SINOPEC Engineering (Group) Co., Ltd. (HKG:2386) Is Going Strong But Fundamentals Appear To Be Mixed : Is There A Clear Direction For The Stock?

SINOPEC Engineering (Group)'s (HKG:2386) stock is up by a considerable 28% over the past three months. However, we decided to pay attention to the company's fundamentals which don't appear to give a clear sign about the company's financial health. Particularly, we will be paying attention to SINOPEC Engineering (Group)'s ROE today.

Return on equity or ROE is a key measure used to assess how efficiently a company's management is utilizing the company's capital. Put another way, it reveals the company's success at turning shareholder investments into profits.

Check out our latest analysis for SINOPEC Engineering (Group)

How Is ROE Calculated?

The formula for return on equity is:

Return on Equity = Net Profit (from continuing operations) ÷ Shareholders' Equity

So, based on the above formula, the ROE for SINOPEC Engineering (Group) is:

7.5% = CN¥2.3b ÷ CN¥31b (Based on the trailing twelve months to June 2024).

The 'return' is the profit over the last twelve months. So, this means that for every HK$1 of its shareholder's investments, the company generates a profit of HK$0.08.

What Has ROE Got To Do With Earnings Growth?

We have already established that ROE serves as an efficient profit-generating gauge for a company's future earnings. Depending on how much of these profits the company reinvests or "retains", and how effectively it does so, we are then able to assess a company’s earnings growth potential. Assuming all else is equal, companies that have both a higher return on equity and higher profit retention are usually the ones that have a higher growth rate when compared to companies that don't have the same features.

SINOPEC Engineering (Group)'s Earnings Growth And 7.5% ROE

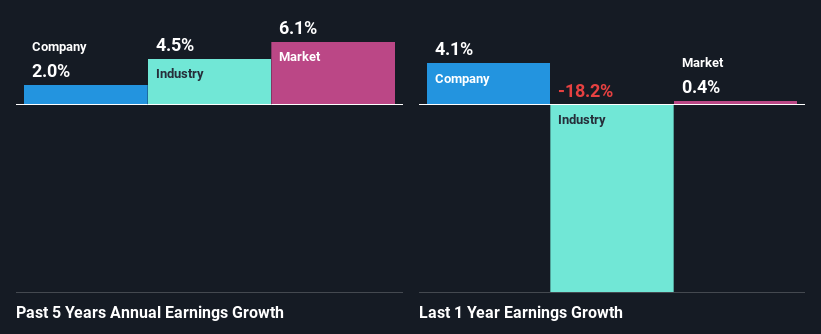

At first glance, SINOPEC Engineering (Group)'s ROE doesn't look very promising. However, the fact that the company's ROE is higher than the average industry ROE of 6.1%, is definitely interesting. However, SINOPEC Engineering (Group) has seen a flattish net income growth over the past five years, which is not saying much. Remember, the company's ROE is a bit low to begin with, just that it is higher than the industry average. So that could be one of the factors that are causing earnings growth to stay flat.

Next, on comparing with the industry net income growth, we found that SINOPEC Engineering (Group)'s reported growth was lower than the industry growth of 4.5% over the last few years, which is not something we like to see.

The basis for attaching value to a company is, to a great extent, tied to its earnings growth. It’s important for an investor to know whether the market has priced in the company's expected earnings growth (or decline). By doing so, they will have an idea if the stock is headed into clear blue waters or if swampy waters await. If you're wondering about SINOPEC Engineering (Group)'s's valuation, check out this gauge of its price-to-earnings ratio, as compared to its industry.

Is SINOPEC Engineering (Group) Making Efficient Use Of Its Profits?

The high three-year median payout ratio of 65% (meaning, the company retains only 35% of profits) for SINOPEC Engineering (Group) suggests that the company's earnings growth was miniscule as a result of paying out a majority of its earnings.

Additionally, SINOPEC Engineering (Group) has paid dividends over a period of at least ten years, which means that the company's management is determined to pay dividends even if it means little to no earnings growth. Our latest analyst data shows that the future payout ratio of the company over the next three years is expected to be approximately 64%. However, SINOPEC Engineering (Group)'s ROE is predicted to rise to 9.3% despite there being no anticipated change in its payout ratio.

Summary

On the whole, we feel that the performance shown by SINOPEC Engineering (Group) can be open to many interpretations. Specifically, the low earnings growth is a bit concerning, especially given that the company has a respectable rate of return. Investors may have benefitted, had the company been reinvesting more of its earnings. As discussed earlier, the company is retaining a small portion of its profits. Having said that, looking at the current analyst estimates, we found that the company's earnings are expected to gain momentum. To know more about the company's future earnings growth forecasts take a look at this free report on analyst forecasts for the company to find out more.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency• Be alerted to new Warning Signs or Risks via email or mobile• Track the Fair Value of your stocks

Try a Demo Portfolio for FreeHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

免责声明:投资有风险,本文并非投资建议,以上内容不应被视为任何金融产品的购买或出售要约、建议或邀请,作者或其他用户的任何相关讨论、评论或帖子也不应被视为此类内容。本文仅供一般参考,不考虑您的个人投资目标、财务状况或需求。TTM对信息的准确性和完整性不承担任何责任或保证,投资者应自行研究并在投资前寻求专业建议。

热议股票

- 1

- 2

- 3

- 4

- 5

- 6

- 7

- 8

- 9

- 10