MotorCycle Holdings (ASX:MTO) Has Announced That It Will Be Increasing Its Dividend To A$0.08

MotorCycle Holdings Limited's (ASX:MTO) periodic dividend will be increasing on the 27th of March to A$0.08, with investors receiving 167% more than last year's A$0.03. The payment will take the dividend yield to 5.0%, which is in line with the average for the industry.

See our latest analysis for MotorCycle Holdings

MotorCycle Holdings' Payment Could Potentially Have Solid Earnings Coverage

We aren't too impressed by dividend yields unless they can be sustained over time. Based on the last payment, MotorCycle Holdings was quite comfortably earning enough to cover the dividend. This indicates that a lot of the earnings are being reinvested into the business, with the aim of fueling growth.

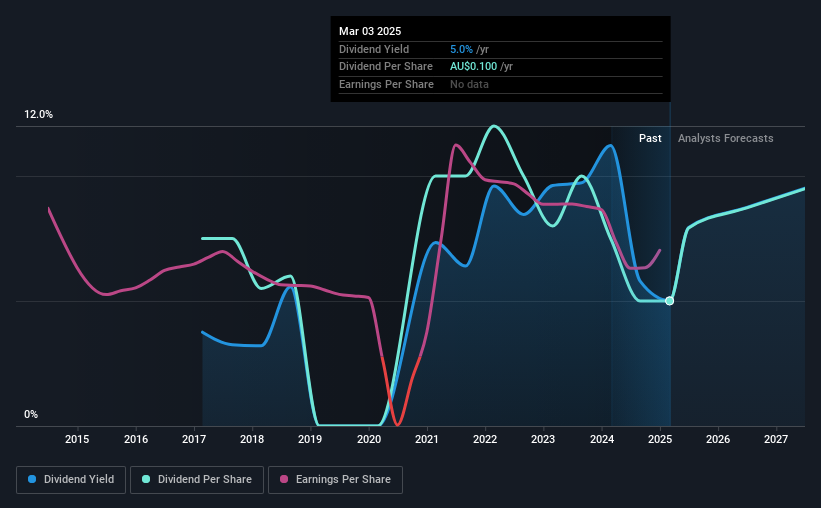

Looking forward, earnings per share is forecast to rise by 34.9% over the next year. Assuming the dividend continues along recent trends, we think the payout ratio could be 52% by next year, which is in a pretty sustainable range.

MotorCycle Holdings' Dividend Has Lacked Consistency

MotorCycle Holdings has been paying dividends for a while, but the track record isn't stellar. Due to this, we are a little bit cautious about the dividend consistency over a full economic cycle. The annual payment during the last 8 years was A$0.15 in 2017, and the most recent fiscal year payment was A$0.10. The dividend has shrunk at around 4.9% a year during that period. A company that decreases its dividend over time generally isn't what we are looking for.

The Dividend Looks Likely To Grow

With a relatively unstable dividend, it's even more important to see if earnings per share is growing. MotorCycle Holdings has seen EPS rising for the last five years, at 12% per annum. The company is paying a reasonable amount of earnings to shareholders, and is growing earnings at a decent rate so we think it could be a decent dividend stock.

MotorCycle Holdings Looks Like A Great Dividend Stock

Overall, we think this could be an attractive income stock, and it is only getting better by paying a higher dividend this year. Earnings are easily covering distributions, and the company is generating plenty of cash. All of these factors considered, we think this has solid potential as a dividend stock.

Investors generally tend to favour companies with a consistent, stable dividend policy as opposed to those operating an irregular one. Meanwhile, despite the importance of dividend payments, they are not the only factors our readers should know when assessing a company. As an example, we've identified 2 warning signs for MotorCycle Holdings that you should be aware of before investing. Is MotorCycle Holdings not quite the opportunity you were looking for? Why not check out our selection of top dividend stocks.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency• Be alerted to new Warning Signs or Risks via email or mobile• Track the Fair Value of your stocks

Try a Demo Portfolio for FreeHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

免责声明:投资有风险,本文并非投资建议,以上内容不应被视为任何金融产品的购买或出售要约、建议或邀请,作者或其他用户的任何相关讨论、评论或帖子也不应被视为此类内容。本文仅供一般参考,不考虑您的个人投资目标、财务状况或需求。TTM对信息的准确性和完整性不承担任何责任或保证,投资者应自行研究并在投资前寻求专业建议。

热议股票

- 1

- 2

- 3

- 4

- 5

- 6

- 7

- 8

- 9

- 10