VIG: Not Enough Yield To Be Interesting

MoMo Productions/DigitalVision via Getty Images

Smart investing involves finding opportunities and managing risk. And there are times when it’s far riskier investing in stocks without dividends than investing in stocks that pay them out. I think we are entering a period where dividend investing makes a comeback given economic weakness and a Fed rate cutting cycle. And if you’re in the same boat, then you may want to consider the Vanguard Dividend Appreciation Index Fund ETF Shares (NYSEARCA:VIG).

This ETF aims to match the performance of the S&P U.S. Dividend Growers Index. The index includes companies that have a track record of raising dividends over time, showing their dedication to giving value back to shareholders. VIG stands as one of the biggest ETFs in the large-cap blend group, with more than $82 billion under management. And with an expense ratio of just 0.06%, it’s difficult to beat cost-wise.

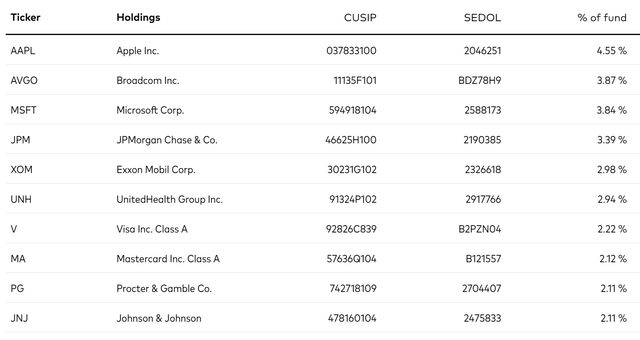

A Look At The Holdings

VIG provides you with access to a diverse set of companies. The portfolio has 339 positions, and no position makes up more than 4.55% of the portfolio.

vanguard.com

You’ll notice all the mega familiar names at the top, but clearly more focused on those with a strong history of paying dividends. Hence, why good old Nvidia isn’t showing up here.

Sector and Global Allocation

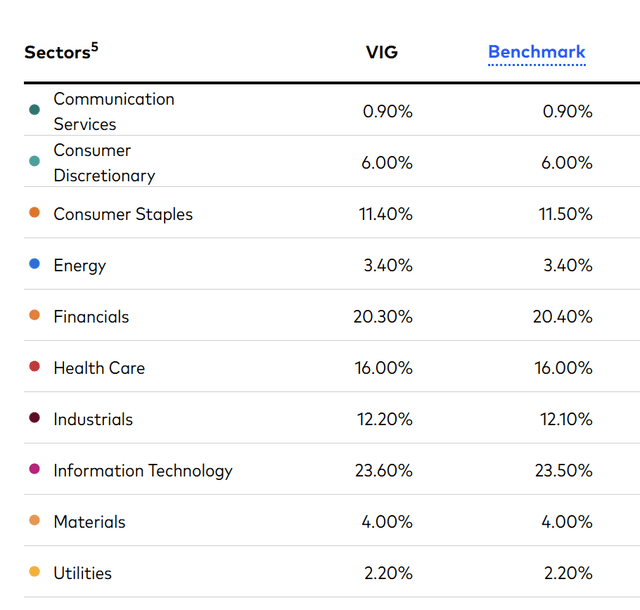

Information Technology dominates VIG's sector makeup, accounting for about 23% of the fund, which is far less than what we see currently in broad market-cap weighted averages.

vanguard.com

Financials come in close second at 20.3%, and that sector clearly has a history of paying dividends that grow over time. One of the more notable aspects of the sector allocation is that it’s a blend of growth and value. Tech is more on the growth side, Financials more on the value side. And this may be the issue given the fund's yield, which stands at a relatively paltry 1.67%. High dividend growth funds tend to have much more exposure to Industrials and Utilities. VIG doesn't. A dividend portfolio that doesn't more heavily weight those sectors just isn't as dividend heavy as it should be, in my view.

Peer Comparison

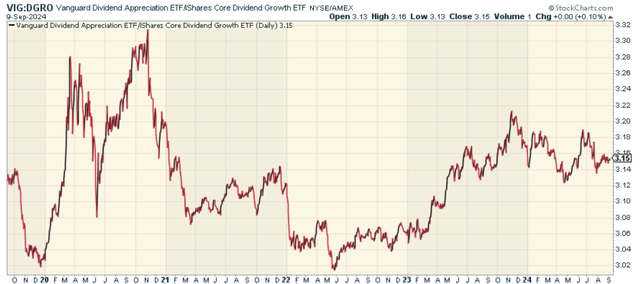

One fund worth comparing VIG against is the iShares Core Dividend Growth ETF (DGRO). DGRO also is focused on dividend growers (and frankly has a far better ticker than VIG!). When we look at the price ratio of VIG to DGRO, we find that it has slightly outperformed since 2019, but not by much. The two funds have essentially been in a wide range relative to each other. No clear winner or loser in my opinion.

stockcharts.com

Pros and Cons

On the plus side, VIG’s emphasis on dividend growth gives potentially more stability than a non-dividend focused core equity fund, since companies that keep raising dividends often show good financial health. The fund's low costs boost potential profits over time, making it appealing to investors who watch their expenses. Furthermore, VIG's mix of holdings cuts down on risks tied to specific companies, letting investors tap into a wide range of industries. And it has far less Tech exposure than more popular market proxies.

But we need to keep some things in mind. The fund's still has a big investment in the Tech sector, which I, personally, find quite vulnerable now given valuations and an overcrowded investment narrative around AI. Furthermore, while growing dividends are a good sign, they don't guarantee how well the fund will do in the future. Investors should also know that VIG's focus on U.S. companies might mean missing out on some fast-growing markets outside the country. And lastly, let’s not forget that the dividend yield isn’t especially exciting. Sure, the fund is tilted towards dividend growers, but is 1.67% attractive for income oriented investors?

Conclusion

There’s nothing wrong with Vanguard Dividend Appreciation Index Fund ETF Shares. I’d prefer it to the S&P 500 (SP500) based on the sector mix alone, and think that investors generally will likely begin to favor dividends over capital appreciation in the next cycle (or perhaps current one). I just wish there were more dividends paid out than what the fund does currently to really take advantage. While the fund is focused on dividend growers, it’s not appealing enough relative to other equity funds that are heavily weighted more towards sectors like Utilities and Consumer Staples as sources of yield. Worth considering for some. Not for me, though.

免责声明:投资有风险,本文并非投资建议,以上内容不应被视为任何金融产品的购买或出售要约、建议或邀请,作者或其他用户的任何相关讨论、评论或帖子也不应被视为此类内容。本文仅供一般参考,不考虑您的个人投资目标、财务状况或需求。TTM对信息的准确性和完整性不承担任何责任或保证,投资者应自行研究并在投资前寻求专业建议。

热议股票

- 1

- 2

- 3

- 4

- 5

- 6

- 7

- 8

- 9

- 10