Talen Energy (NasdaqGS:TLN) Declines 0.25% Despite US$850M Share Repurchase Completion

Talen Energy (NasdaqGS:TLN) recently navigated a series of financial milestones, including significant debt restructuring, a comprehensive share buyback program, and its inclusion in the S&P Global BMI Index. Despite these strategic endeavors, the price of Talen Energy's stock experienced a 0.25% decline over the last quarter. The debt restructuring, aimed at enhancing the company’s financial efficiency by lowering annual interest costs, and the completion of an extensive $850 million share repurchase plan, underscored the company's commitment to improving shareholder value. However, these efforts unfolded against the backdrop of broader market volatility, with the S&P 500 and Nasdaq experiencing declines of 1% and 1.9%, respectively, largely driven by a sell-off in technology stocks and weaker-than-expected economic indicators. This sector-wide turbulence may have influenced TLN's slight stock price contraction despite the positive corporate events.

Click here to discover the nuances of Talen Energy with our detailed analytical report.

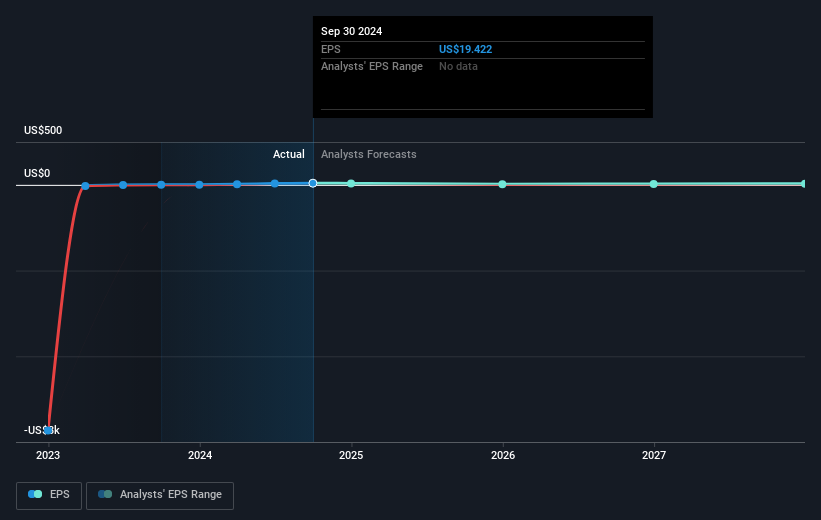

Over the past year, Talen Energy's total shareholder return was 208.35%, a performance that significantly surpassed the US market's 18.3% return and the Renewable Energy industry’s 70.5% return. This impressive growth can be attributed to several key developments. Firstly, the company's net profit margins increased substantially from 4.4% to very high levels, showcasing a successful turnaround in profitability. Additionally, Talen's earnings growth was very large, outpacing the renewable energy sector considerably. The profit surge was supported by effective cost management and significant restructuring efforts, which included an $850 million share buyback completed in December 2024.

Another contributing factor was the inclusion of Talen Energy in major indices like the S&P Global BMI and NASDAQ Composite Index, potentially enhancing its stock visibility and investor interest. Furthermore, the company made substantial progress in financial restructuring by reducing interest rates on loans and extending debt maturities, contributing to better financial health. These actions have positioned Talen Energy attractively within its industry, aiding in its remarkable performance over the last year.

- See whether Talen Energy's current market price aligns with its intrinsic value in our detailed report

- Understand the uncertainties surrounding Talen Energy's market positioning with our detailed risk analysis report.

- Have a stake in Talen Energy? Integrate your holdings into Simply Wall St's portfolio for notifications and detailed stock reports.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Valuation is complex, but we're here to simplify it.

Discover if Talen Energy might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

免责声明:投资有风险,本文并非投资建议,以上内容不应被视为任何金融产品的购买或出售要约、建议或邀请,作者或其他用户的任何相关讨论、评论或帖子也不应被视为此类内容。本文仅供一般参考,不考虑您的个人投资目标、财务状况或需求。TTM对信息的准确性和完整性不承担任何责任或保证,投资者应自行研究并在投资前寻求专业建议。

热议股票

- 1

- 2

- 3

- 4

- 5

- 6

- 7

- 8

- 9

- 10