Coty Inc. (NYSE:COTY) reported weaker-than-expected earnings for its second quarter after the closing bell on Monday.

Coty posted quarterly earnings of 11 cents per share which missed the analyst consensus estimate of 21 cents per share. The company reported quarterly sales of $1.67 billion which missed the analyst consensus estimate of $1.72 billion.

Sue Nabi, Coty’s CEO, said, “As we are now midway through our fiscal year, it is clear that FY25 is shaping up to be a pivotal year. On the one hand, the global beauty market continues to grow at a healthy pace, even if growth has moderated off of the elevated levels of the last few years, which benefited from more material pricing increases. And in this backdrop, fragrances of all price points continue to outperform most other beauty categories, which strongly benefits Coty’s business as fragrances account for over 60% of our revenues and an even bigger portion of our profits."

Coty’s shares fell 5.5% to trade at $5.79 on Wednesday.

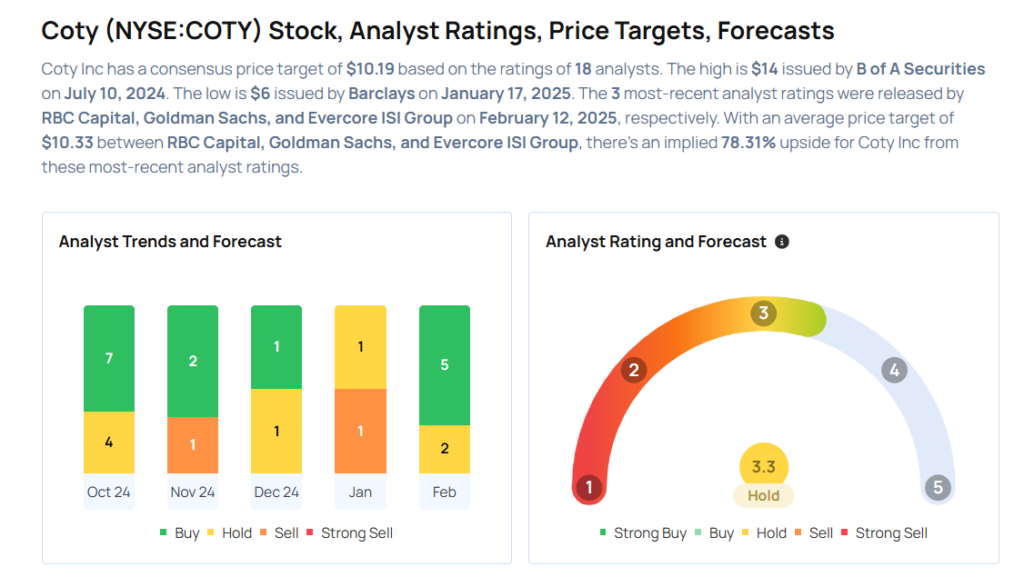

These analysts made changes to their price targets on Coty following earnings announcement.

- Morgan Stanley analyst Dara Mohsenian maintained Coty with an Equal-Weight and lowered the price target from $9 to $7.

- Canaccord Genuity analyst Susan Anderson maintained Coty with a Buy and lowered the price target from $10 to $8.

- Evercore ISI Group analyst Robert Ottenstein maintained the stock with an Outperform and cut the price target from $15 to $10.

- Goldman Sachs analyst Patty Kanada maintained Coty with a Neutral and lowered the price target from $9 to $8.

Considering buying COTY stock? Here’s what analysts think:

Read This Next:

- Snowflake To Rally Around 9%? Here Are 10 Top Analyst Forecasts For Wednesday