Premier (NASDAQ:PINC) Has Announced A Dividend Of $0.21

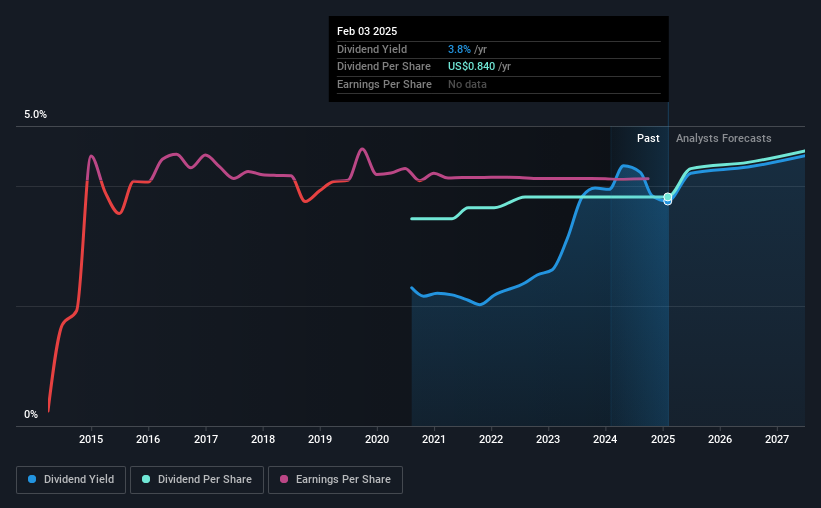

Premier, Inc.'s (NASDAQ:PINC) investors are due to receive a payment of $0.21 per share on 15th of March. The dividend yield will be 3.8% based on this payment which is still above the industry average.

Check out our latest analysis for Premier

Premier's Projected Earnings Seem Likely To Cover Future Distributions

While it is great to have a strong dividend yield, we should also consider whether the payment is sustainable. Prior to this announcement, Premier's dividend was comfortably covered by both cash flow and earnings. This indicates that quite a large proportion of earnings is being invested back into the business.

EPS is set to fall by 20.8% over the next 12 months. If recent patterns in the dividend continue, we could see the payout ratio reaching 79% in the next 12 months, which is on the higher end of the range we would say is sustainable.

Premier Doesn't Have A Long Payment History

The company has maintained a consistent dividend for a few years now, but we would like to see a longer track record before relying on it. The annual payment during the last 4 years was $0.76 in 2021, and the most recent fiscal year payment was $0.84. This means that it has been growing its distributions at 2.5% per annum over that time. We like that the dividend hasn't been shrinking. However we're conscious that the company hasn't got an overly long track record of dividend payments yet, which makes us wary of relying on its dividend income.

Dividend Growth Potential Is Shaky

The company's investors will be pleased to have been receiving dividend income for some time. Unfortunately things aren't as good as they seem. Premier's EPS has fallen by approximately 42% per year during the past five years. This steep decline can indicate that the business is going through a tough time, which could constrain its ability to pay a larger dividend each year in the future.

Our Thoughts On Premier's Dividend

In summary, while it's good to see that the dividend hasn't been cut, we are a bit cautious about Premier's payments, as there could be some issues with sustaining them into the future. The company is generating plenty of cash, which could maintain the dividend for a while, but the track record hasn't been great. We would probably look elsewhere for an income investment.

It's important to note that companies having a consistent dividend policy will generate greater investor confidence than those having an erratic one. However, there are other things to consider for investors when analysing stock performance. Case in point: We've spotted 2 warning signs for Premier (of which 1 shouldn't be ignored!) you should know about. If you are a dividend investor, you might also want to look at our curated list of high yield dividend stocks.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency• Be alerted to new Warning Signs or Risks via email or mobile• Track the Fair Value of your stocks

Try a Demo Portfolio for FreeHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

免责声明:投资有风险,本文并非投资建议,以上内容不应被视为任何金融产品的购买或出售要约、建议或邀请,作者或其他用户的任何相关讨论、评论或帖子也不应被视为此类内容。本文仅供一般参考,不考虑您的个人投资目标、财务状况或需求。TTM对信息的准确性和完整性不承担任何责任或保证,投资者应自行研究并在投资前寻求专业建议。

热议股票

- 1

- 2

- 3

- 4

- 5

- 6

- 7

- 8

- 9

- 10