These Analysts Revise Their Forecasts On Compass Minerals Following Q4 Earnings

Compass Minerals International, Inc. (NYSE:CMP) reported weaker-than-expected first-quarter adjusted EPS results and cut its FY25 salt segment revenue guidance, after the closing bell on Monday.

Compass Minerals Intl reported quarterly losses of 55 cents per share which missed the analyst consensus estimate of 15 cents per share. The company reported quarterly sales of $307.20 million which beat the analyst consensus estimate of $294.00 million.

“This quarter we began to see results from our back-to-basics strategy and initiatives to reduce inventory volumes, improve our cost structure, and enhance profitability. Our efforts are expected to further strengthen our future financial performance, leveraging our exceptional set of unique assets that are virtually irreplaceable, enjoy durable competitive advantages and have strong leadership positions in their respective marketplaces,” said Edward C. Dowling Jr., president and CEO.

Compass Minerals slashed its 2025 salt segment revenue outlook from $940 million – $1.04 billion to $900 million – $1 billion.

Compass Minerals shares gained 3.3% to trade at $11.80 on Wednesday.

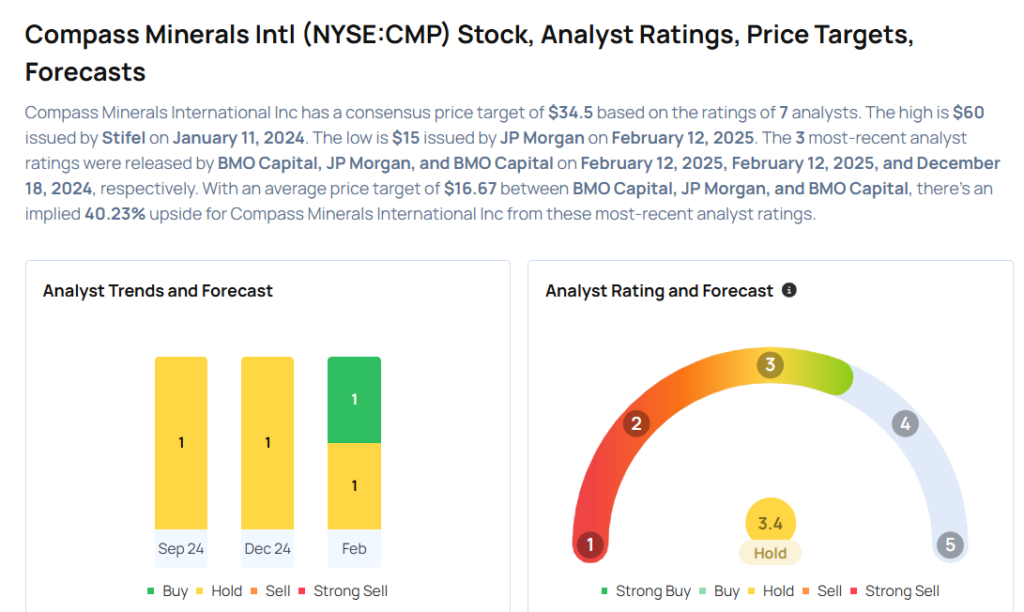

These analysts made changes to their price targets on Compass Minerals following earnings announcement.

- JP Morgan analyst Jeffrey Zekauskas upgraded Compass Minerals Intl from Neutral to Overweight and raised the price target from $13 to $15.

- BMO Capital analyst Joel Jackson maintained Compass Minerals with a Market Perform and lowered the price target from $18 to $17.

Considering buying CMP stock? Here’s what analysts think:

Read This Next:

- Snowflake To Rally Around 9%? Here Are 10 Top Analyst Forecasts For Wednesday

免责声明:投资有风险,本文并非投资建议,以上内容不应被视为任何金融产品的购买或出售要约、建议或邀请,作者或其他用户的任何相关讨论、评论或帖子也不应被视为此类内容。本文仅供一般参考,不考虑您的个人投资目标、财务状况或需求。TTM对信息的准确性和完整性不承担任何责任或保证,投资者应自行研究并在投资前寻求专业建议。

热议股票

- 1

- 2

- 3

- 4

- 5

- 6

- 7

- 8

- 9

- 10