Hong Kong's 3 Top Undervalued Small Caps With Insider Activity

As global markets navigate through economic fluctuations and interest rate changes, the Hong Kong market has shown resilience, with small-cap stocks presenting unique opportunities amidst broader market sentiment. In this article, we explore three top undervalued small caps in Hong Kong that have attracted insider activity, highlighting their potential in the current economic landscape.

Top 10 Undervalued Small Caps With Insider Buying In Hong Kong

| Name | PE | PS | Discount to Fair Value | Value Rating |

|---|---|---|---|---|

| Shenzhen International Holdings | 5.7x | 0.7x | 25.17% | ★★★★★★ |

| Shanghai Chicmax Cosmetic | 14.5x | 1.8x | -113.63% | ★★★★☆☆ |

| Ferretti | 10.3x | 0.7x | 49.83% | ★★★★☆☆ |

| EVA Precision Industrial Holdings | 4.5x | 0.2x | 17.39% | ★★★★☆☆ |

| Meilleure Health International Industry Group | 25.9x | 9.5x | 21.72% | ★★★☆☆☆ |

| Analogue Holdings | 13.4x | 0.2x | 41.24% | ★★★☆☆☆ |

| Skyworth Group | 5.0x | 0.1x | -153.82% | ★★★☆☆☆ |

| Lee & Man Paper Manufacturing | 5.8x | 0.3x | -18.81% | ★★★☆☆☆ |

| CN Logistics International Holdings | 19.8x | 0.5x | 23.06% | ★★★☆☆☆ |

| Comba Telecom Systems Holdings | NA | 0.6x | 36.84% | ★★★☆☆☆ |

Click here to see the full list of 10 stocks from our Undervalued SEHK Small Caps With Insider Buying screener.

We're going to check out a few of the best picks from our screener tool.

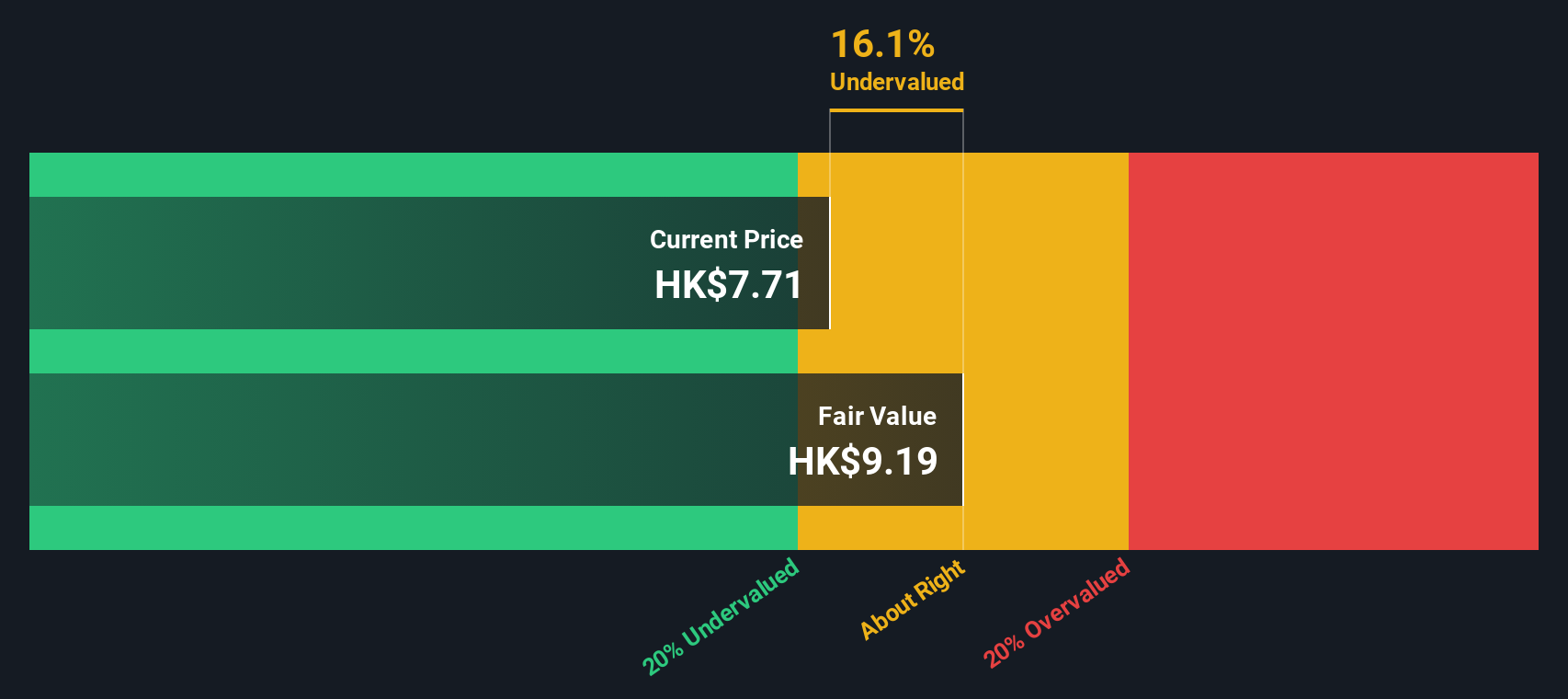

Shenzhen International Holdings (SEHK:152)

Simply Wall St Value Rating: ★★★★★★

Overview: Shenzhen International Holdings operates in logistics, including logistic parks, services, and port-related activities, as well as toll roads and environmental protection businesses, with a market cap of HK$23.95 billion.

Operations: Shenzhen International Holdings generates revenue primarily from Toll Roads and General-Environmental Protection Business, Logistics Park Transformation and Upgrading Services, Port and Related Services, Logistic Parks, and Logistic Services. The company's net income margin has shown variability over the periods with a recent figure of 12.18% as of June 30, 2024. Gross profit margin also fluctuated but was recorded at 34.90% for the same period.

PE: 5.7x

Shenzhen International Holdings, a small cap stock in Hong Kong, has shown promising financial performance recently. For the half-year ending June 30, 2024, they reported sales of HK$6.61 billion and net income of HK$652.7 million, a significant increase from last year's HK$92.05 million. Basic earnings per share rose to HK$0.27 from HK$0.04 previously. Insider confidence is evident with Zhengyu Liu purchasing 693,000 shares worth approximately HK$3.97 million recently (0.03% of total shares). Despite debt concerns due to reliance on external borrowing for funding, the company forecasts an annual earnings growth rate of 12.86%.

- Click here and access our complete valuation analysis report to understand the dynamics of Shenzhen International Holdings.

Learn about Shenzhen International Holdings' historical performance.

Skyworth Group (SEHK:751)

Simply Wall St Value Rating: ★★★☆☆☆

Overview: Skyworth Group is a diversified company primarily involved in the production of smart household appliances, smart systems technology, modern services, and new energy business with a market cap of CN¥7.65 billion.

Operations: Skyworth Group generates revenue from Smart Household Appliances, Smart Systems Technology, New Energy Business, and Modern Services. The company has recently seen a gross profit margin of 14.36%, with operating expenses comprising sales and marketing, R&D, and general administrative costs.

PE: 5.0x

Skyworth Group, a small cap in Hong Kong, has caught attention due to its promising financials and recent strategic moves. For the half year ending June 30, 2024, Skyworth reported net income of CNY 384 million, up from CNY 302 million the previous year. Sales grew to CNY 265 million from CNY 252 million. Notably, insider confidence is evident with Chi Shi purchasing over two million shares for approximately US$6.3 million between August and September. Additionally, Skyworth's expansion into Russia showcases their commitment to innovation with advanced products like the BM series and Frame+ TV. Despite relying solely on external borrowing for funding, earnings are forecasted to grow by nearly 13% annually.

- Navigate through the intricacies of Skyworth Group with our comprehensive valuation report here.

Gain insights into Skyworth Group's past trends and performance with our Past report.

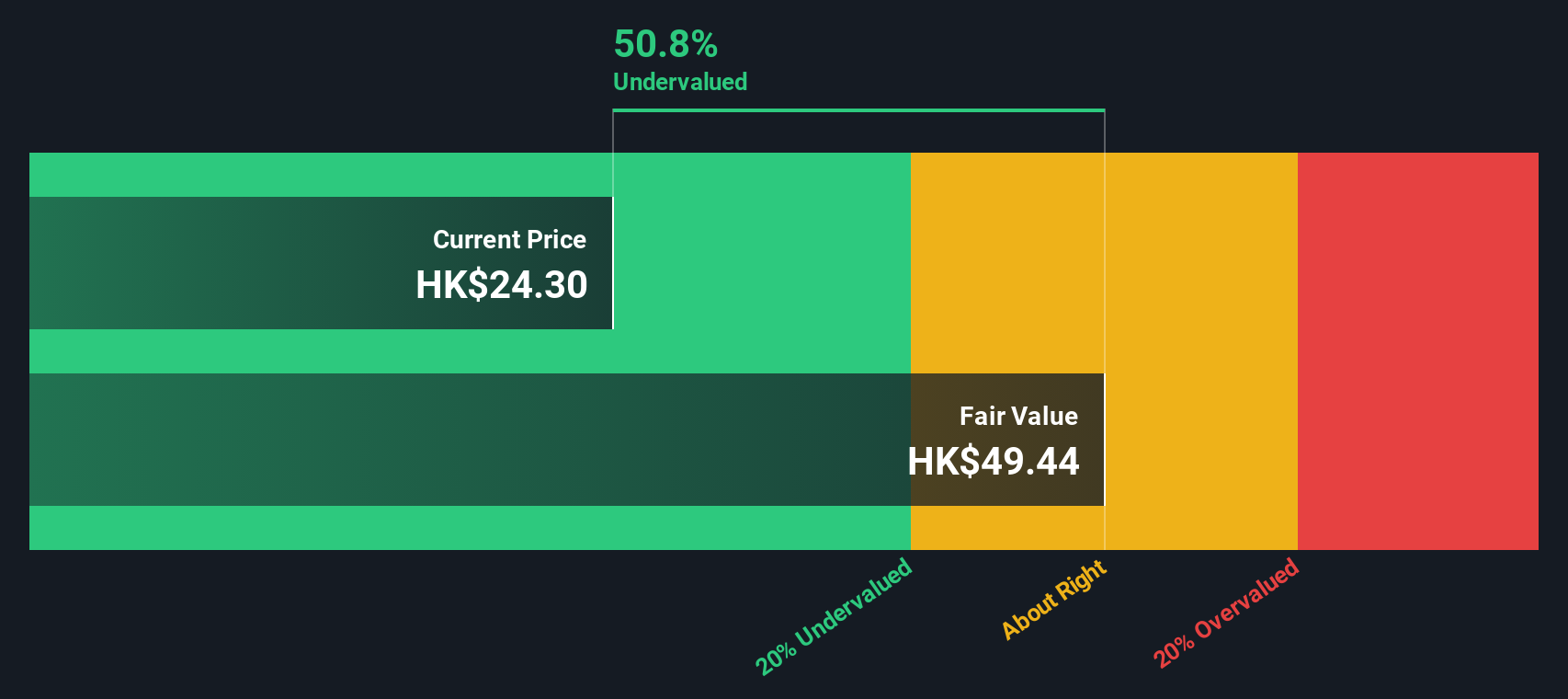

Ferretti (SEHK:9638)

Simply Wall St Value Rating: ★★★★☆☆

Overview: Ferretti is a company engaged in the design, construction, and marketing of yachts and recreational boats with a market cap of approximately €1.14 billion.

Operations: Ferretti generates revenue primarily from the design, construction, and marketing of yachts and recreational boats. The company has seen fluctuations in its gross profit margin, with a recent figure of 36.04%. Operating expenses include significant costs for general and administrative functions, depreciation and amortization, as well as sales and marketing efforts. Net income margins have varied over time, reaching 6.67% in the latest period.

PE: 10.3x

Ferretti, a niche player in the luxury yacht industry, has shown promising financial resilience with half-year sales reaching €695.1 million and net income at €43.86 million as of June 30, 2024. Despite recent executive changes, including Mr. de Vivo's departure and Mr. Jiang's appointment as Chairman on August 29, insider confidence remains strong with consistent share purchases throughout the year. The company’s earnings are forecast to grow annually by 12.48%, suggesting potential for future value appreciation in its market segment.

- Delve into the full analysis valuation report here for a deeper understanding of Ferretti.

Review our historical performance report to gain insights into Ferretti's's past performance.

Taking Advantage

- Discover the full array of 10 Undervalued SEHK Small Caps With Insider Buying right here.

- Shareholder in one or more of these companies? Ensure you're never caught off-guard by adding your portfolio in Simply Wall St for timely alerts on significant stock developments.

- Simply Wall St is your key to unlocking global market trends, a free user-friendly app for forward-thinking investors.

Looking For Alternative Opportunities?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency• Be alerted to new Warning Signs or Risks via email or mobile• Track the Fair Value of your stocks

Try a Demo Portfolio for FreeHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

免责声明:投资有风险,本文并非投资建议,以上内容不应被视为任何金融产品的购买或出售要约、建议或邀请,作者或其他用户的任何相关讨论、评论或帖子也不应被视为此类内容。本文仅供一般参考,不考虑您的个人投资目标、财务状况或需求。TTM对信息的准确性和完整性不承担任何责任或保证,投资者应自行研究并在投资前寻求专业建议。

热议股票

- 1

- 2

- 3

- 4

- 5

- 6

- 7

- 8

- 9

- 10