Kyndryl Holdings (NYSE:KD) Launches Liverpool Tech Hub Adding 1,000 AI Jobs and Expands The Very Group Partnership

Kyndryl Holdings (NYSE:KD) recently announced the launch of a new technology hub in Liverpool, focusing on digital transformation and job creation. This expansion, alongside a partnership with The Very Group, has likely influenced the company's share price, which rose 10% over the last quarter. Additional positive momentum might stem from new service offerings like the Access Service Edge (SASE) in collaboration with Palo Alto Networks, further diversifying Kyndryl's portfolio. Despite a mixed earnings report with declining sales but improved net income, the market view has been generally rosy. This is highlighted by positive investor sentiment in a fluctuating market, where major indices have demonstrated both gains and declines. With broader market trends showing a 3% drop recently but an annual gain of 17%, Kyndryl's performance reflects its strategic efforts amidst economic shifts. Additionally, the company's completed share buyback program may have positively affected investor perception and the share price uptick.

Click here to discover the nuances of Kyndryl Holdings with our detailed analytical report.

Over the past three years, Kyndryl Holdings has delivered a total shareholder return of 200.08%. This performance highlights significant developments within the company. Notably, Kyndryl announced a $500 million debt offering early last year to refinance existing debt at a lower interest rate, enhancing financial stability. The company also expanded strategic alliances, such as with Nokia, to integrate advanced solutions within its portfolio. Furthermore, the introduction of a dedicated AI private cloud in Japan has positioned Kyndryl favorably in the growing tech space.

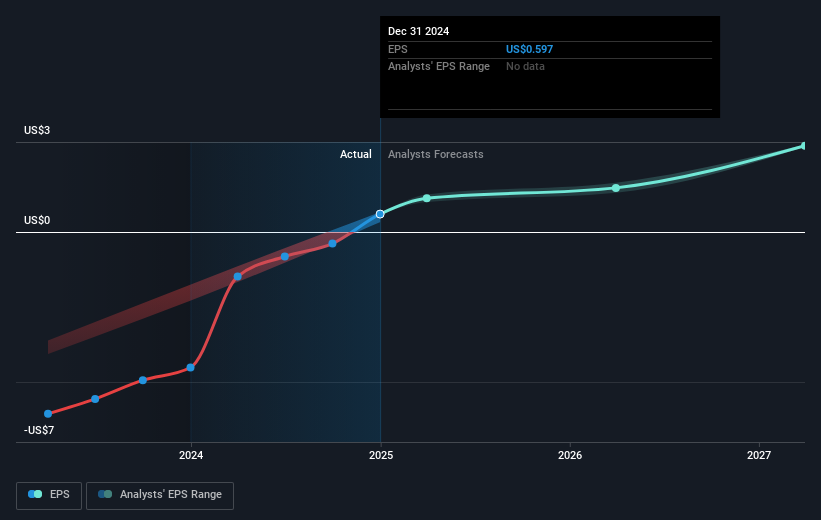

Despite challenges reflected in declining sales, Kyndryl became profitable, marking a notable turnaround in net income. Over the last year, Kyndryl’s share success has eclipsed both the US IT industry, which returned 12.2%, and the broader US market that saw 16.7% in returns. This combination of smart partnerships, financial maneuvering, and profitability has translated into a robust shareholder return over the three-year period.

- Learn how Kyndryl Holdings' intrinsic value compares to its market price with our detailed valuation report.

- Understand the uncertainties surrounding Kyndryl Holdings' market positioning with our detailed risk analysis report.

- Shareholder in Kyndryl Holdings? Ensure you're never caught off-guard by adding your portfolio in Simply Wall St for timely alerts on significant stock developments.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Valuation is complex, but we're here to simplify it.

Discover if Kyndryl Holdings might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

免责声明:投资有风险,本文并非投资建议,以上内容不应被视为任何金融产品的购买或出售要约、建议或邀请,作者或其他用户的任何相关讨论、评论或帖子也不应被视为此类内容。本文仅供一般参考,不考虑您的个人投资目标、财务状况或需求。TTM对信息的准确性和完整性不承担任何责任或保证,投资者应自行研究并在投资前寻求专业建议。

热议股票

- 1

- 2

- 3

- 4

- 5

- 6

- 7

- 8

- 9

- 10