Algorand (ALGO) Gains 20%, Market Cap Hits $4 Billion in Strong Rebound

- Algorand price surges 20% in 24 hours, gaining 38% for the week and reclaiming a $4 billion market cap.

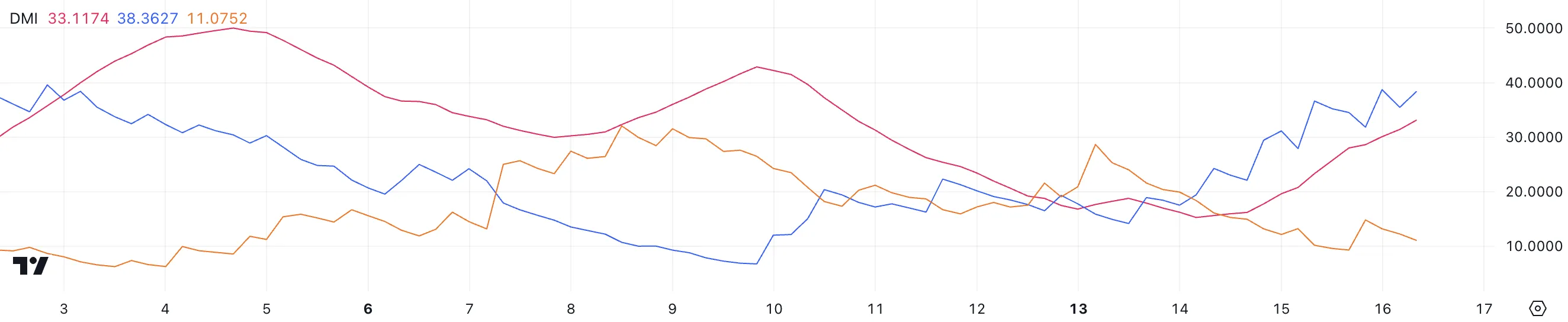

- DMI shows strong trend growth, with ADX at 33.1 and bullish dominance reflected in +DI's sharp rise.

- CMF hits 0.28, its highest level since November 2024, indicating strong buyer demand and accumulation trends.

Algorand (ALGO) price has surged 20% in the last 24 hours, bringing its market cap back to $4 billion. Over the past seven days, ALGO has gained 38%.

Key indicators such as the DMI and CMF show increasing trend strength and buyer dominance, reinforcing optimism around the ongoing uptrend. With a golden cross recently forming on its EMA lines, ALGO could target significant resistance levels, potentially unlocking further upside if bullish momentum persists.

Algorand’s DMI Indicates a Strong Uptrend

Algorand DMI chart shows its ADX at 33.1, up sharply from 15.2 two days ago. This indicates a strong and quickly strengthening uptrend.

The +DI has risen to 38.3 from 17.5, showing increased bullish momentum, while the -DI has fallen to 11 from 19.9, reflecting reduced bearish pressure. These movements suggest that buyers are gaining control as ALGO uptrend solidifies.

The ADX measures trend strength, with values above 25 signaling a strong trend. With the +DI significantly higher than the -DI, Algorand price appears poised to continue its upward movement.

However, any stalling in the ADX or a reversal in the +DI could signal weakening momentum, potentially leading to a consolidation phase.

ALGO’s CMF Reaches Highest Levels Since November 2024

ALGO Chaikin Money Flow (CMF) is currently at 0.28, up significantly from -0.23 two days ago. This marks the highest CMF level for ALGO since November 29, reflecting a strong shift in market sentiment toward accumulation and buying pressure.

The CMF measures the flow of money into and out of an asset over time, with values above 0 indicating net inflows (buying pressure) and values below 0 suggesting net outflows (selling pressure).

At 0.28, Algorand CMF indicates strong buyer dominance, which could support continued upward price movement if sustained. However, if the CMF begins to decline, it could signal weakening demand and potential consolidation.

ALGO Price Prediction: A Further 28% Upside?

Algorand EMA lines show that a golden cross formed yesterday, signaling the potential for sustained bullish momentum. If the current uptrend continues, ALGO price could test the resistance at $0.529, and breaking that level might propel it to $0.613, representing a potential 28.2% upside from current levels.

On the downside, if the trend reverses, ALGO price could test the support at $0.43. A break below this level might lead to further declines, with $0.39 as the next key support. In a strong downtrend, Algorand price could drop as low as $0.28, erasing recent gains.

免责声明:投资有风险,本文并非投资建议,以上内容不应被视为任何金融产品的购买或出售要约、建议或邀请,作者或其他用户的任何相关讨论、评论或帖子也不应被视为此类内容。本文仅供一般参考,不考虑您的个人投资目标、财务状况或需求。TTM对信息的准确性和完整性不承担任何责任或保证,投资者应自行研究并在投资前寻求专业建议。

热议股票

- 1

- 2

- 3

- 4

- 5

- 6

- 7

- 8

- 9

- 10