Undervalued Opportunities Penny Stocks To Consider In February 2025

As global markets navigate geopolitical tensions and consumer spending concerns, major indices have experienced volatility with recent declines. In such uncertain times, investors often look towards undervalued opportunities that offer potential for growth despite broader economic challenges. Penny stocks, while an older term, continue to represent smaller or less-established companies that may provide value through strong financials and growth potential. We will examine three penny stocks that stand out for their balance sheet strength and possible long-term upside in today's market landscape.

Top 10 Penny Stocks

| Name | Share Price | Market Cap | Financial Health Rating |

| DXN Holdings Bhd (KLSE:DXN) | MYR0.515 | MYR2.56B | ★★★★★★ |

| Datasonic Group Berhad (KLSE:DSONIC) | MYR0.32 | MYR890.29M | ★★★★★★ |

| Bosideng International Holdings (SEHK:3998) | HK$3.86 | HK$44.31B | ★★★★★★ |

| T.A.C. Consumer (SET:TACC) | THB4.22 | THB2.53B | ★★★★★★ |

| Warpaint London (AIM:W7L) | £4.00 | £323.15M | ★★★★★★ |

| Hil Industries Berhad (KLSE:HIL) | MYR0.855 | MYR283.81M | ★★★★★★ |

| Foresight Group Holdings (LSE:FSG) | £4.00 | £455.98M | ★★★★★★ |

| Next 15 Group (AIM:NFG) | £3.185 | £316.77M | ★★★★☆☆ |

| Embark Early Education (ASX:EVO) | A$0.795 | A$145.87M | ★★★★☆☆ |

| Polar Capital Holdings (AIM:POLR) | £4.865 | £468.97M | ★★★★★★ |

Click here to see the full list of 5,706 stocks from our Penny Stocks screener.

Here's a peek at a few of the choices from the screener.

RCS MediaGroup (BIT:RCS)

Simply Wall St Financial Health Rating: ★★★★☆☆

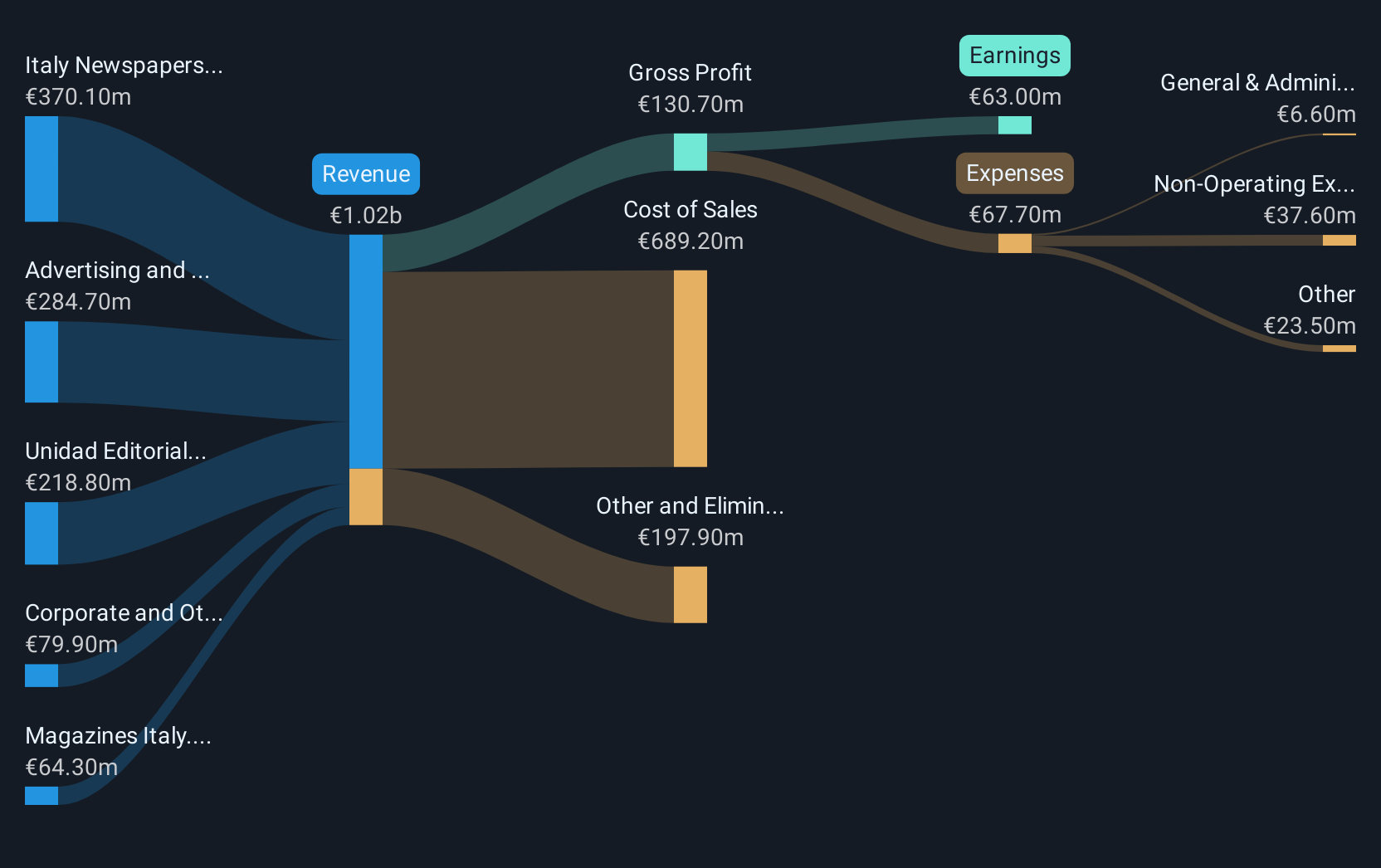

Overview: RCS MediaGroup S.p.A. offers multimedia publishing services both in Italy and internationally, with a market cap of €433.30 million.

Operations: RCS MediaGroup's revenue is primarily derived from its Italy Newspapers segment (€371 million), Advertising and Sport (€286.1 million), Unidad Editorial (€220.6 million), Magazines Italy (€65.2 million), and Corporate and Other Activities (€80.8 million).

Market Cap: €433.3M

RCS MediaGroup presents a mixed picture for investors interested in penny stocks. The company has demonstrated robust earnings growth over the past year, with profits increasing by 13.1%, surpassing its five-year average of 2.5%. Its interest payments are well-covered by EBIT, and debt management appears prudent with a satisfactory net debt to equity ratio of 4.8%. However, RCS faces challenges as short-term assets do not cover liabilities, and its dividend track record is unstable. Despite trading significantly below estimated fair value, potential investors should weigh these financial strengths against existing liabilities and market volatility considerations.

- Jump into the full analysis health report here for a deeper understanding of RCS MediaGroup.

- Gain insights into RCS MediaGroup's past trends and performance with our report on the company's historical track record.

Karrie International Holdings (SEHK:1050)

Simply Wall St Financial Health Rating: ★★★★★☆

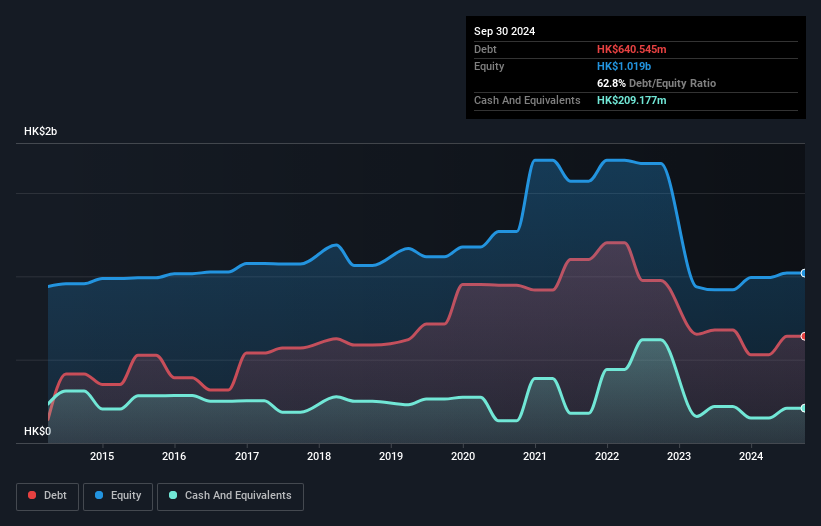

Overview: Karrie International Holdings Limited is an investment holding company that manufactures and sells metal, plastic, and electronic products across various regions including Hong Kong, Japan, Mainland China, Asia, North America, and Western Europe with a market cap of HK$1.74 billion.

Operations: The company's revenue is primarily derived from its Metal and Plastic Business, contributing HK$1.86 billion, and its Electronic Manufacturing Services Business, which adds HK$1.16 billion.

Market Cap: HK$1.74B

Karrie International Holdings offers a nuanced investment case for those exploring penny stocks. The company has seen a substantial earnings increase of 21.3% over the past year, outpacing its five-year average decline. It maintains high-quality earnings and boasts a seasoned management team with an average tenure of 28.5 years. Despite having high debt levels, Karrie's interest payments are well-covered by EBIT, and its short-term assets exceed liabilities. Recent initiatives include share repurchases to enhance net asset value and increased dividends, indicating efforts to bolster shareholder returns amidst stable weekly volatility in stock performance.

- Unlock comprehensive insights into our analysis of Karrie International Holdings stock in this financial health report.

- Review our growth performance report to gain insights into Karrie International Holdings' future.

SSY Group (SEHK:2005)

Simply Wall St Financial Health Rating: ★★★★★☆

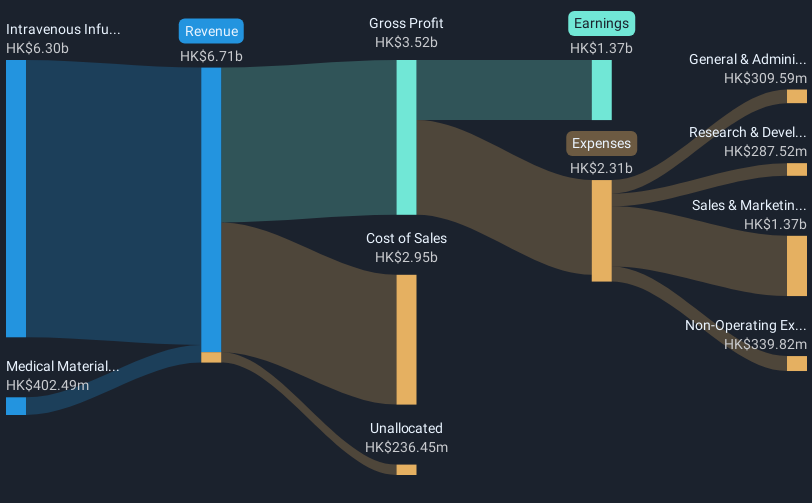

Overview: SSY Group Limited is an investment holding company that engages in the research, development, manufacturing, trading, and sale of pharmaceutical products to hospitals and distributors both within the People’s Republic of China and internationally, with a market cap of approximately HK$9.81 billion.

Operations: The company's revenue primarily comes from its Intravenous Infusion Solution and Others segment, generating HK$6.30 billion, followed by Medical Materials contributing HK$402.49 million.

Market Cap: HK$9.81B

SSY Group Limited presents an intriguing case within the penny stock realm, marked by robust recent developments and steady financial health. The company has secured multiple approvals from China's National Medical Products Administration for various drugs, enhancing its product portfolio. Earnings growth of 14.6% over the past year surpasses both industry averages and its five-year trend. While debt levels have increased, they remain well-covered by operating cash flow and interest payments are comfortably managed. Despite a low return on equity of 18.2%, SSY's short-term assets exceed liabilities significantly, suggesting sound liquidity management amidst stable weekly volatility in stock performance.

- Navigate through the intricacies of SSY Group with our comprehensive balance sheet health report here.

- Explore SSY Group's analyst forecasts in our growth report.

Make It Happen

- Click through to start exploring the rest of the 5,703 Penny Stocks now.

- Already own these companies? Bring clarity to your investment decisions by linking up your portfolio with Simply Wall St, where you can monitor all the vital signs of your stocks effortlessly.

- Enhance your investing ability with the Simply Wall St app and enjoy free access to essential market intelligence spanning every continent.

Curious About Other Options?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Jump on the AI train with fast growing tech companies forging a new era of innovation.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency• Be alerted to new Warning Signs or Risks via email or mobile• Track the Fair Value of your stocks

Try a Demo Portfolio for FreeHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

免责声明:投资有风险,本文并非投资建议,以上内容不应被视为任何金融产品的购买或出售要约、建议或邀请,作者或其他用户的任何相关讨论、评论或帖子也不应被视为此类内容。本文仅供一般参考,不考虑您的个人投资目标、财务状况或需求。TTM对信息的准确性和完整性不承担任何责任或保证,投资者应自行研究并在投资前寻求专业建议。

热议股票

- 1

- 2

- 3

- 4

- 5

- 6

- 7

- 8

- 9

- 10