Root stock slumps after JMP downgrades to Perform after YTD stock surge

3D_generator

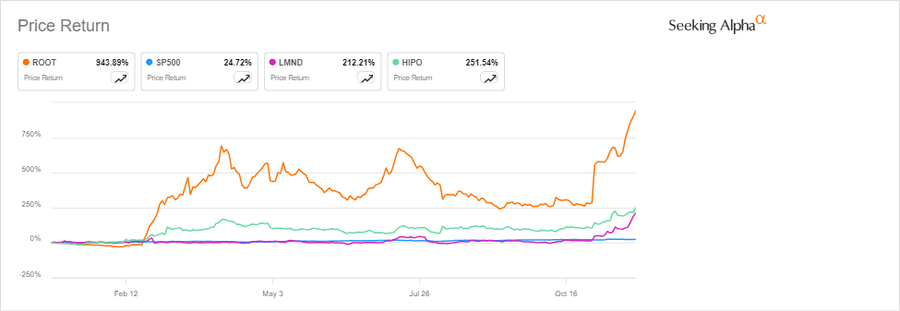

Root (NASDAQ:ROOT) stock dropped 2.4% in early Friday trading after JMP downgraded the insurtech to Market Perform following the sector's recent stock rally, with ROOT rising more than 10-fold year to date.

Root surges year-to-date, outpacing peers, S&P (Seeking Alpha)

The run-up reflects improvements in underlying profitability, along with a return to solid growth, JMP analyst Matthew J. Carletti said. While he sees the valuation as fair, "we struggle to come up with the desired upside from current levels to continue to support a Market Outperform rating," he wrote in a note to clients.

Specifically, Root (NASDAQ:ROOT) needs "to walk the tightrope of strong loss ratios (which it has done for several quarters now) alongside continued solid growth," Carletti said. In addition, the company's larger peers are likely to pursue growth in coming quarters, making it more difficult for Root to thread the needle, though he still sees it as attainable.

In JMP's insurtech update, Carletti reaffirms Lemonade (LMND) at Market Outperform and lifts its price target to $60 from $40 and reaffirms Hippo's (HIPO) Market Outperform rating while boosting its price target to $35 from $25.

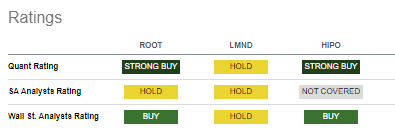

JMP's Market Perform rating contrasts with the SA Quant rating of Strong Buy and the average Wall Street rating of Buy.

Comparison of ratings for ROOT, LMND, HIPO (SA data compilation)

免责声明:投资有风险,本文并非投资建议,以上内容不应被视为任何金融产品的购买或出售要约、建议或邀请,作者或其他用户的任何相关讨论、评论或帖子也不应被视为此类内容。本文仅供一般参考,不考虑您的个人投资目标、财务状况或需求。TTM对信息的准确性和完整性不承担任何责任或保证,投资者应自行研究并在投资前寻求专业建议。

热议股票

- 1

- 2

- 3

- 4

- 5

- 6

- 7

- 8

- 9

- 10