We Discuss Why Lynas Rare Earths Limited's (ASX:LYC) CEO Compensation May Be Closely Reviewed

Key Insights

- Lynas Rare Earths' Annual General Meeting to take place on 27th of November

- Salary of AU$1.48m is part of CEO Amanda Lacaze's total remuneration

- Total compensation is similar to the industry average

- Lynas Rare Earths' three-year loss to shareholders was 18% while its EPS was down 21% over the past three years

Shareholders will probably not be too impressed with the underwhelming results at Lynas Rare Earths Limited (ASX:LYC) recently. At the upcoming AGM on 27th of November, shareholders can hear from the board including their plans for turning around performance. This will be also be a chance where they can challenge the board on company direction and vote on resolutions such as executive remuneration. We present the case why we think CEO compensation is out of sync with company performance.

View our latest analysis for Lynas Rare Earths

Comparing Lynas Rare Earths Limited's CEO Compensation With The Industry

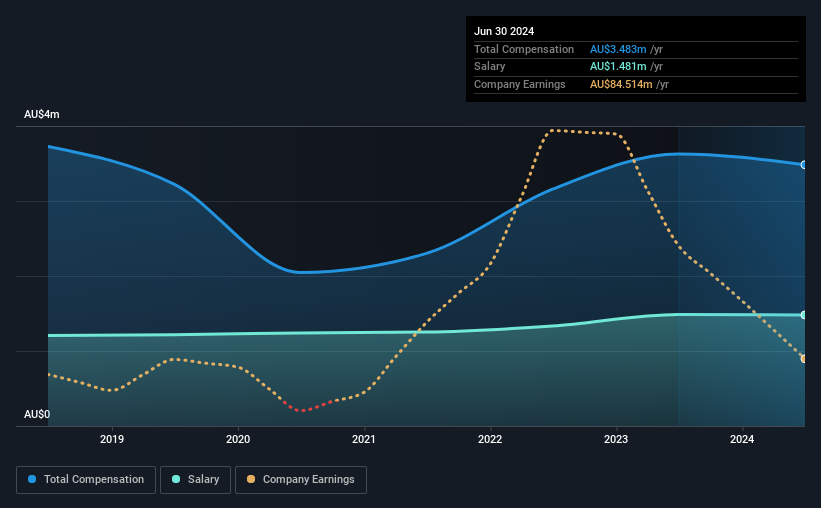

According to our data, Lynas Rare Earths Limited has a market capitalization of AU$6.6b, and paid its CEO total annual compensation worth AU$3.5m over the year to June 2024. That's slightly lower by 4.0% over the previous year. While this analysis focuses on total compensation, it's worth acknowledging that the salary portion is lower, valued at AU$1.5m.

On examining similar-sized companies in the Australian Metals and Mining industry with market capitalizations between AU$3.1b and AU$9.9b, we discovered that the median CEO total compensation of that group was AU$3.1m. From this we gather that Amanda Lacaze is paid around the median for CEOs in the industry. What's more, Amanda Lacaze holds AU$16m worth of shares in the company in their own name, indicating that they have a lot of skin in the game.

| Component | 2024 | 2023 | Proportion (2024) |

| Salary | AU$1.5m | AU$1.5m | 43% |

| Other | AU$2.0m | AU$2.1m | 57% |

| Total Compensation | AU$3.5m | AU$3.6m | 100% |

On an industry level, around 63% of total compensation represents salary and 37% is other remuneration. In Lynas Rare Earths' case, non-salary compensation represents a greater slice of total remuneration, in comparison to the broader industry. If total compensation is slanted towards non-salary benefits, it indicates that CEO pay is linked to company performance.

Lynas Rare Earths Limited's Growth

Over the last three years, Lynas Rare Earths Limited has shrunk its earnings per share by 21% per year. In the last year, its revenue is down 37%.

Few shareholders would be pleased to read that EPS have declined. And the impression is worse when you consider revenue is down year-on-year. These factors suggest that the business performance wouldn't really justify a high pay packet for the CEO. Moving away from current form for a second, it could be important to check this free visual depiction of what analysts expect for the future.

Has Lynas Rare Earths Limited Been A Good Investment?

Since shareholders would have lost about 18% over three years, some Lynas Rare Earths Limited investors would surely be feeling negative emotions. This suggests it would be unwise for the company to pay the CEO too generously.

In Summary...

Along with the business performing poorly, shareholders have suffered with poor share price returns on their investments, suggesting that there's little to no chance of them being in favor of a CEO pay raise. At the upcoming AGM, management will get a chance to explain how they plan to get the business back on track and address the concerns from investors.

CEO pay is simply one of the many factors that need to be considered while examining business performance. We identified 2 warning signs for Lynas Rare Earths (1 doesn't sit too well with us!) that you should be aware of before investing here.

Switching gears from Lynas Rare Earths, if you're hunting for a pristine balance sheet and premium returns, this free list of high return, low debt companies is a great place to look.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)• Undervalued Small Caps with Insider Buying• High growth Tech and AI CompaniesOr build your own from over 50 metrics.

Explore Now for FreeHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

免责声明:投资有风险,本文并非投资建议,以上内容不应被视为任何金融产品的购买或出售要约、建议或邀请,作者或其他用户的任何相关讨论、评论或帖子也不应被视为此类内容。本文仅供一般参考,不考虑您的个人投资目标、财务状况或需求。TTM对信息的准确性和完整性不承担任何责任或保证,投资者应自行研究并在投资前寻求专业建议。

热议股票

- 1

- 2

- 3

- 4

- 5

- 6

- 7

- 8

- 9

- 10