dYdX (DYDX) Emerges as Top Performing Altcoin with 30% Rally — More Upside Ahead?

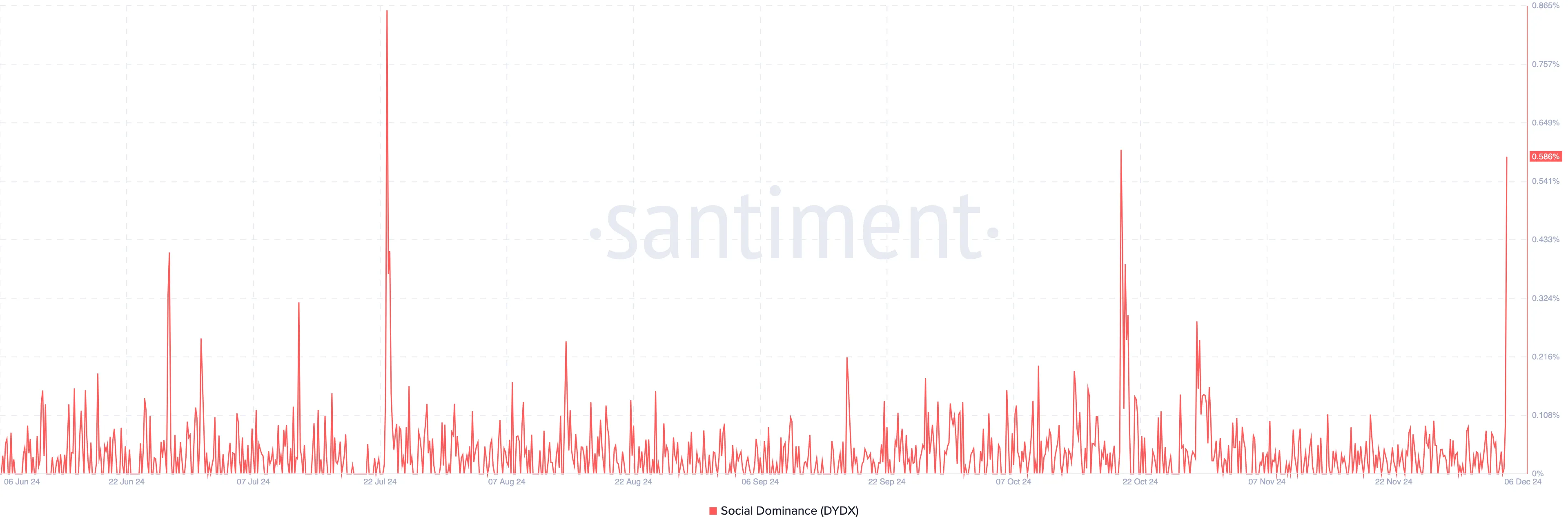

- DYDX’s social dominance jumped to 0.59%, reflecting growing market interest that could drive further price gains.

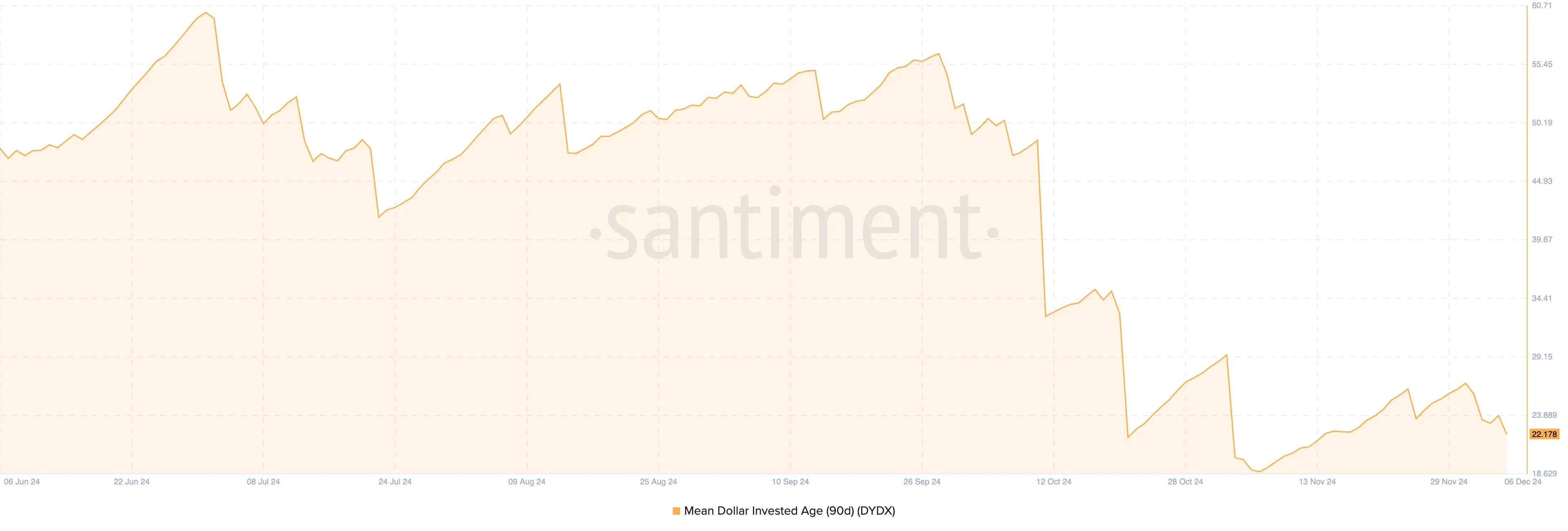

- A drop in the Mean Dollar Invested Age suggests renewed trading activity, supporting DYDX’s bullish outlook.

- If the breakout holds, DYDX could rally to $4.53. However, rising selling pressure might pull the altcoin to $1.56.

DYDX, the native token of decentralized trading platform dYdX, has become the top-performing altcoin in the last 24 hours. According to CoinGecko, DYDX rallied to this peak after the price increased by 30%.

As a result, it outperformed altcoins, including Bitget Token (BGB) and Virtuals Protocol (VIRTUAL). Here is how it happened and what could be next for the token.

Interest in dYdX Reaches Extremely High Levels

24 hours ago, DYDX price was $1.82. But in the early trading session today, the cryptocurrency’s value rallied to $2.48, becoming the top-performing altcoin out of the top 100. While the price has slightly retraced to $2.34, Santiment data shows that the market is significantly interested in it.

One metric that proves this is social dominance. Social dominance measures the percentage of discussions in crypto-related media that mention a specific asset or keyword. This metric provides insights into the relative popularity or attention an asset receives compared to others.

When the metric increases, it means that there are more conversations about the cryptocurrency relative to others in the top 100. On the other hand, a decline indicates otherwise. As of this writing, DYDX’s social dominance has spiked to 0.59%.

If Social Dominance continues to rise, it could signal increased demand for the altcoin, potentially driving its price to rebound toward $2.48. Supporting this outlook, the Mean Dollar Invested Age (MDIA) also indicates growing market activity.

MDIA measures the average age of all dollars invested in a cryptocurrency and can reflect market phases. Typically, a rising MDIA suggests token stagnation, often inhibiting price growth.

However, Santiment data shows that MDIA has recently declined, signaling increased trading activity as previously dormant tokens are now circulating. This trend could further bolster the altcoin’s recovery potential.

DYDX Price Prediction: $4 Coming?

According to the 3-day chart, DYDX’s position as the top-performing altcoin resulted from a break out of the descending triangle.

A descending triangle is a bearish pattern frequently defined by a falling upper trendline connecting a series of lower highs and a horizontal lower trendline serving as support. This pattern indicates weakening buying pressure and a likelihood of a breakdown below the horizontal support level, signaling a potential continuation of a downward trend.

However, the altcoin broke out of the upper trendline, invalidating the bearish prediction. Should this be the case, then DYDX’s value could rally to $4.53. On the flip side, if selling pressure rises and trading volume drops, the trend might reverse, and the DYDX may lose its place as the top-performing altcoin.

免责声明:投资有风险,本文并非投资建议,以上内容不应被视为任何金融产品的购买或出售要约、建议或邀请,作者或其他用户的任何相关讨论、评论或帖子也不应被视为此类内容。本文仅供一般参考,不考虑您的个人投资目标、财务状况或需求。TTM对信息的准确性和完整性不承担任何责任或保证,投资者应自行研究并在投资前寻求专业建议。

热议股票

- 1

- 2

- 3

- 4

- 5

- 6

- 7

- 8

- 9

- 10