Digi International Inc. (NASDAQ:DGII) reported better-than-expected fourth-quarter financial results on Wednesday.

Digi Intl reported quarterly earnings of 52 cents per share which beat the analyst consensus estimate of 50 cents per share. The company reported quarterly sales of $105.00 million which beat the analyst consensus estimate of $104.08 million.

“The Digi team delivered an impressive fiscal 2024 performance in soft industrial economic conditions. As the market seeks to gain increased efficiencies, our customers increasingly appreciate entrusting their value-added IoT solutions to Digi, as evidenced by our record ARR which represents approximately 27% of revenues,” stated Ron Konezny, President and CEO. “We continue to hit our objectives as we make the discovery of our solutions easier for the channel and end users with the advent of offerings like Digi 360. In addition, we lowered inventory levels, generated cash and paid down debt to strengthen our balance sheet. We remain confident in our customer centric solutions strategy and the long-term opportunity for Digi.”

Digi International said it sees first-quarter revenue of $102 million to $106 million and adjusted earnings of 46 to 50 cents per share.

Digi International shares closed at $31.97 on Wednesday.

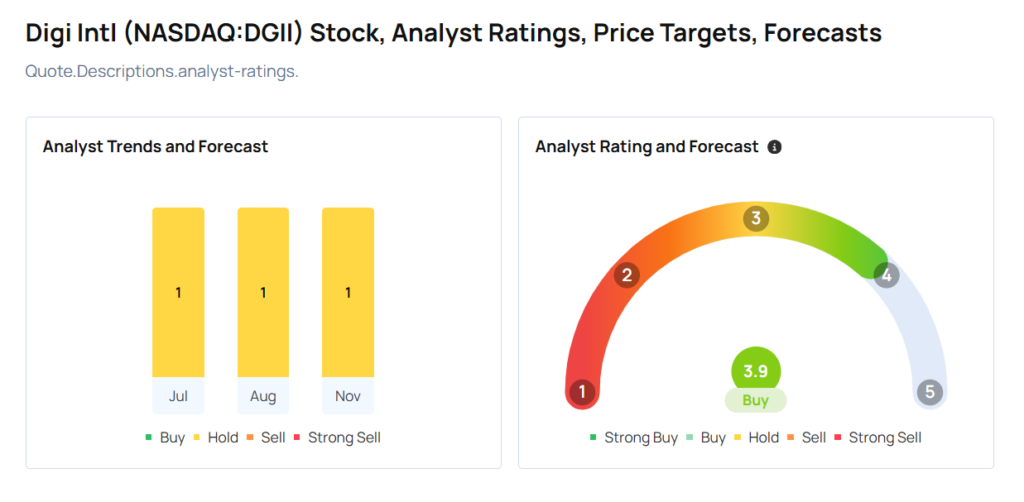

These analysts made changes to their price targets on Digi International following earnings announcement.

- Piper Sandler analyst James Fish maintained Digi Intl with a Neutral and raised the price target from $26 to $32.

- Craig-Hallum analyst Anthony Stoss downgraded Digi Intl from Buy to Hold and raised the price target from $28 to $32.

Considering buying DGII stock? Here’s what analysts think:

Read This Next:

- Jim Cramer Recommends Microsoft, Praises American Water Works For Being ‘Consistent’