We Think The Compensation For Flight Centre Travel Group Limited's (ASX:FLT) CEO Looks About Right

Key Insights

- Flight Centre Travel Group will host its Annual General Meeting on 14th of November

- Total pay for CEO Skroo Turner includes AU$779.8k salary

- The total compensation is 51% less than the average for the industry

- Flight Centre Travel Group's EPS grew by 108% over the past three years while total shareholder loss over the past three years was 21%

Shareholders may be wondering what CEO Skroo Turner plans to do to improve the less than great performance at Flight Centre Travel Group Limited (ASX:FLT) recently. One way they can exercise their influence on management is through voting on resolutions, such as executive remuneration at the next AGM, coming up on 14th of November. It has been shown that setting appropriate executive remuneration incentivises the management to act in the interests of shareholders. We have prepared some analysis below to show that CEO compensation looks to be reasonable.

See our latest analysis for Flight Centre Travel Group

How Does Total Compensation For Skroo Turner Compare With Other Companies In The Industry?

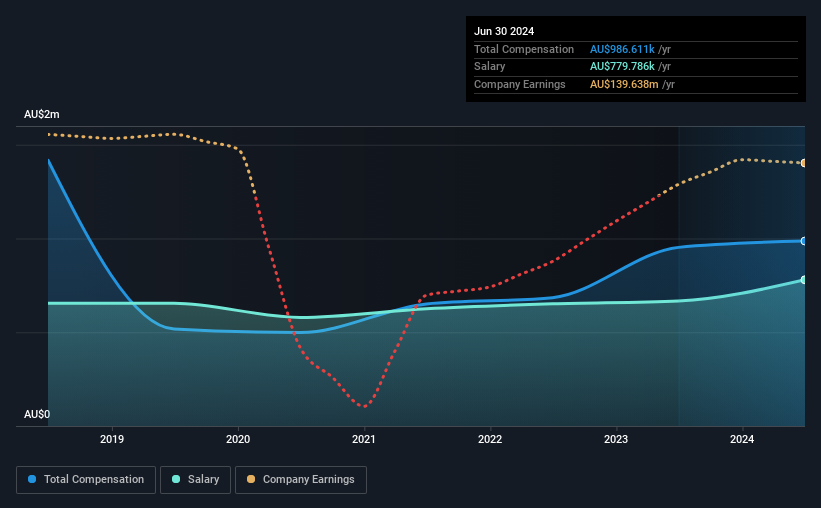

Our data indicates that Flight Centre Travel Group Limited has a market capitalization of AU$3.5b, and total annual CEO compensation was reported as AU$987k for the year to June 2024. That's just a smallish increase of 3.6% on last year. We note that the salary portion, which stands at AU$779.8k constitutes the majority of total compensation received by the CEO.

For comparison, other companies in the Australian Hospitality industry with market capitalizations ranging between AU$1.5b and AU$4.9b had a median total CEO compensation of AU$2.0m. That is to say, Skroo Turner is paid under the industry median. Moreover, Skroo Turner also holds AU$263m worth of Flight Centre Travel Group stock directly under their own name, which reveals to us that they have a significant personal stake in the company.

| Component | 2024 | 2023 | Proportion (2024) |

| Salary | AU$780k | AU$667k | 79% |

| Other | AU$207k | AU$286k | 21% |

| Total Compensation | AU$987k | AU$953k | 100% |

Talking in terms of the industry, salary represented approximately 57% of total compensation out of all the companies we analyzed, while other remuneration made up 43% of the pie. Flight Centre Travel Group is paying a higher share of its remuneration through a salary in comparison to the overall industry. If salary is the major component in total compensation, it suggests that the CEO receives a higher fixed proportion of the total compensation, regardless of performance.

A Look at Flight Centre Travel Group Limited's Growth Numbers

Flight Centre Travel Group Limited has seen its earnings per share (EPS) increase by 108% a year over the past three years. In the last year, its revenue is up 19%.

Overall this is a positive result for shareholders, showing that the company has improved in recent years. This sort of respectable year-on-year revenue growth is often seen at a healthy, growing business. Looking ahead, you might want to check this free visual report on analyst forecasts for the company's future earnings..

Has Flight Centre Travel Group Limited Been A Good Investment?

Given the total shareholder loss of 21% over three years, many shareholders in Flight Centre Travel Group Limited are probably rather dissatisfied, to say the least. Therefore, it might be upsetting for shareholders if the CEO were paid generously.

In Summary...

The fact that shareholders are sitting on a loss is certainly disheartening. The share price trend has diverged with the robust growth in EPS however, suggesting there may be other factors that could be driving the price performance. There needs to be more focus by management and the board to examine why the share price has diverged from fundamentals. In the upcoming AGM, shareholders will get the opportunity to discuss these concerns with the board and assess if the board's plan is likely to improve company performance.

While it is important to pay attention to CEO remuneration, investors should also consider other elements of the business. That's why we did some digging and identified 1 warning sign for Flight Centre Travel Group that you should be aware of before investing.

Arguably, business quality is much more important than CEO compensation levels. So check out this free list of interesting companies that have HIGH return on equity and low debt.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)• Undervalued Small Caps with Insider Buying• High growth Tech and AI CompaniesOr build your own from over 50 metrics.

Explore Now for FreeHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

免责声明:投资有风险,本文并非投资建议,以上内容不应被视为任何金融产品的购买或出售要约、建议或邀请,作者或其他用户的任何相关讨论、评论或帖子也不应被视为此类内容。本文仅供一般参考,不考虑您的个人投资目标、财务状况或需求。TTM对信息的准确性和完整性不承担任何责任或保证,投资者应自行研究并在投资前寻求专业建议。

热议股票

- 1

- 2

- 3

- 4

- 5

- 6

- 7

- 8

- 9

- 10