Dell Technologies Inc. (NYSE:DELL) reported better-than-expected earnings for its third quarter, while sales missed estimates.

The company reported quarterly earnings of $2.15 per share, which beat the analyst consensus estimate of $2.05. Quarterly revenue came in at $24.37 billion, which missed the consensus estimate of $24.65 billion and is an increase over revenue of $22.25 billion from the same period last year.

"We continued to build on our AI leadership and momentum, delivering combined ISG and CSG revenue of $23.5 billion, up 13% year over year," said Yvonne McGill, CFO of Dell Technologies. "Our continued focus on profitability resulted in EPS growth that outpaced revenue growth, and we again delivered strong cash performance."

Dell shares fell 11.9% to trade at $124.82 on Wednesday.

These analysts made changes to their price targets on Dell following earnings announcement.

- Barclays analyst Tim Long maintained Dell with an Equal-Weight and raised the price target from $106 to $115.

- Citigroup analyst Asiya Merchant maintained the stock with a Buy and lowered the price target from $160 to $156.

- Mizuho analyst Vijay Rakesh maintained Dell with an Outperform and cut the price target from $155 to $150.

- Melius Research analyst Ben Reitzes maintained Dell Technologies with a Buy and increased the price target from $140 to $155.

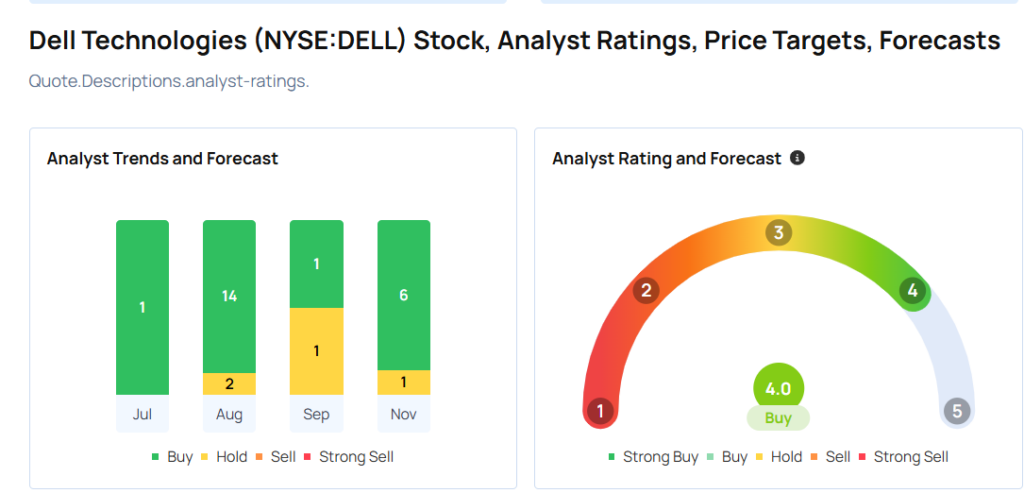

Considering buying DELL stock? Here’s what analysts think:

Read This Next:

- Urban Outfitters To Rally Around 47%? Here Are 10 Top Analyst Forecasts For Wednesday