Solana Open Interest Nears $5 Billion, but Price ATH Remains Elusive

- Solana nears $245 resistance, with Futures Open Interest at $4.7 billion signaling strong trader confidence despite overbought RSI.

- Technical challenges emerge, as RSI suggests overbought conditions, risking a pullback to $221 if SOL fails to breach resistance.

- Flipping $245 into support could drive Solana to a new all-time high above $260, reinforcing its bullish trajectory.

Solana’s price rally has brought it close to forming a new all-time high, stirring optimism among traders and investors. The altcoin’s upward momentum reflects heightened market activity, but challenges remain as Solana struggles to breach critical resistance levels.

Despite these hurdles, SOL enthusiasts remain bullish about the asset’s long-term potential.

Solana Is Struggling

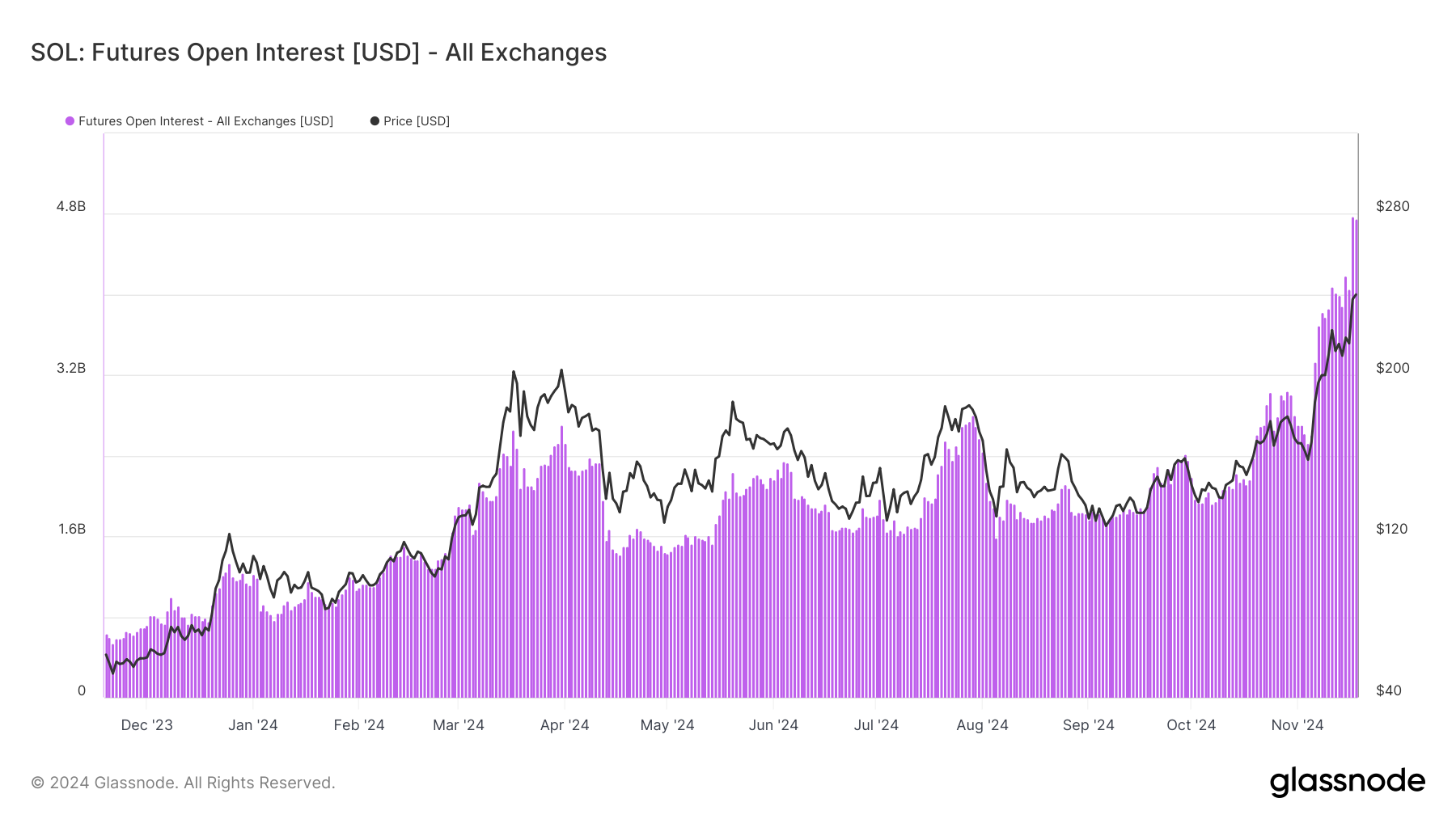

Solana traders exhibit strong optimism, with the asset’s Futures Open Interest (OI) reaching a record $4.7 billion. This surge highlights increasing confidence among traders as they pour significant capital into SOL amid its ongoing rally. With OI nearing $5 billion, Solana is experiencing a notable rise in market participation, reflecting heightened anticipation for further gains.

However, this growing OI highlights a divergence between expectations and current price movement. While traders are heavily investing, Solana’s price has yet to break past critical resistance levels. This contrast between open interest and price action raises questions about whether the bullish momentum can sustain itself or lead to a correction.

From a technical perspective, Solana’s Relative Strength Index (RSI) indicates overbought conditions, sitting well above the neutral range. Historically, such RSI levels have triggered price corrections, suggesting SOL may face short-term headwinds. A dip in price could materialize as traders adjust positions and secure profits, pulling the asset away from its all-time high ambitions.

Despite this, Solana’s macro momentum remains strong, driven by broader market cues and increased adoption. These factors contribute to the asset’s resilience, but the overbought conditions warrant caution. Investors will need to monitor whether Solana can maintain its upward trajectory or succumb to market pressures.

SOL Price Prediction: Continuing the Rise

Solana’s price is trading just below the $245 resistance level, which serves as the final barrier to a new ATH beyond $260. Breaching this critical level would confirm the continuation of SOL’s rally, allowing the asset to set new milestones.

However, mixed signals from market sentiment and technical indicators suggest potential difficulties in overcoming $245. A failure to break through could send Solana down to $221 or lower, testing investor confidence.

But if the broader market cues remain positive and $245 is flipped into support, Solana would have a chance at forming a new ATH beyond $260, invalidating the bearish thesis

免责声明:投资有风险,本文并非投资建议,以上内容不应被视为任何金融产品的购买或出售要约、建议或邀请,作者或其他用户的任何相关讨论、评论或帖子也不应被视为此类内容。本文仅供一般参考,不考虑您的个人投资目标、财务状况或需求。TTM对信息的准确性和完整性不承担任何责任或保证,投资者应自行研究并在投资前寻求专业建议。

热议股票

- 1

- 2

- 3

- 4

- 5

- 6

- 7

- 8

- 9

- 10