Do These 3 Checks Before Buying Channel Infrastructure NZ Limited (NZSE:CHI) For Its Upcoming Dividend

It looks like Channel Infrastructure NZ Limited (NZSE:CHI) is about to go ex-dividend in the next four days. The ex-dividend date is usually set to be two business days before the record date, which is the cut-off date on which you must be present on the company's books as a shareholder in order to receive the dividend. The ex-dividend date is an important date to be aware of as any purchase of the stock made on or after this date might mean a late settlement that doesn't show on the record date. This means that investors who purchase Channel Infrastructure NZ's shares on or after the 12th of March will not receive the dividend, which will be paid on the 27th of March.

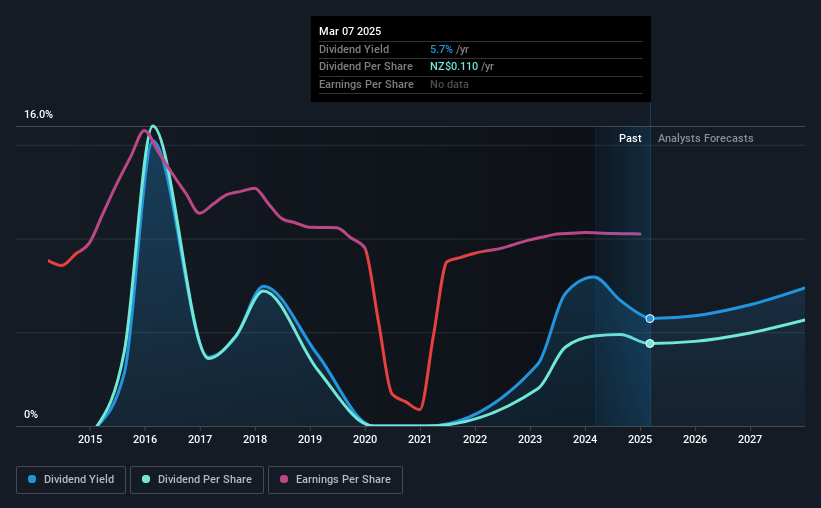

The company's next dividend payment will be NZ$0.066 per share. Last year, in total, the company distributed NZ$0.11 to shareholders. Last year's total dividend payments show that Channel Infrastructure NZ has a trailing yield of 5.7% on the current share price of NZ$1.92. Dividends are an important source of income to many shareholders, but the health of the business is crucial to maintaining those dividends. We need to see whether the dividend is covered by earnings and if it's growing.

Check out our latest analysis for Channel Infrastructure NZ

Dividends are usually paid out of company profits, so if a company pays out more than it earned then its dividend is usually at greater risk of being cut. Channel Infrastructure NZ distributed an unsustainably high 161% of its profit as dividends to shareholders last year. Without extenuating circumstances, we'd consider the dividend at risk of a cut. A useful secondary check can be to evaluate whether Channel Infrastructure NZ generated enough free cash flow to afford its dividend. It paid out an unsustainably high 377% of its free cash flow as dividends over the past 12 months, which is worrying. Unless there were something in the business we're not grasping, this could signal a risk that the dividend may have to be cut in the future.

Cash is slightly more important than profit from a dividend perspective, but given Channel Infrastructure NZ's payments were not well covered by either earnings or cash flow, we are concerned about the sustainability of this dividend.

Click here to see the company's payout ratio, plus analyst estimates of its future dividends.

Have Earnings And Dividends Been Growing?

Stocks in companies that generate sustainable earnings growth often make the best dividend prospects, as it is easier to lift the dividend when earnings are rising. Investors love dividends, so if earnings fall and the dividend is reduced, expect a stock to be sold off heavily at the same time. It's encouraging to see Channel Infrastructure NZ has grown its earnings rapidly, up 37% a year for the past five years. Earnings per share are increasing at a rapid rate, but the company is paying out more than we think is sustainable, based on current earnings. Companies that pay out more than they earned while growing rapidly, can find themselves short of cash in a few years when growth slows.

Channel Infrastructure NZ also issued more than 5% of its market cap in new stock during the past year, which we feel is likely to hurt its dividend prospects in the long run. Trying to grow the dividend while issuing large amounts of new shares reminds us of the ancient Greek tale of Sisyphus - perpetually pushing a boulder uphill.

The main way most investors will assess a company's dividend prospects is by checking the historical rate of dividend growth. Channel Infrastructure NZ has delivered 1.0% dividend growth per year on average over the past 10 years. Earnings per share have been growing much quicker than dividends, potentially because Channel Infrastructure NZ is keeping back more of its profits to grow the business.

Final Takeaway

Should investors buy Channel Infrastructure NZ for the upcoming dividend? Earnings per share have been growing, despite the company paying out a concerningly high percentage of its earnings and cashflow. We struggle to see how a company paying out so much of its earnings and cash flow will be able to sustain its dividend in a downturn, or reinvest enough into its business to continue growing earnings without borrowing heavily. With the way things are shaping up from a dividend perspective, we'd be inclined to steer clear of Channel Infrastructure NZ.

So if you're still interested in Channel Infrastructure NZ despite it's poor dividend qualities, you should be well informed on some of the risks facing this stock. Case in point: We've spotted 1 warning sign for Channel Infrastructure NZ you should be aware of.

Generally, we wouldn't recommend just buying the first dividend stock you see. Here's a curated list of interesting stocks that are strong dividend payers.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)• Undervalued Small Caps with Insider Buying• High growth Tech and AI CompaniesOr build your own from over 50 metrics.

Explore Now for FreeHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

免责声明:投资有风险,本文并非投资建议,以上内容不应被视为任何金融产品的购买或出售要约、建议或邀请,作者或其他用户的任何相关讨论、评论或帖子也不应被视为此类内容。本文仅供一般参考,不考虑您的个人投资目标、财务状况或需求。TTM对信息的准确性和完整性不承担任何责任或保证,投资者应自行研究并在投资前寻求专业建议。

热议股票

- 1

- 2

- 3

- 4

- 5

- 6

- 7

- 8

- 9

- 10