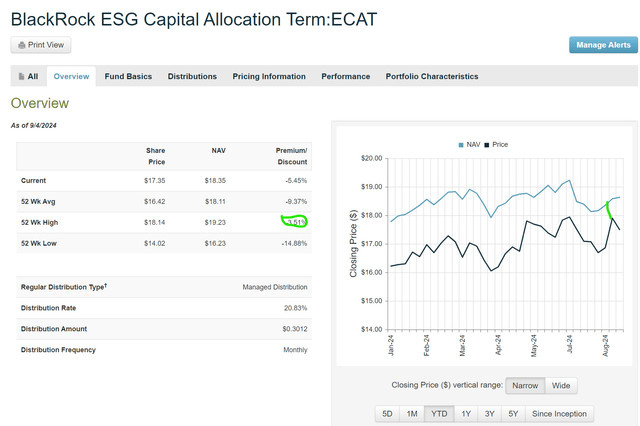

Looking back now, several of those funds have delivered strong performance since that article was written. One of those funds is the BlackRock ESG Capital Allocation Term Trust (NYSE:ECAT). Incidentally, all 12 of the “dirty dozen” are term funds with a 12-year termination date (2033) from inception, unless extended or changed to perpetual with shareholder approval. The total return from ECAT over the past year has exceeded the S&P 500, and now with the latest change to the distribution, it distributes 20% of the previous month’s NAV each month, yielding over 20% at market price while the fund still trades at a discount.

Seeking Alpha

Furthermore, recent news about the fund include a tender offer based on the new Discount Management program announced in May for multiple BlackRock funds, and a big increase in the monthly distribution announced May 20, 2024, including the change to a managed distribution based on 20% of the previous month’s NAV to be paid out to shareholders on a monthly basis.

Effective today, each of ECAT and BCAT will pay monthly distributions to shareholders at an annual rate of 20% of the Fund’s 12-month rolling average daily net asset value to be calculated 5 business days prior to declaration date.

By the way, sibling fund BCAT may also be of interest, with many similarities to ECAT but with a little longer history, having been launched in 2020. This analysis is focused on ECAT and I have not performed a thorough review of BCAT, so I am not recommending it, at least not yet.

ECAT Overview

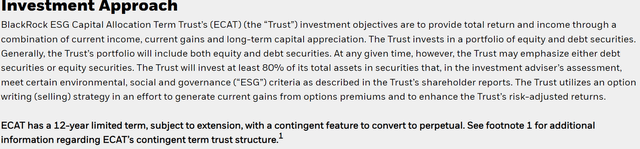

From the fund website, this term trust invests in both equity and debt (fixed income) securities:

ECAT website

The fund has about $1.8B in AUM after nearly 3 years in existence with about 99M shares outstanding as of 9/4/24.

ECAT website

As of July 31, 2024, the fund held about 68% in equities, 29.5% in fixed income, and less than 3% cash.

Equity Positioning

From the fund’s Q2 2024 commentary on equity adjustments made during the quarter:

As of June month-end, the Trust had a 69.7% weighting in equities, down slightly from 71.4% at the end of March. This reduction was in recognition of a resilient US economy, continued strength across corporate earnings and a nominal GDP environment, that while decelerating, has proven to hold up better than expected at the beginning of the year. During Q2 2024, exposure to the information technology sector increased from 22.1% to 23.5%. The increase was largely driven by additions to software providers and semi-conductor companies.

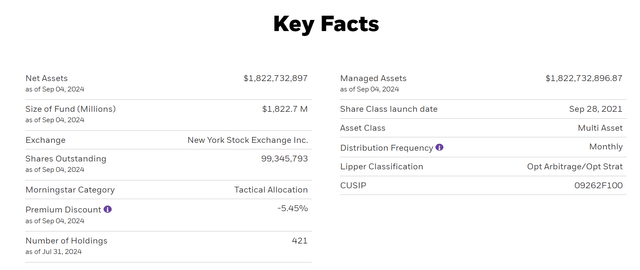

The top 10 equity holdings are high-quality companies that you would expect to see in a high performing equity fund.

ECAT website

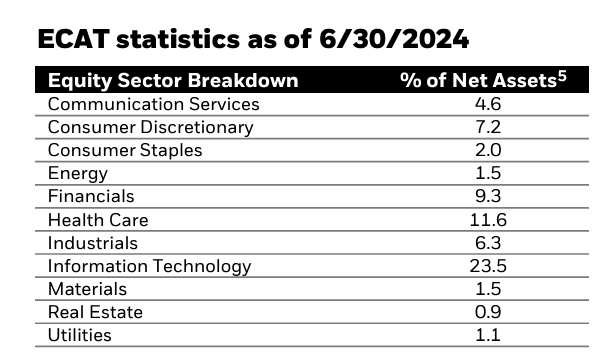

And the following table from the Q2 2024 fund commentary shows the equity sector breakdown as of 6/30/24, with the largest allocations in technology, healthcare, and financials.

ECAT Quarterly Commentary

ECAT Fixed Income Holdings

The top 10 fixed income holdings included about 6.5% in 30-year Treasuries and a mix of government and corporate debt as of the end of July.

ECAT website

From the Q2 fund commentary (ending June 30) on fixed income adjustments made during the quarter:

During Q2 2024, overall exposure to fixed income was increased from 25.7%. to 26.4%. Within fixed income, investment grade credit decreased from 4.7% to 4.5% while high yield increased from 8.3% to 9.5%. Interest rate derivatives had been used in prior quarters to manage the duration profile of the fund; however, elevated interest rate volatility has driven the cost of these instruments higher. Accordingly, the use of these derivatives came down over Q2 2024.

The breakdown of fixed income investments held in the fund as of 6/30/24 is also included in the Q2 fund commentary.

ECAT Quarterly Commentary

The fund also uses some option writing on the equity portion as well as some private investments, both of which are also summarized in the fund commentary.

Option Activity Enables Increased Income

The team has used options as a primary source of income throughout the period, taking advantage of the pick-up in volatility in the options market in recent weeks to write covered call options. As of 6/30/2024, approximately 10.2% of the equity portion of the Trust was overwritten. The Trust continues to seek opportunities to generate option premiums during periods of heightened volatility.

ECAT Private Investments

The fund intends to continue to grow the private investments, including both private equity and credit, as summarized in the Q2 commentary:

With respect to private investments, the Trust continued to establish holdings across both private equity and private debt, with a 5.7% weighting in aggregate as of June 2024 month-end. Our goal is to gradually build a diversified portfolio2 of private investments across equity and credit, with a general (but not exclusive) focus on technological innovation. Within private equity, we typically look for companies that we believe are growing revenue and consider the expected timeline to IPO (or other exit) as part of our analysis. Within private credit, the team seeks to identify opportunities for well-established businesses, with covenanted deals, and potential yields that may help during stressful periods.

ECAT Fund Strategy and ESG Focus

The fund’s overall investment approach and a more detailed description of the ESG strategy is included in the Q2 2024 Quarterly commentary (bold emphasis is mine).

The BlackRock ESG Capital Allocation Term Trust (the “Trust”) is a closed-end fund (“CEF”) that has an unconstrained approach with the ability to invest in public and private markets across different asset classes, looking to identify untapped growth opportunities tied to the evolution of ESG. We believe that a generational shift toward sustainable practices, coupled with a large reallocation of capital towards ESG, presents a long-term investment trend.

With the S in ESG referring to Sustainability, it makes sense to put the focus primarily on that aspect of investing, in my opinion. Along those lines, I have previously written about the Fourth Industrial Revolution and some specific companies like Powell Industries (POWL) that are benefitting from this historic shift that we are now in the midst of with respect to AI, digitalization of everything, process optimization, sustainable business practices, and so on.

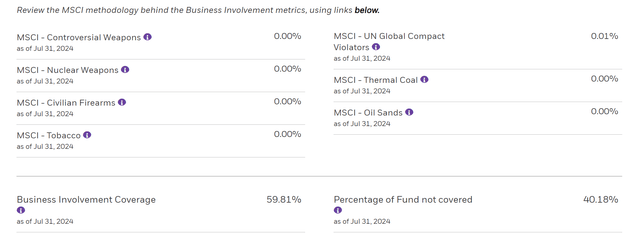

The ESG focus of the fund may turn off some investors and may be even more appealing to others. Regardless of your opinion, the strategy appears to be working. The “Business Involvement Metrics” on the fund website tends to focus more on what the fund does NOT invest in versus what it does.

ECAT website

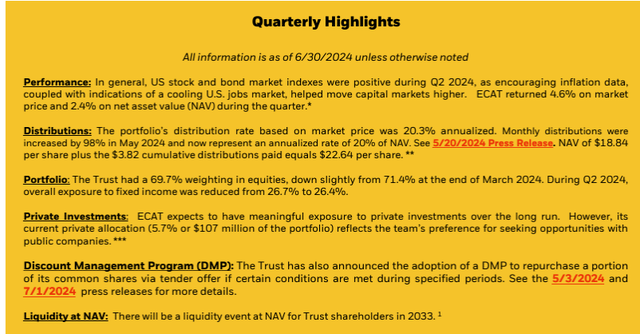

Q2 2024 Fund Summary

The Quarterly Highlights from the Q2 fund commentary also touch on the recent tender offer that was held in August as a result of the conditions of the Discount Management program being met.

ECAT Quarterly Commentary

ECAT Discount Management Program and Tender Offer

The fund Discount Management Program or DMP was initially announced on May 3. On July 1, the company announced that a tender offer would be held for several BlackRock funds that met the conditions, as explained in that press release.

As previously announced, under the Programs, each Fund intends to offer to repurchase a portion of its outstanding common shares based on 3-month measurement periods (each a "Measurement Period") if the Fund's common shares trade at an average daily discount to net asset value ("NAV") of greater than 7.50% during a Measurement Period (a "Trigger Event"). The Funds’ first Measurement Period commenced on April 1, 2024 and ended on June 30, 2024 (the "Quarterly Measurement Period").

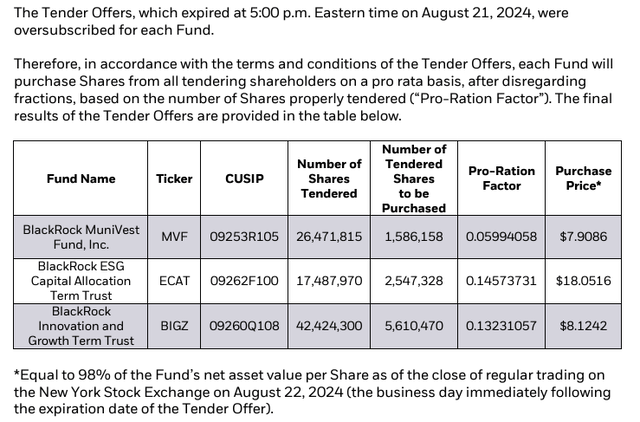

The ECAT fund discount was -8.72% as of the June 30 measurement date, so the tender offer was commenced. The tender offer for ECAT and two other BlackRock funds closed on August 22, 2024. Because the tender offers were oversubscribed, shareholders of ECAT were able to tender (sell) about 14% of shares owned back to the fund for 98% of NAV.

ECAT press release

Now as I write this on September 5, 2024, the discount has indeed closed to about -5.5%, so the intended effect of the tender offer was realized. The next measurement period of the DMP will be September 30, so as long as the discount does not widen out beyond -7.5% between now and the end of the month, there will not likely be any additional tender offers for this measurement period. You can see in the overview chart from CEFConnect how the price action in August resulted in a narrower discount (although starting to widen again from a high of -3.5%), which is the intention of the DMP.

CEFconnect

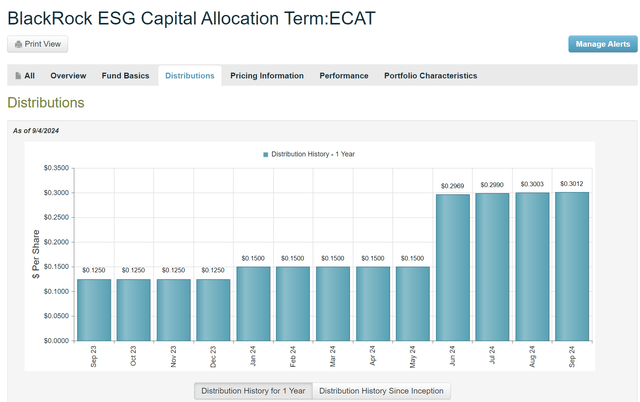

ECAT Distributions

As mentioned above, the fund moved to a managed distribution policy (which is not the same as a level distribution that pays the same amount each month) that is based on 20% of the previous month’s NAV. That means that as the NAV increases, as it has for the past four months since the change was announced, the distribution amount will also increase as illustrated on this distribution history chart.

CEFconnect

As shown in the Q2 fund commentary document, about 95% of the YTD distributions (as of 6/30/24) consisted of ROC, although the percentage dropped to 87% for the June payment. While this large percentage of ROC should not be cause for concern in itself, as I and others have discussed in various articles, including my recent review of taxable income holdings in my Income Compounder portfolio, it should be noted. In fact, some investors who hold ECAT in a taxable account may enjoy the tax benefits of the large ROC component. Remember that ROC is just a tax classification and really just means capital that was not derived from net investment income. This detailed insight from Nuveen further explains how CEFs that employ a managed distribution policy use ROC to help facilitate steady distributions.

ECAT Q224 Fund Commentary

Furthermore, consider that ECAT is also generating income from writing options, and that income may also be classified as ROC. This explanation from Fidelity discusses the tax implications of covered calls in more detail if you are interested in understanding more about that topic.

Investors who fear that the big jump in the distribution to a 20% yield on NAV with a large ROC component will lead to problems for the fund should be somewhat eased by the fact that NAV has risen over the past four months. There is a risk that if the market sentiment were to suddenly shift due to a weakening economy or renewed fears of recession, that the NAV could see a negative impact. Meanwhile, the DMP is in place to keep the discount from widening further and that should provide some additional potential for capital appreciation as the price rises, which in turn helps to boost the NAV of the fund going forward as more investors buy shares while the discount remains elevated.

Summary: Buy ECAT for the Income Before the Discount Vanishes

In the past few months, activist pressure from Saba Capital and other investment firms that have a large stake in several closed end funds have pushed hard to cause the fund managers to take action to close the large discount that has been prevalent for some time in many of those funds. In addition to the BlackRock funds, activist pressure has led to actions taken to close the discount with other CEFs from fund managers such as Nuveen, Voya, and abrdn. For example, abrdn Total Dynamic Dividend Fund (AOD) recently announced a 70% increase to the monthly distribution, as I discussed here. In June, Nuveen announced increases to the distributions of several funds that they manage. The Voya Global Advantage and Premium Opportunity Fund (IGA) announced a 29% increase in the distribution back in April and switched from quarterly to monthly distributions as I discussed in this article.

Many CEF managers are feeling the pressure not just from Saba, but from other shareholders who wish to see the funds that they invest in trading closer to par, or even at a premium to NAV. Typically, those CEFs that offer a very high-yield distribution and are able to maintain that high yield over a long period of time tend to trade at a premium, which benefits both shareholders and fund managers. One example is the Guggenheim Strategic Opportunities Fund (GOF), which trades at a 52-week average premium of 18% and offers a steady monthly distribution of $0.1821, which it has paid every month for over 10 years now, even throughout the COVID-19 pandemic and the horrible year of 2022.

When I see an opportunity present itself that may result in a unique opportunity to benefit from the actions of activist investors like Saba, I like to dig in and investigate further to try to determine if the potential for a strong return exists. In the case of ECAT, which now trades at a discount of about -5.5% while offering a distribution yield exceeding 20% at market price, and with potential for some capital appreciation due to the DMP that helps motivate investors to buy more shares of the fund to close the discount, I feel that now is a good time to add some shares. ECAT looks like a Buy to me while the discount remains and the managed distribution offers a high-yield income stream.

免责声明:投资有风险,本文并非投资建议,以上内容不应被视为任何金融产品的购买或出售要约、建议或邀请,作者或其他用户的任何相关讨论、评论或帖子也不应被视为此类内容。本文仅供一般参考,不考虑您的个人投资目标、财务状况或需求。TTM对信息的准确性和完整性不承担任何责任或保证,投资者应自行研究并在投资前寻求专业建议。

热议股票

- 1

- 2

- 3

- 4

- 5

- 6

- 7

- 8

- 9

- 10