Even after rising 18% this past week, Congyu Intelligent Agricultural Holdings (HKG:875) shareholders are still down 54% over the past year

This week we saw the Congyu Intelligent Agricultural Holdings Limited (HKG:875) share price climb by 18%. But that doesn't change the fact that the returns over the last year have been disappointing. Like an arid lake in a warming world, shareholder value has evaporated, with the share price down 54% in that time. The share price recovery is not so impressive when you consider the fall. Of course, it could be that the fall was overdone.

Although the past week has been more reassuring for shareholders, they're still in the red over the last year, so let's see if the underlying business has been responsible for the decline.

View our latest analysis for Congyu Intelligent Agricultural Holdings

To quote Buffett, 'Ships will sail around the world but the Flat Earth Society will flourish. There will continue to be wide discrepancies between price and value in the marketplace...' One flawed but reasonable way to assess how sentiment around a company has changed is to compare the earnings per share (EPS) with the share price.

During the last year Congyu Intelligent Agricultural Holdings grew its earnings per share, moving from a loss to a profit.

Earnings per share growth rates aren't particularly useful for comparing with the share price, when a company has moved from loss to profit. But we may find different metrics more enlightening.

In contrast, the 62% drop in revenue is a real concern. If the market sees the weak revenue as jeopardising EPS, that could explain the lower share price.

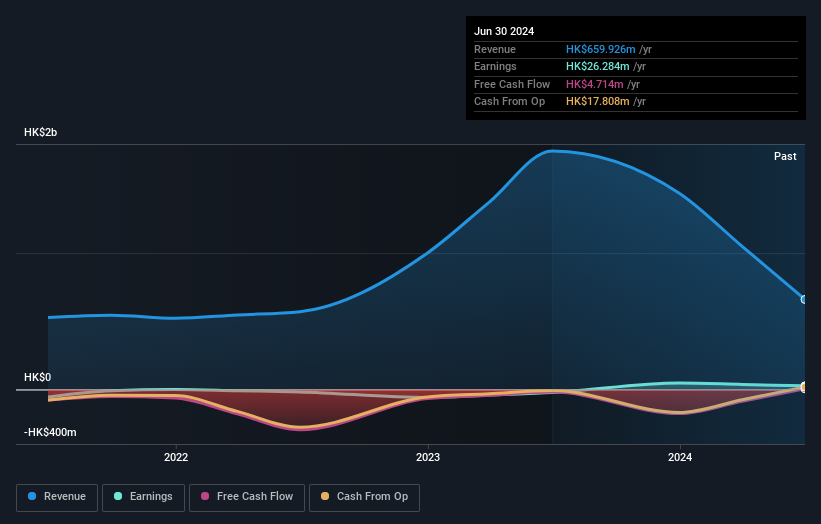

The company's revenue and earnings (over time) are depicted in the image below (click to see the exact numbers).

If you are thinking of buying or selling Congyu Intelligent Agricultural Holdings stock, you should check out this FREE detailed report on its balance sheet.

A Different Perspective

Investors in Congyu Intelligent Agricultural Holdings had a tough year, with a total loss of 54%, against a market gain of about 25%. Even the share prices of good stocks drop sometimes, but we want to see improvements in the fundamental metrics of a business, before getting too interested. On the bright side, long term shareholders have made money, with a gain of 8% per year over half a decade. It could be that the recent sell-off is an opportunity, so it may be worth checking the fundamental data for signs of a long term growth trend. It's always interesting to track share price performance over the longer term. But to understand Congyu Intelligent Agricultural Holdings better, we need to consider many other factors. Like risks, for instance. Every company has them, and we've spotted 3 warning signs for Congyu Intelligent Agricultural Holdings (of which 1 makes us a bit uncomfortable!) you should know about.

Of course, you might find a fantastic investment by looking elsewhere. So take a peek at this free list of companies we expect will grow earnings.

Please note, the market returns quoted in this article reflect the market weighted average returns of stocks that currently trade on Hong Kong exchanges.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)• Undervalued Small Caps with Insider Buying• High growth Tech and AI CompaniesOr build your own from over 50 metrics.

Explore Now for FreeHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

免责声明:投资有风险,本文并非投资建议,以上内容不应被视为任何金融产品的购买或出售要约、建议或邀请,作者或其他用户的任何相关讨论、评论或帖子也不应被视为此类内容。本文仅供一般参考,不考虑您的个人投资目标、财务状况或需求。TTM对信息的准确性和完整性不承担任何责任或保证,投资者应自行研究并在投资前寻求专业建议。

热议股票

- 1

- 2

- 3

- 4

- 5

- 6

- 7

- 8

- 9

- 10