After Leaping 26% Eton Pharmaceuticals, Inc. (NASDAQ:ETON) Shares Are Not Flying Under The Radar

The Eton Pharmaceuticals, Inc. (NASDAQ:ETON) share price has done very well over the last month, posting an excellent gain of 26%. Unfortunately, the gains of the last month did little to right the losses of the last year with the stock still down 11% over that time.

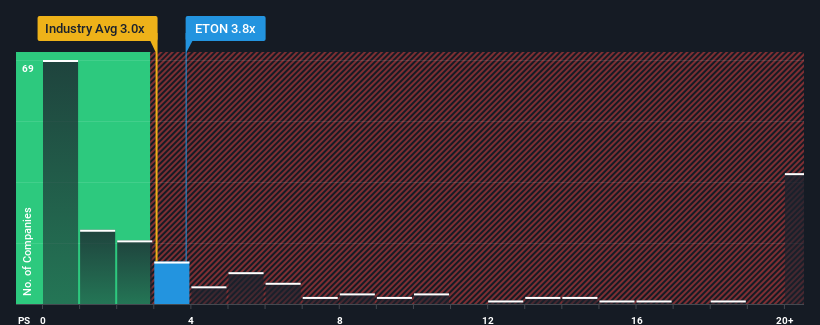

Following the firm bounce in price, Eton Pharmaceuticals may be sending sell signals at present with a price-to-sales (or "P/S") ratio of 3.8x, when you consider almost half of the companies in the Pharmaceuticals industry in the United States have P/S ratios under 3x and even P/S lower than 0.9x aren't out of the ordinary. However, the P/S might be high for a reason and it requires further investigation to determine if it's justified.

Check out our latest analysis for Eton Pharmaceuticals

How Has Eton Pharmaceuticals Performed Recently?

With revenue growth that's inferior to most other companies of late, Eton Pharmaceuticals has been relatively sluggish. One possibility is that the P/S ratio is high because investors think this lacklustre revenue performance will improve markedly. If not, then existing shareholders may be very nervous about the viability of the share price.

If you'd like to see what analysts are forecasting going forward, you should check out our free report on Eton Pharmaceuticals.Do Revenue Forecasts Match The High P/S Ratio?

There's an inherent assumption that a company should outperform the industry for P/S ratios like Eton Pharmaceuticals' to be considered reasonable.

If we review the last year of revenue growth, the company posted a worthy increase of 8.1%. Pleasingly, revenue has also lifted 111% in aggregate from three years ago, partly thanks to the last 12 months of growth. Accordingly, shareholders would have definitely welcomed those medium-term rates of revenue growth.

Looking ahead now, revenue is anticipated to climb by 37% each year during the coming three years according to the dual analysts following the company. That's shaping up to be materially higher than the 16% each year growth forecast for the broader industry.

In light of this, it's understandable that Eton Pharmaceuticals' P/S sits above the majority of other companies. Apparently shareholders aren't keen to offload something that is potentially eyeing a more prosperous future.

What Does Eton Pharmaceuticals' P/S Mean For Investors?

The large bounce in Eton Pharmaceuticals' shares has lifted the company's P/S handsomely. Using the price-to-sales ratio alone to determine if you should sell your stock isn't sensible, however it can be a practical guide to the company's future prospects.

Our look into Eton Pharmaceuticals shows that its P/S ratio remains high on the merit of its strong future revenues. At this stage investors feel the potential for a deterioration in revenues is quite remote, justifying the elevated P/S ratio. Unless these conditions change, they will continue to provide strong support to the share price.

A lot of potential risks can sit within a company's balance sheet. You can assess many of the main risks through our free balance sheet analysis for Eton Pharmaceuticals with six simple checks.

If you're unsure about the strength of Eton Pharmaceuticals' business, why not explore our interactive list of stocks with solid business fundamentals for some other companies you may have missed.

Valuation is complex, but we're here to simplify it.

Discover if Eton Pharmaceuticals might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

免责声明:投资有风险,本文并非投资建议,以上内容不应被视为任何金融产品的购买或出售要约、建议或邀请,作者或其他用户的任何相关讨论、评论或帖子也不应被视为此类内容。本文仅供一般参考,不考虑您的个人投资目标、财务状况或需求。TTM对信息的准确性和完整性不承担任何责任或保证,投资者应自行研究并在投资前寻求专业建议。

热议股票

- 1

- 2

- 3

- 4

- 5

- 6

- 7

- 8

- 9

- 10