What’s Next for Solana (SOL) After Daily Volume Jumps Back to $13 Billion

- Solana daily trading volume surged to $13 billion, a level last seen on November 22, boosting bullish sentiment.

- Rising to $4.05 billion, Solana’open interest signals heightened market participation, favoring further price rally.

- If volume and support hold, SOL may rally toward $264. A bearish scenario could see a price drop to $220.

Solana’s (SOL) daily volume rebounded to $13 billion for the first time since November 22, suggesting heightened interaction with the cryptocurrency. This surge comes amid a slight price increase, which has seen SOL rise from $230 to $239 within a few hours.

With the altcoin’s price showing signs of stabilization and on-chain activity increasing, could Solana be positioned for a potential breakout?

Solana Sees All-Round Increase In Key Areas

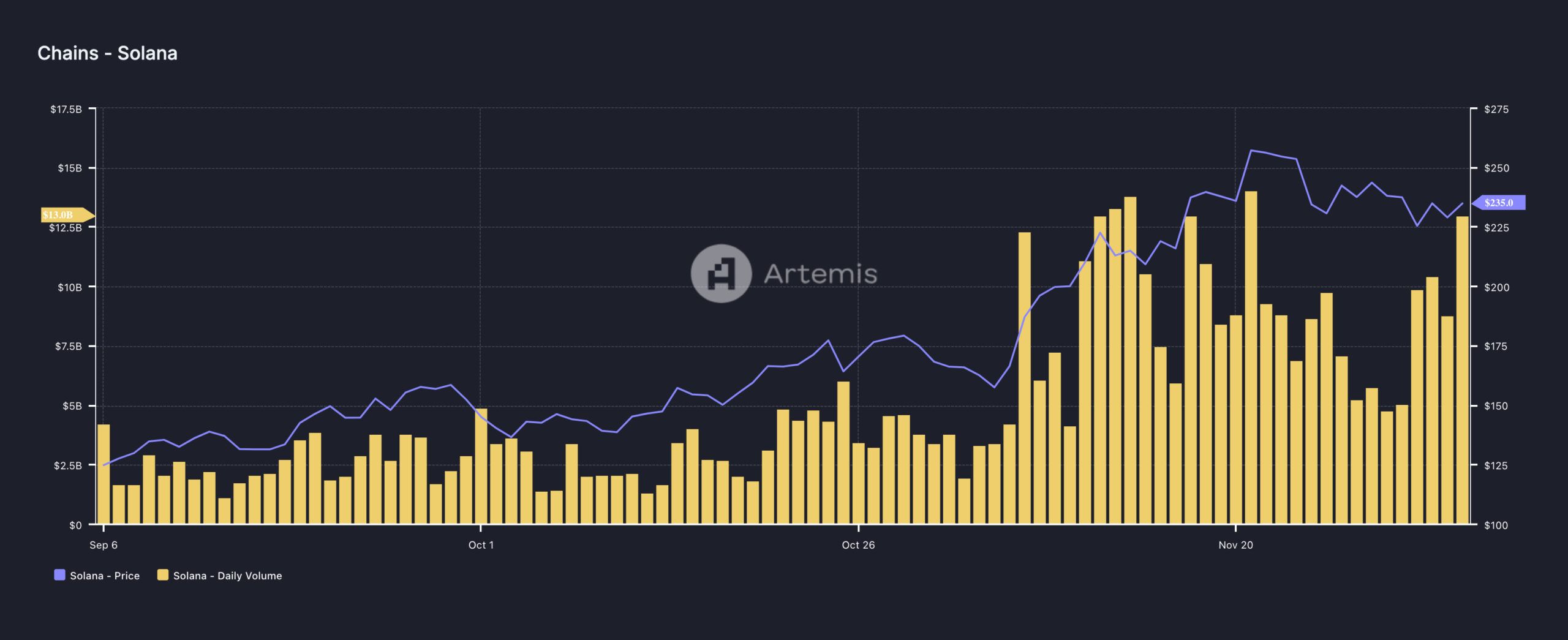

According to Artemis data, the last time the Solana daily volume surpassed $13 billion was on November 22. Interestingly, that day coincided with SOL’s rally to a new all-time high. The volume shows in monetary terms how much cryptocurrency has traded over a given period.

High volume is generally considered to be a prerequisite for a significant price move. But it is not always like that. Notably, rising volume on falling prices can indicate an extended downturn. However, if volume rises alongside the price, it indicates strength to the uptrend.

In Solana’s case, the volume increase with the altcoin’s value rising to $239 suggests that the value might continue to jump in the short term.

Furthermore, would this also mean that Solana’s price could reclaim its all-time high? To assess this potential, BeInCrypto looks at the Open Interest (OI).

The OI represents the total number of open positions in a contract. It increases or decreases based on net open positioning activity. While price increases alongside rising OI may suggest aggressive buying, technically, the ratio of buyers to sellers remains 50/50 since every trade requires both.

Instead, rising OI reflects market participants increasing their net exposure, indicating heightened interest in the asset. Conversely, declining OI suggests a reduction in overall positioning, implying traders are closing contracts or exiting the market.

According to Santiment, Solana’s OI has increased to $4.05 billion. Considering this position, then SOL might trade much higher than $239 in the coming days.

SOL Price Prediction: Retracement to $220 Possible

On the daily chart, SOL bulls seem to be defending the support at $226. On November 17, when bulls kept the support in check, Solana’s price rallied to $264.

Therefore, if history rhymes, it is likely that the altcoin’s value could replicate the performance. Like the data from Artemis, the chart below shows that the Solana daily volume has increased. Should this value continue to rise, then SOL could climb to $264 or higher in the short term.

However, if selling pressure increases, this might not happen. In that scenario, SOL’s price could decline to $220. In a highly bearish scenario, the token could decrease to $196.

免责声明:投资有风险,本文并非投资建议,以上内容不应被视为任何金融产品的购买或出售要约、建议或邀请,作者或其他用户的任何相关讨论、评论或帖子也不应被视为此类内容。本文仅供一般参考,不考虑您的个人投资目标、财务状况或需求。TTM对信息的准确性和完整性不承担任何责任或保证,投资者应自行研究并在投资前寻求专业建议。

热议股票

- 1

- 2

- 3

- 4

- 5

- 6

- 7

- 8

- 9

- 10