XLC: Meta And Google Domination Has Helped

Thomas Barwick/DigitalVision via Getty Images

I kind of miss the days when we would communicate by picking up a rotary phone or sending numbers through a beeper. The world is very different than it was decades ago. Mainly for the better (or so I hope). Companies in the communications segment of the economy have now almost become crucial to our very way of life. And their prominence will keep growing. So why not invest in it through The Communication Services Select Sector SPDR® ETF Fund (NYSEARCA:XLC)? This fund gives investors the ability to invest quickly in companies that are molding our connected world.

XLC aims to mirror the Communication Services Select Sector Index's performance. This index consists of S&P 500 companies that fall under the Global Industry Classification Standard (GICS) communication services sector. The fund has a straightforward goal: to give investors specific exposure to top-performing companies in the communication services sector across different industries.

XLC has 22 stocks offering a focused investment in the biggest names in the sector. This targeted strategy lets the fund track the performance of industry giants while keeping a manageable and efficient portfolio structure. The ETF's expense ratio is a competitive 0.09% making it cost-effective and a good option to consider boosting your allocation to the sector.

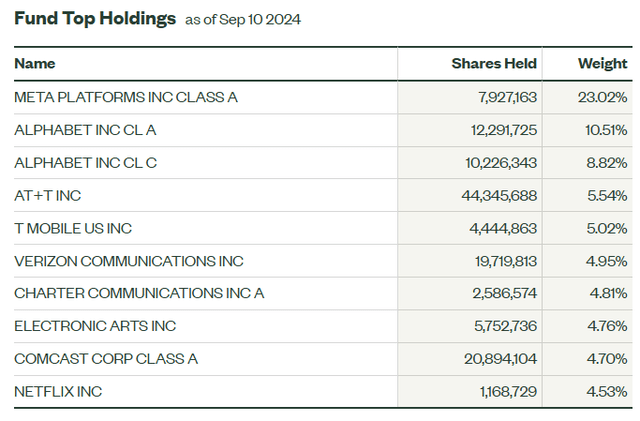

A Look At The Holdings

Because this is such a focused fund by sector, it should come as no surprise that it's top-heavy.

ssga.com

The takeaway is simple here. Meta Platforms, Inc. (META), Alphabet Inc. (GOOG) (GOOGL), AT&T Inc. (T), T-Mobile US, Inc. (TMUS), Verizon Communications Inc. (VZ), and Charter Communications, Inc. (CHTR) are essentially out connected world. And they are companies that we can't really live without anymore now, can we?

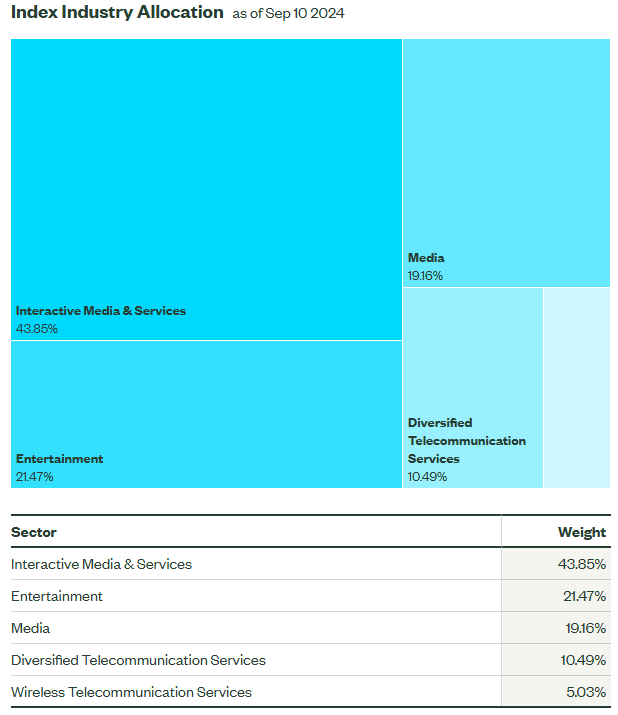

Sector Allocation

Within the sector, there's a decent amount of diversification from an industry subgroup perspective.

ssga.com

The media focus is interesting in the 2nd and 3rd spots. This fund does have one can argue discretionary names in the holdings (Netflix, Inc. (NFLX) comes to mind) but the point is that it involves several content providers that the communications companies basically pushed out.

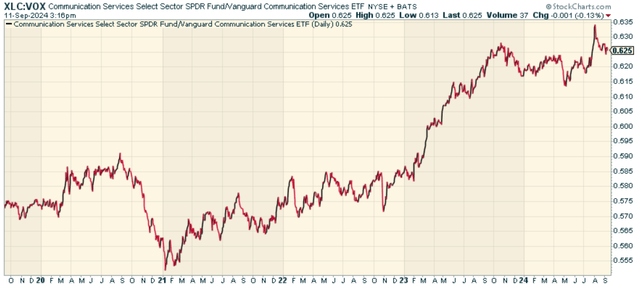

Peer Comparison

One fund worth comparing against is the Vanguard Communication Services Index Fund ETF Shares (VOX). Both XLC and VOX are passive ETFs that focus on the communication services sector, but they have differing tenures as to how long they've been available and the indices they track. XLC, which began in 2018, tracks the S&P Communication Services Select Sector Index. VOX, which started in 2004, follows the MSCI US Investable Market Telecommunication Services 25/50 Index. When we look at the price ratio of XLC to VOX, we find that XLC has solidly outperformed, largely given the more concentrated positioning in the top 10 in a Mag 7 world. So long as Meta and Alphabet dominate, so too likely will XLC versus VOX.

StockCharts.com

Pros and Cons

On the positive side, XLC gives you a chance to invest in some top companies in communication services. These companies, like Meta, Alphabet, and Netflix, are leading the way in new tech. They're at the forefront of things like AI and the metaverse. This means XLC could grow as these technologies become more important. XLC also includes some older telecom companies. These add some stability and might pay dividends. This mix of old and new allows XLC to do well in different market conditions. It can benefit from both value and growth investment styles.

The downside? The fund's focused nature means that weak performance from just a few top holdings can have a big effect on overall returns. Also, the communication services sector is known to be cyclical often doing well during economic booms but struggling during downturns. Regulatory risks are another thing to think about for the big tech companies that make up most of the fund. Ongoing checks on data privacy practices, worries about monopolies, and possible new rules could affect these companies' growth paths.

Conclusion

Investors who see promise in the long-term growth of digital communication and entertainment, and who don't mind the fund's focused strategy, might find XLC a useful addition to their diverse portfolio. I still worry about the high concentration at the top, but it's clearly worked and can continue to do so. Overall a good fund, though one that, I think, can be better timed after a market correction that would likely hit tech hardest (whenever it does happen).

免责声明:投资有风险,本文并非投资建议,以上内容不应被视为任何金融产品的购买或出售要约、建议或邀请,作者或其他用户的任何相关讨论、评论或帖子也不应被视为此类内容。本文仅供一般参考,不考虑您的个人投资目标、财务状况或需求。TTM对信息的准确性和完整性不承担任何责任或保证,投资者应自行研究并在投资前寻求专业建议。

热议股票

- 1

- 2

- 3

- 4

- 5

- 6

- 7

- 8

- 9

- 10