Dogecoin (DOGE) Open Interest Nears 2-Month Low Following Steep 20% Pullback

- Dogecoin Open Interest fell to $1.42 billion, indicating waning trader confidence amid a 20% drop.

- The coin's Dollar Invested Age shows stagnation, reinforcing a bearish outlook if this trend persists.

- DOGE could drop to $0.27 if bearish trends hold, but regaining $0.35 support might spark a recovery.

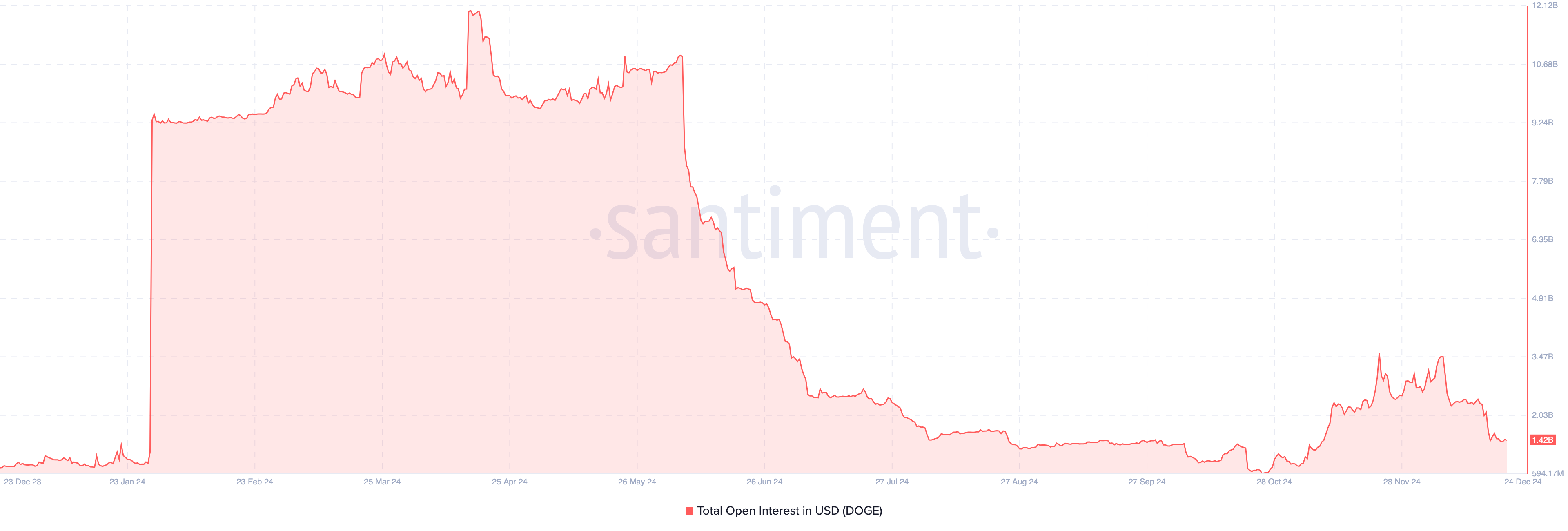

In April, Dogecoin (DOGE) Open Interest reached a yearly high of $12 billion but dropped massively between that peak and October. It rose again earlier this month but is now on the verge of declining to its lowest point since November 10.

The decline in OI, as it is commonly called, aligns with DOGE’s price action, which has declined 20% within the last seven days. So, what’s next for the cryptocurrency?

Dogecoin Traders Reduce Exposure, Investors Cautious

Currently, Dogecoin Open Interest is down to $1.42 billion. OI represents the total number of open contracts—long or short—in a futures or options market at any given time. Rising OI indicates new positions are being added, reflecting greater engagement and confidence in the cryptocurrency’s price movement.

Conversely, a decrease in the indicator reflects position closures, suggesting dwindling trader confidence or a neutral outlook on the asset. Therefore, the notable decline in DOGE’s OI suggests that traders do not expect the short-term price movement to yield good gains.

If this trend continues, alongside Dogecoin’s price decrease to $0.32, the cryptocurrency’s value could see an extended correction.

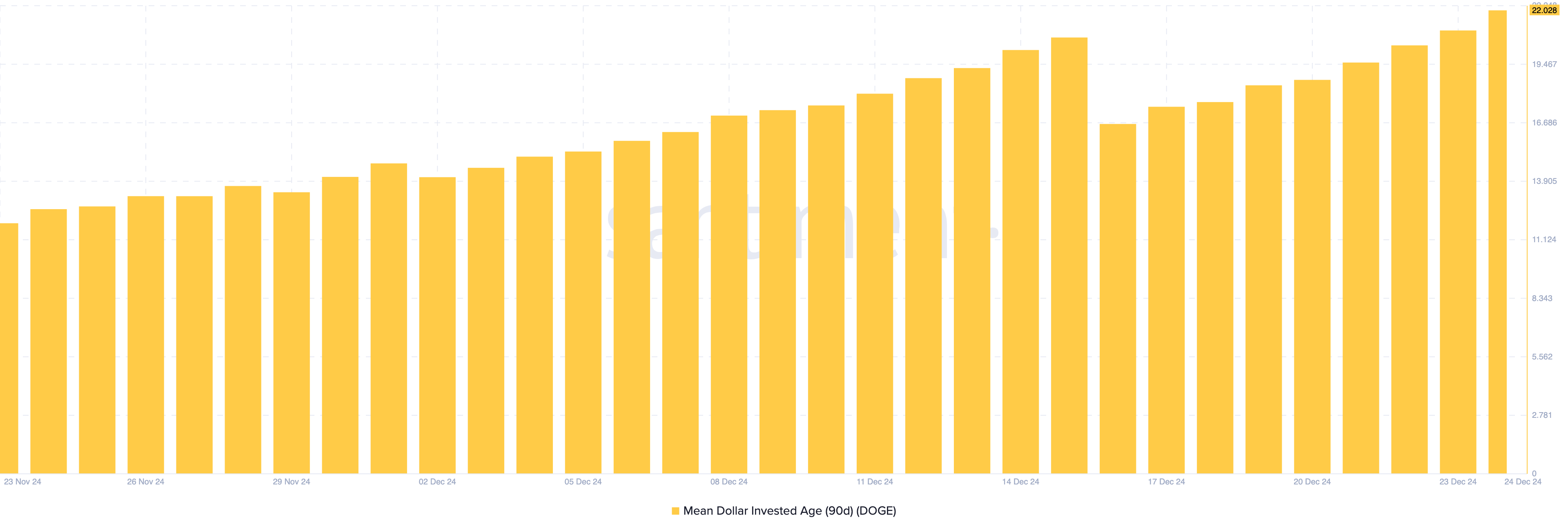

The Mean Dollar Invested Age (MDIA) is another indicator suggesting a further decrease in Dogecoin’s price. As the name implies, the MDIA is the average age of all coins on a blockchain weighted by the purchase price.

When the MDIA rises, it suggests that holders are keeping their coins in wallets without active trading. This indicates stagnation and is typically seen as bearish. A decline in the MDIA suggests that previously dormant coins are moving, implying increased activity or trading. This is usually considered bullish, as it may indicate renewed interest and liquidity

According to Santiment, Dogecoin’s 90-day MDIA has increased, signaling that holders are largely keeping their coins stagnant. If sustained, this supports the bearish outlook for the cryptocurrency.

DOGE Price Prediction: Correction Not Over

On the daily chart, DOGE continues to lose hold on key support levels. Notably, the coin has dropped below the $0.35 support region as bulls failed to defend the zone. The Moving Average Convergence Divergence (MACD) also supports this decline.

The MACD measures momentum. When the reading is positive, momentum is bullish. But if it is negative, the reading is bearish. As seen below, the MACD reading is in the negative region. If this remains the same, Dogecoin’s price might drop to $0.27.

On the other hand, if bulls regain the $0.35 support and successfully defend it, this trend might change. In that scenario, DOGE could rebound toward $0.48.

免责声明:投资有风险,本文并非投资建议,以上内容不应被视为任何金融产品的购买或出售要约、建议或邀请,作者或其他用户的任何相关讨论、评论或帖子也不应被视为此类内容。本文仅供一般参考,不考虑您的个人投资目标、财务状况或需求。TTM对信息的准确性和完整性不承担任何责任或保证,投资者应自行研究并在投资前寻求专业建议。

热议股票

- 1

- 2

- 3

- 4

- 5

- 6

- 7

- 8

- 9

- 10