PEY: A Nice Balance Of Sectors

The Good Brigade/DigitalVision via Getty Images

One thing I’ve learned is fairly constant over time is that when faced with uncertainty, investors tend to flock to dividend paying stocks. The market may take away capital gains, but rarely takes away dividends. So if you’re worried about the future, and want more stability in your portfolio, you may want to consider the Invesco High Yield Equity Dividend Achievers™ ETF (NASDAQ:PEY). This ETF tries to capture the best of high-yield dividend investing. It gives you access to companies that pay high dividends and which keep growing them year after year. It works well for investors who want income, growth, or both.

Invesco runs PEY, which aims to mirror the NASDAQ US Dividend Achievers 50 Index. This index has 50 stocks picked for their dividend yield and growth history. PEY has $1.2 billion under its belt, making it a decent sized player in the all-cap value field. Its 0.52% expense ratio matches industry norms for more focused, non-market-cap weighted funds. The fund's 4.80% 12-month trailing dividend yield is also nothing to sneeze at from an equity perspective.

A Look At The Holdings

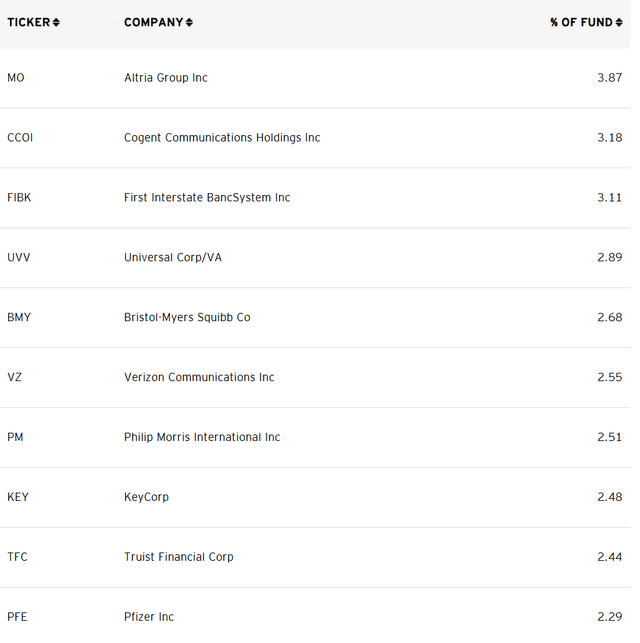

No position makes up more than 3.87% of the portfolio currently, and the mix looks highly diversified.

invesco.com

What do these companies do? Altria Group, Inc. (MO) makes and sells tobacco products cigarettes and smokeless tobacco brands. Cogent Communications Holdings, Inc. (CCOI) offers fast internet access and data transport to companies and carriers worldwide. First Interstate BancSystem, Inc. (FIBK) runs as a bank holding company providing various banking products and services to people, businesses, and towns. Universal Corporation (UVV) buys, processes, and supplies leaf tobacco to makers of consumer tobacco products. Bristol-Myers Squibb Co. (BMY) operates as a global biopharmaceutical company that finds, develops, and delivers new medicines for patients with serious illnesses.

Sector and Global Allocation

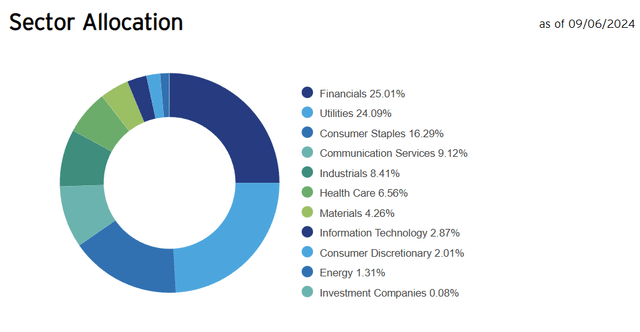

PEY's sector makeup leans toward financials, utilities, and consumer staples.

invesco.com

I like that Financials and Utilities have nearly the exact same weight here. Utilities are the quintessential defensive sectors and rarely makes up large portions of diversified portfolios. When you pare that against Financials, which are known for being more value tilted, you get an interesting blend of exposure that looks very different than the S&P 500.

Peer Comparison

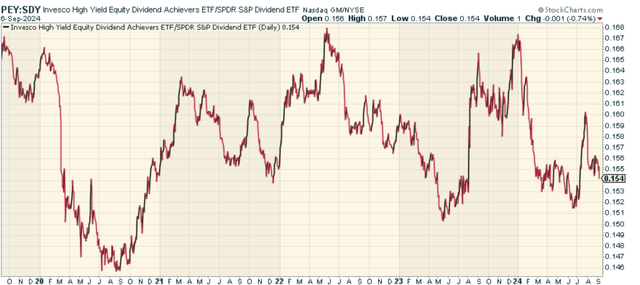

Since this fund is focused on dividends, and since there are tons of dividend focused ETFs, let's focus on one of the more popular ones in the SPDR S&P Dividend ETF (SDY). PEY tends to target high-yielding stocks. SDY, in contrast, follows the S&P High Yield Dividend Aristocrats Index. This index includes companies from the S&P Composite 1500 that have raised dividends yearly for at least 20 years and, as such, contains bigger, well-established firms. When we look at the price ratio of PEY to SDY, we find that the two funds have been in a relative range to each other for a number of years. No clear winner or trend to have confidence in from my perspective.

stockcharts.com

Pros and Cons

On the plus side, the fund's emphasis on high-yield dividend achievers gives a consistent income flow, which appeals to investors during times of market uncertainty. I like the sector exposure a lot with the balance of Financials and Utilities at the top, and I also like the fairly muted concentration in the top 10 with what look to be bellwether companies.

Yet, some things need consideration. The fund's heavy investment in the financial sector might bring in risks specific to that sector when the economy slows down. Also, though the expense ratio stands up well to competitors, it's higher than some regular market cap-weighted ETFs, which could affect returns over time. Remember that while dividend stocks tend to hold up well during recessions, they are still stocks that will likely go down in value.

Conclusion

I think the Invesco High Yield Equity Dividend Achievers™ ETF (PEY) is a good fund. It has appeal to investors looking for both income and growth. Its focus on dividend achievers, along with its mix of different sectors that isn’t typical, makes it a strong option for investors who want income. And candidly, with market volatility rising as of late, something like this makes a lot more sense to me than buying the S&P 500. I think this can be a nice core allocation in a portfolio overall.

免责声明:投资有风险,本文并非投资建议,以上内容不应被视为任何金融产品的购买或出售要约、建议或邀请,作者或其他用户的任何相关讨论、评论或帖子也不应被视为此类内容。本文仅供一般参考,不考虑您的个人投资目标、财务状况或需求。TTM对信息的准确性和完整性不承担任何责任或保证,投资者应自行研究并在投资前寻求专业建议。

热议股票

- 1

- 2

- 3

- 4

- 5

- 6

- 7

- 8

- 9

- 10