Power Integrations (POWI) Q4 Earnings: What To Expect

Semiconductor designer Power Integrations (NASDAQ:POWI) will be reporting earnings tomorrow after the bell. Here’s what investors should know.

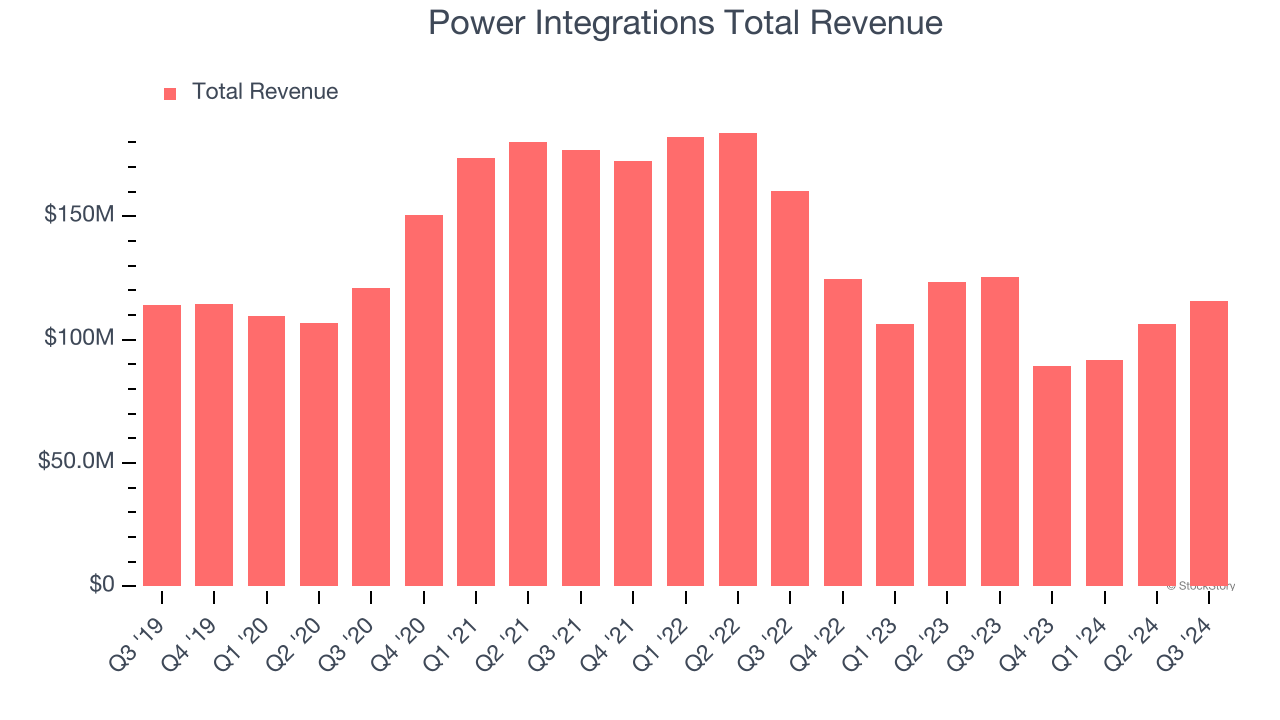

Power Integrations beat analysts’ revenue expectations by 1% last quarter, reporting revenues of $115.8 million, down 7.7% year on year. It was a very strong quarter for the company, with a solid beat of analysts’ EPS estimates and an impressive beat of analysts’ adjusted operating income estimates.

Is Power Integrations a buy or sell going into earnings? Read our full analysis here, it’s free.

This quarter, analysts are expecting Power Integrations’s revenue to grow 17.4% year on year to $105.1 million, a reversal from the 28.3% decrease it recorded in the same quarter last year. Adjusted earnings are expected to come in at $0.28 per share.

Analysts covering the company have generally reconfirmed their estimates over the last 30 days, suggesting they anticipate the business to stay the course heading into earnings. Power Integrations has missed Wall Street’s revenue estimates three times over the last two years.

Looking at Power Integrations’s peers in the analog semiconductors segment, some have already reported their Q4 results, giving us a hint as to what we can expect. Texas Instruments’s revenues decreased 1.7% year on year, beating analysts’ expectations by 3.3%, and NXP Semiconductors reported a revenue decline of 9.1%, in line with consensus estimates. Texas Instruments traded down 7.5% following the results while NXP Semiconductors was also down 1.1%.

Read our full analysis of Texas Instruments’s results here and NXP Semiconductors’s results here.

Stocks, especially growth stocks where cash flows further in the future are more important to the story, have had a good 2024. An economic soft landing (so far), the start of the Fed's rate cutting campaign, and the election of Donald Trump were positives for the market, and while some of the analog semiconductors stocks have shown solid performance, the group has generally underpeformed, with share prices down 3.1% on average over the last month. Power Integrations’s stock price was unchanged during the same time and is heading into earnings with an average analyst price target of $78 (compared to the current share price of $62.17).

Here at StockStory, we certainly understand the potential of thematic investing. Diverse winners from Microsoft (MSFT) to Alphabet (GOOG), Coca-Cola (KO) to Monster Beverage (MNST) could all have been identified as promising growth stories with a megatrend driving the growth. So, in that spirit, we’ve identified a relatively under-the-radar profitable growth stock benefiting from the rise of AI, available to you FREE via this link.

免责声明:投资有风险,本文并非投资建议,以上内容不应被视为任何金融产品的购买或出售要约、建议或邀请,作者或其他用户的任何相关讨论、评论或帖子也不应被视为此类内容。本文仅供一般参考,不考虑您的个人投资目标、财务状况或需求。TTM对信息的准确性和完整性不承担任何责任或保证,投资者应自行研究并在投资前寻求专业建议。

热议股票

- 1

- 2

- 3

- 4

- 5

- 6

- 7

- 8

- 9

- 10