Cardano Outflows Hit 2-Month High Amid Prolonged Downtrend

- Cardano’s price fell to $0.84, with high outflows and declining user activity deepening the bearish market sentiment.

- The Price DAA Divergence and Chaikin Money Flow indicators point to weak momentum, with investor skepticism on the rise.

- Reclaiming $0.85 as support could target $1.00, but ongoing outflows and bearish sentiment risk further declines to $0.77.

Cardano’s (ADA) price has been on a steady decline, recently falling to a multi-week low of $0.84. This ongoing downtrend reflects broader market challenges, with investors displaying diminished optimism.

ADA’s inability to hold critical support levels has further contributed to its weakened position heading into 2025.

Cardano Investors Are Skeptical

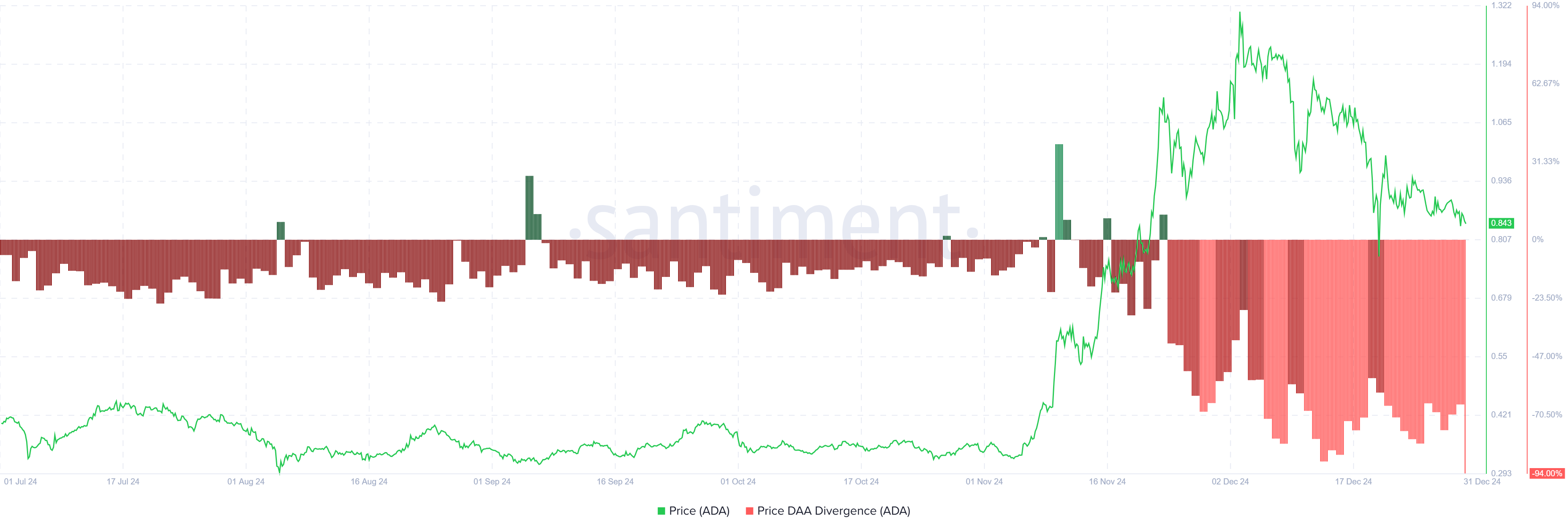

The Price DAA Divergence indicator is currently flashing a sell signal, highlighting Cardano’s deteriorating market sentiment. This signal emerges from the combination of declining prices and reduced network participation. Such patterns suggest investors are losing confidence, with uncertainty surrounding ADA’s potential for recovery.

Adding to the bearish outlook, ADA’s participation metrics reveal a shrinking active user base. This declining interest reflects broader hesitation among investors. The reduced activity aligns with the downtrend, suggesting that market participants are increasingly backing away from the asset as recovery appears uncertain.

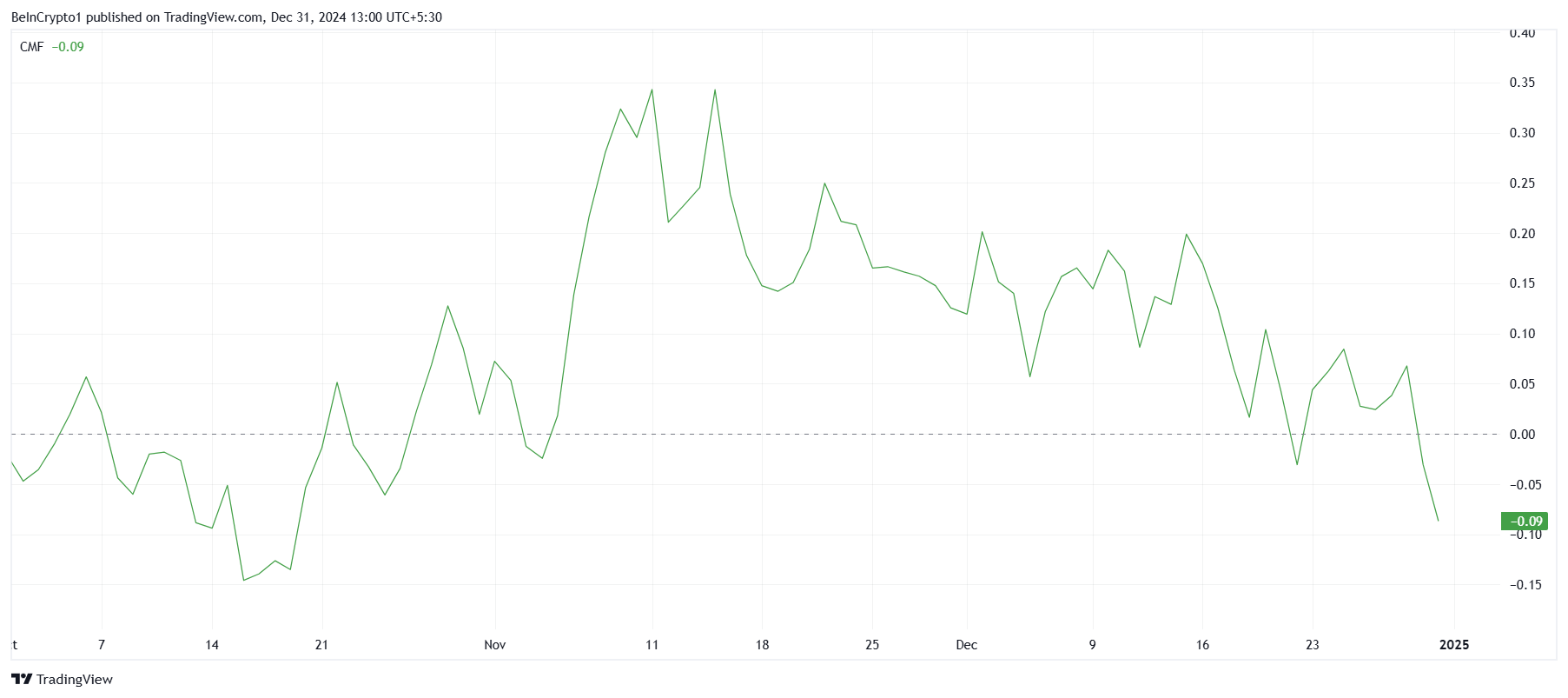

Cardano’s macro momentum shows further weakness, with the Chaikin Money Flow (CMF) indicator hitting a two-and-a-half-month low. This trend signals that outflows are currently dominating ADA’s market activity, reflecting a lack of fresh capital entering the ecosystem. The prolonged negative CMF highlights the challenges ADA faces in attracting investor confidence.

The lack of clear price direction is compelling ADA holders to exit their positions with selling pressure mounting, and the asset risks further decline. Unless macroeconomic or network-specific factors shift significantly, this trend is likely to persist, exacerbating ADA’s struggles as outflows continue to dominate.

ADA Price Prediction: Aiming At Recovery

Cardano’s current price of $0.84 has slipped below the crucial support level of $0.85. While ADA had managed to sustain itself above this mark in recent days, the last 24 hours have seen renewed pressure, resulting in further losses. This decline places ADA in a precarious position.

If ADA fails to reclaim the $0.85 support level, it risks falling to $0.77. Such a drop could be compounded by the ongoing high outflows, which weaken the asset’s price stability. This scenario would likely heighten bearish sentiment and further discourage investor participation.

Conversely, reclaiming $0.85 as support could provide ADA with a chance to recover. Successfully flipping this level could enable ADA to target $1.00 as a support floor once again. However, such a recovery depends heavily on improving sentiment and reducing capital outflows.

免责声明:投资有风险,本文并非投资建议,以上内容不应被视为任何金融产品的购买或出售要约、建议或邀请,作者或其他用户的任何相关讨论、评论或帖子也不应被视为此类内容。本文仅供一般参考,不考虑您的个人投资目标、财务状况或需求。TTM对信息的准确性和完整性不承担任何责任或保证,投资者应自行研究并在投资前寻求专业建议。

热议股票

- 1

- 2

- 3

- 4

- 5

- 6

- 7

- 8

- 9

- 10