Here's Why Shareholders May Want To Be Cautious With Increasing NRW Holdings Limited's (ASX:NWH) CEO Pay Packet

Key Insights

- NRW Holdings will host its Annual General Meeting on 27th of November

- CEO Jules Pemberton's total compensation includes salary of AU$1.32m

- Total compensation is 62% above industry average

- Over the past three years, NRW Holdings' EPS grew by 22% and over the past three years, the total shareholder return was 189%

CEO Jules Pemberton has done a decent job of delivering relatively good performance at NRW Holdings Limited (ASX:NWH) recently. This is something shareholders will keep in mind as they cast their votes on company resolutions such as executive remuneration in the upcoming AGM on 27th of November. However, some shareholders may still want to keep CEO compensation within reason.

View our latest analysis for NRW Holdings

How Does Total Compensation For Jules Pemberton Compare With Other Companies In The Industry?

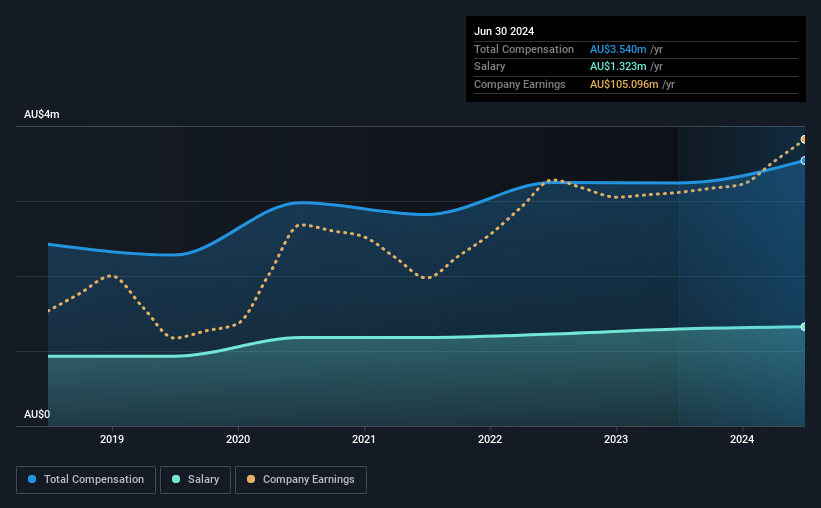

At the time of writing, our data shows that NRW Holdings Limited has a market capitalization of AU$1.8b, and reported total annual CEO compensation of AU$3.5m for the year to June 2024. That's a notable increase of 9.2% on last year. While we always look at total compensation first, our analysis shows that the salary component is less, at AU$1.3m.

In comparison with other companies in the Australian Construction industry with market capitalizations ranging from AU$616m to AU$2.5b, the reported median CEO total compensation was AU$2.2m. Hence, we can conclude that Jules Pemberton is remunerated higher than the industry median. Furthermore, Jules Pemberton directly owns AU$45m worth of shares in the company, implying that they are deeply invested in the company's success.

| Component | 2024 | 2023 | Proportion (2024) |

| Salary | AU$1.3m | AU$1.3m | 37% |

| Other | AU$2.2m | AU$1.9m | 63% |

| Total Compensation | AU$3.5m | AU$3.2m | 100% |

On an industry level, roughly 48% of total compensation represents salary and 52% is other remuneration. It's interesting to note that NRW Holdings allocates a smaller portion of compensation to salary in comparison to the broader industry. If total compensation is slanted towards non-salary benefits, it indicates that CEO pay is linked to company performance.

A Look at NRW Holdings Limited's Growth Numbers

NRW Holdings Limited has seen its earnings per share (EPS) increase by 22% a year over the past three years. It achieved revenue growth of 9.3% over the last year.

Shareholders would be glad to know that the company has improved itself over the last few years. It's also good to see modest revenue growth, suggesting the underlying business is healthy. Looking ahead, you might want to check this free visual report on analyst forecasts for the company's future earnings..

Has NRW Holdings Limited Been A Good Investment?

Most shareholders would probably be pleased with NRW Holdings Limited for providing a total return of 189% over three years. So they may not be at all concerned if the CEO were to be paid more than is normal for companies around the same size.

In Summary...

Given that the company's overall performance has been reasonable, the CEO remuneration policy might not be shareholders' central point of focus in the upcoming AGM. However, if the board proposes to increase the compensation, some shareholders might have questions given that the CEO is already being paid higher than the industry.

CEO compensation can have a massive impact on performance, but it's just one element. That's why we did some digging and identified 1 warning sign for NRW Holdings that investors should think about before committing capital to this stock.

Important note: NRW Holdings is an exciting stock, but we understand investors may be looking for an unencumbered balance sheet and blockbuster returns. You might find something better in this list of interesting companies with high ROE and low debt.

Valuation is complex, but we're here to simplify it.

Discover if NRW Holdings might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

免责声明:投资有风险,本文并非投资建议,以上内容不应被视为任何金融产品的购买或出售要约、建议或邀请,作者或其他用户的任何相关讨论、评论或帖子也不应被视为此类内容。本文仅供一般参考,不考虑您的个人投资目标、财务状况或需求。TTM对信息的准确性和完整性不承担任何责任或保证,投资者应自行研究并在投资前寻求专业建议。

热议股票

- 1

- 2

- 3

- 4

- 5

- 6

- 7

- 8

- 9

- 10