SRET: High-Yield ETF And How I Build My Portfolio With REITs

JamesBrey

I have set 8% high yield (HY8) as a target for my income portfolio. I have found the objective to be achievable but a bit stretching. However a stretching goal would "force" me to find what I called "WISE Edge" holding choices for my portfolio. The process will be time consuming and often requires me to build procedures to process adaptively improve-able. The latter part sounds a bit "scary" for passive investors. It is actually one of the key tenets of my investment. That is to build an effective income investment process that I can apply to so-many asset classes with winning results and improve efficiency.

I am heavily relying on the base portfolios from the funds, such as ETFs and CEFs, to laydown a solid framework. While I am willing to pay for the expertise and operational advantages for the fund management, well structured fund portfolios often offer decent risk-management, such as setting guardrails with proper weights to control the high-concentration risk and achieve diversification. With the base work handed-off, I can focus on my "job" that the fund management can't not do due to the fund's specific restrictions, and I will decide what funds to invest. More importantly, I will have more time to focus on when to use these funds based on the macro backdrops and various other conditions.

In this article, I will show how I select mortgage REIT (mREIT) ETFs holdings for my HY8 income portfolio. For starters, mREITs may sound like no brainers, as many of them offer yields exceeding 10%. But if you own the mREIT for last 3 years or so, your holdings would probably have given you painful losses while the broad markets have got sizeable gains. Therefore in what follows, I will also explain the reasons why I plan to add or increase some mREIT ETF positions right now.

SRET Highlight - Primary Case Study for high-yield investing Process with REIT

Global X SuperDividend® REIT ETF (NASDAQ:SRET) is an index ETF, designed to track Solactive Global SuperDividend REIT Index. SRET's strategy is described as follows in the latest Prospectus

The Index Provider screens the highest yielding REITs to exclude REITs that have historically exhibited the highest volatility, as determined by the Index Provider

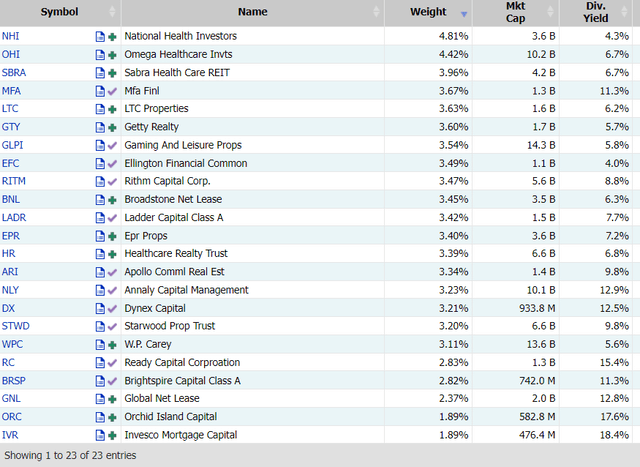

SRET employs a simply strategy to go after the highest dividends of the REIT stocks and fill the current 37 holdings in the portfolio. The following shows the top 23 holdings, which account for 76.14% of the portfolio.

SRET Holdings - from marketchameleon.com

Notice the portfolio include both equity REITs and mortgage REITs. The top Equity REITs are in healthcare sector such as NHI, OHI, SBRA, and LTC are among the top 5. The mortgage REITs are the ones showing double-digit dividends such as MFA, NLY, DX, RC, BRSP, etc. Some of the high yields under 10% including RITM, ARI, STWD are also mortgage REIT. So the current SRET's portfolio shows strong bias towards mortgage REITs and healthcare REITs, thanks to the "high-yield" requirement.

What is really unique about SRET is its volatility filter. Those high yielders with the highest historical volatility will be left out. I believe this is a very reasonable approach to construct the portfolio for two main reasons:

- REITs stocks are known to be volatile, so historical volatility is a right market property to look at.

- The volatility is an effective measure of risk. Therefore filtering out the highest volatilities should improve the stability of the portfolio.

In fact, SRET has a 52-week HV at 18.5, much lower than the other two mREIT ETF holdings of mine (to be covered in the next sections). Both have 52-week HVs exceeding 22.

Combined with "highest yield", SRET is actually trying to strike a balance between high-yield and risk dynamically. I often use a similar approach to select my high-yield holdings under the other asset classes such as high-yield bond funds etc. In fact, my target HY8 comes from the same thought process, in that what needed here may not have the highest yield but should certainly be a safer holding. 8% will provide some room for me to get the safer ones.

I use ETF portfolio for diversification, that helps me to smooth out the bad beat which could still happen during a trend reversal process, when the market sentiment might be still on the jittery edge and react emotionally to some of not so-good earning report from the individual companies.

SRET is a relative small ETF with some key market characteristics summarized as follows

- Assets (AUM) $$226.13M

- Volume: 18,080. It is small trading volume, often with wide spread between ask and bid prices. Not easily tradeable.

- Inception: March 16, 2015

- Total Holdings: 37

- Expense Ratio:0.59%

- Yield: 7.41%. Paid monthly. It is a bit lower than my target 8% but it is at the historical low level. I expect it to be higher during the rate cut cycle.

- Volatility(52-Week HV): 18.2. One of the lowest ones in the REIT space.

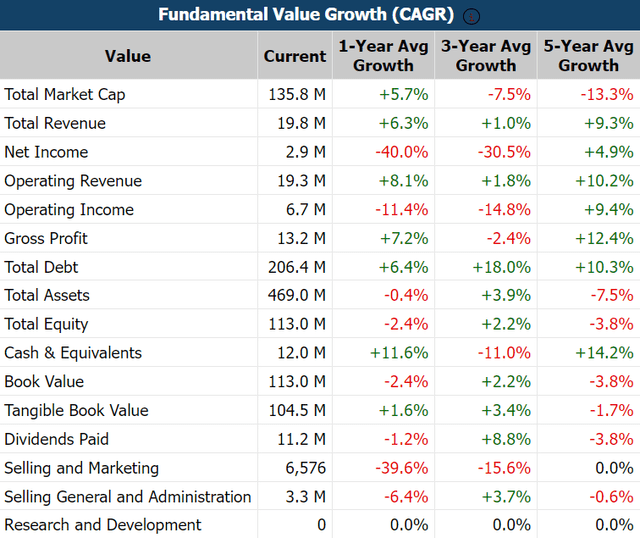

The following shows the aggregate metrics for the SRET portfolio. There are improvements in Book Value metrics compared to the 5-Year average growth. The revenue and income metrics see improvements over the 3-Year averages indicating recovery from the bottoms. They are however still below 5-Year Average.

SRET Value Growth Metrics- from marketchameleon.com

I have had SRET positions in my income portfolio for last 3 years with decreasing size over the time. The ETF has performed poorly and lost about 50% of the shares value, thanks to the perfect storms that hit the REITs in the past few years, such as Coivd19 Pandemic, FED rapid rate-hiking, Regional Bank Crisis in 2023, and "higher-for-long" regime. It is not fair to blame these funds for the poor performances. I think the REIT industry as a whole survived reasonably well compared to what happened during GFC in 2008.

Now with the first rate cut and rate declining cycle coming up, I see REIT play key roles in my HY8 income portfolio. I started to increase gradually my SRET position. Much more mREIT holdings (see more next sections) will be added after the rate cut is in place and also more importantly the house market see more signs of recovery.

REM offers high-yield as a mortgage REIT ETF

iShares Mortgage Real Estate Capped ETF(REM) is a pure play for mortgage REIT sector. It is designed as an index tracking (FTSE Nareit All Mortgage Capped Index) ETF covering both residential and commercial mortgages.

REM has total of 37 holdings, which are all mortgage REIT companies. The capping method limits "22.5% cap in any stock and all stocks above 5% to not exceed 45%", to reduce concentration and maintain a certain level of diversification, at a cost of giving up some yield (potentially). In fact, its 9.23% yield is less than many of its constituents, such as the top holding, Annaly Capital Management, offers a yield at 12.86%. REM has a 0.48% expense ratio which is lower than SRET.

Since these mREIT holdings are offering the yields at the historical high levels, my target of 8% yield can be easily accomplished. As a matter of fact, I am willing use the extra buffer in the yield difference to exchange for a better safety in my portfolio. This where REM comes in. REM's a Capped portfolio structure is designed to improve the diversification. I am feeling more comfortable to hold this ETF than the individual mREITs, due to the uncertainties involved with the current macro conditions.

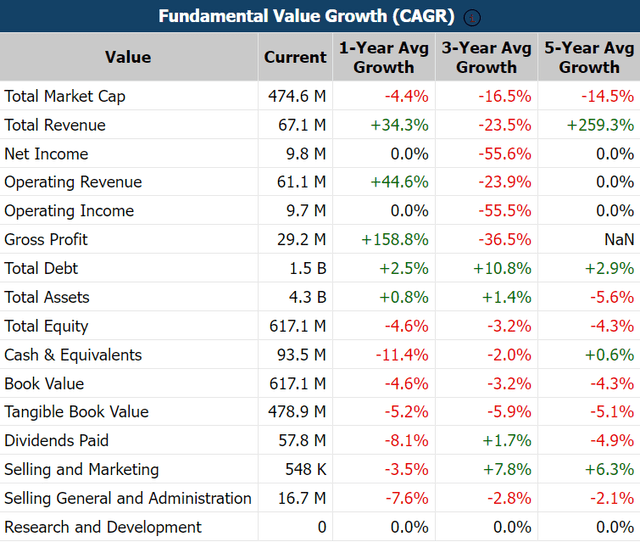

Using my favorite "Portfolio-Style" metrics as shown below, one can see that the overall mortgage business has started to be turning around for the past 12 months or so. The 1-Year growth rates in Revenues and Gross Profit (+158.8%) are great indications. On the value side, I expect the rate-cut tailwinds to help turn many "red" numbers into green in the next year or so.

REM Value Growth Metrics- from marketchameleon.com

The portfolio as a whole makes me feel very comfort to place it as a core holding for my HY8 portfolio. I have collected REM positions in my income portfolio after the market crash in Covid19 Pandemic. Compared to the equity REIT market, mortgage REIT market has been impacted more by the tightening financial conditions in the recent years as mentioned earlier. However, I will be in favor of mREIT funds as we are approaching to the ease cycle.

MORT is a lightly better mortgage REIT ETF

VanEck Mortgage REIT Income ETF(MORT) is very similar to REM in many ways. Its is also an indexing ETF designed to track the overall performance of mortgage REITs in US. The key difference is the total holdings. There are 27 in MORT's portfolio, 10 less than the current total in REM. This may be a result of filtering out the ones with lower distribution rates. In fact, MORT pays dividend with 10.55% yield, that is about 10% higher than REM.

MORT charges 10% less fee with a 0.43% expense ratio. Lower fees and higher yield have been contributed to the difference in total returns of the two. MORT's total performance has gained 21.87% beating REM's 15.18% for the last 10 years. But the price performance is also almost identical to REM, as both have lost about -50% during the same period of time.

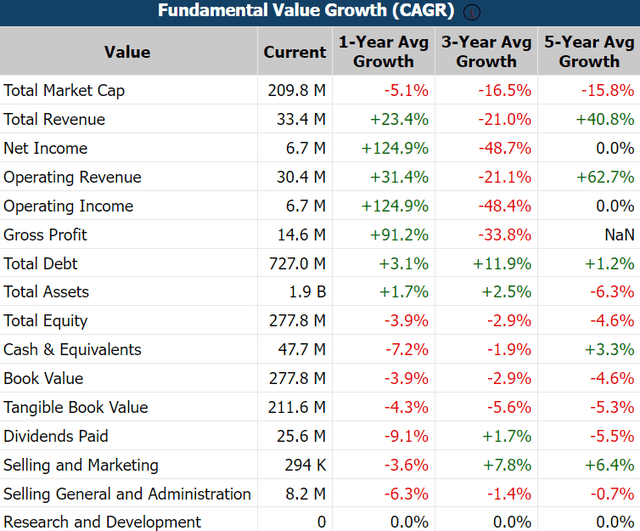

Fundamentally, as shown in the key metrics table below, MORT's Cash & Equivalents are in better positions than REM. Book values have better improvements in more recent years. So MORT offers a lightly better value at the moment.

MORT Value Growth Metrics- from marketchameleon.com

REM and MORT are swappable core holdings in my HY8 portfolio. I use the swapping trades to do dividend capture and squeeze more profit out of the same capital whenever applicable. I will explain this strategy more in my future article.

MORT has 52-Week HV at 22.7, which is slightly more volatile than REM's 22.3. With a higher yield and a better total performance in the long run, I intend to increase more weight on MORT once there is a full-blown recovery in the housing market.

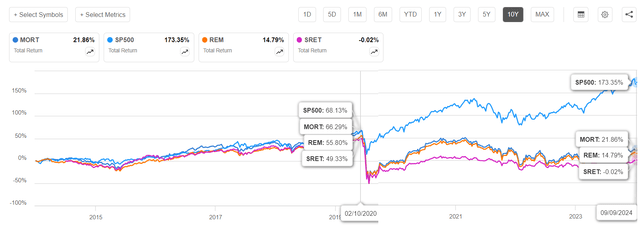

The following shows the performance in the last 10 years. Notice that the mortgage REITs were doing fine and the total returns of performance were comparable to S&P 500 at the point just before the Pandemic crash. The perfect storms hit them pretty hard for the last 4 years. In particular, the "higher for longer" regime has made the highly-leveraged mortgage REITs suffer financially. Now I am highly hopeful that the rate-cut cycle could make ETFs good winners in my HY8 income portfolio.

10-Year Total Performance of Mortgage REIT ETFs - from Author with SA charting

Takeaways

Just like market rotation, I rotate holdings in my HY8 income portfolio based on the macro conditions and rate cycles. The mortgage REIT ETFs are very promising plays in the coming rate cut cycle. These ETFs together will offer a large safe and sustainable base for my high income streams. The deeply beaten-down mREIT prices (about 35% down in 3 years) could make these holdings surprising performance winners in the rest of 2024, starting from the current level.

There are still risks in this space to keep in mind. The delinquent mortgages could creep up from the current 20-year low level and mortgage performance may not be improved as much as expected under the coming rate cut conditions. I will be incrementally adding positions over the next few months, with a focus on the safer ETFs (portfolios) instead the individual REITs.

免责声明:投资有风险,本文并非投资建议,以上内容不应被视为任何金融产品的购买或出售要约、建议或邀请,作者或其他用户的任何相关讨论、评论或帖子也不应被视为此类内容。本文仅供一般参考,不考虑您的个人投资目标、财务状况或需求。TTM对信息的准确性和完整性不承担任何责任或保证,投资者应自行研究并在投资前寻求专业建议。

热议股票

- 1

- 2

- 3

- 4

- 5

- 6

- 7

- 8

- 9

- 10