Puxing Energy (HKG:90) Has More To Do To Multiply In Value Going Forward

If we want to find a potential multi-bagger, often there are underlying trends that can provide clues. Firstly, we'd want to identify a growing return on capital employed (ROCE) and then alongside that, an ever-increasing base of capital employed. Basically this means that a company has profitable initiatives that it can continue to reinvest in, which is a trait of a compounding machine. With that in mind, the ROCE of Puxing Energy (HKG:90) looks decent, right now, so lets see what the trend of returns can tell us.

What Is Return On Capital Employed (ROCE)?

For those that aren't sure what ROCE is, it measures the amount of pre-tax profits a company can generate from the capital employed in its business. To calculate this metric for Puxing Energy, this is the formula:

Return on Capital Employed = Earnings Before Interest and Tax (EBIT) ÷ (Total Assets - Current Liabilities)

0.10 = CN¥140m ÷ (CN¥2.0b - CN¥643m) (Based on the trailing twelve months to June 2024).

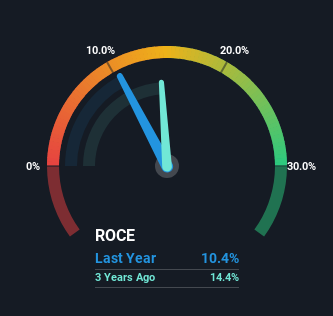

So, Puxing Energy has an ROCE of 10%. On its own, that's a standard return, however it's much better than the 6.9% generated by the Renewable Energy industry.

See our latest analysis for Puxing Energy

While the past is not representative of the future, it can be helpful to know how a company has performed historically, which is why we have this chart above. If you'd like to look at how Puxing Energy has performed in the past in other metrics, you can view this free graph of Puxing Energy's past earnings, revenue and cash flow.

What Does the ROCE Trend For Puxing Energy Tell Us?

The trend of ROCE doesn't stand out much, but returns on a whole are decent. The company has consistently earned 10% for the last five years, and the capital employed within the business has risen 51% in that time. 10% is a pretty standard return, and it provides some comfort knowing that Puxing Energy has consistently earned this amount. Stable returns in this ballpark can be unexciting, but if they can be maintained over the long run, they often provide nice rewards to shareholders.

In Conclusion...

The main thing to remember is that Puxing Energy has proven its ability to continually reinvest at respectable rates of return. In light of this, the stock has only gained 39% over the last five years for shareholders who have owned the stock in this period. So because of the trends we're seeing, we'd recommend looking further into this stock to see if it has the makings of a multi-bagger.

Puxing Energy does have some risks, we noticed 4 warning signs (and 2 which shouldn't be ignored) we think you should know about.

While Puxing Energy may not currently earn the highest returns, we've compiled a list of companies that currently earn more than 25% return on equity. Check out this free list here.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency• Be alerted to new Warning Signs or Risks via email or mobile• Track the Fair Value of your stocks

Try a Demo Portfolio for FreeHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

免责声明:投资有风险,本文并非投资建议,以上内容不应被视为任何金融产品的购买或出售要约、建议或邀请,作者或其他用户的任何相关讨论、评论或帖子也不应被视为此类内容。本文仅供一般参考,不考虑您的个人投资目标、财务状况或需求。TTM对信息的准确性和完整性不承担任何责任或保证,投资者应自行研究并在投资前寻求专业建议。

热议股票

- 1

- 2

- 3

- 4

- 5

- 6

- 7

- 8

- 9

- 10