Insiders Of Roma (meta) Group Reap Rewards After Their Investment Jumps Another HK$9.7m

Roma (meta) Group Limited (HKG:8072) insiders who purchased shares in the last 12 months were richly rewarded last week. The stock climbed by 10.0% resulting in a HK$5.4m addition to the company’s market value. In other words, the original HK$14.9m purchase is now worth HK$24.5m.

While insider transactions are not the most important thing when it comes to long-term investing, logic dictates you should pay some attention to whether insiders are buying or selling shares.

See our latest analysis for Roma (meta) Group

The Last 12 Months Of Insider Transactions At Roma (meta) Group

In the last twelve months, the biggest single purchase by an insider was when insider Kee Yan Luk bought HK$15m worth of shares at a price of HK$0.20 per share. Even though the purchase was made at a significantly lower price than the recent price (HK$0.33), we still think insider buying is a positive. Because the shares were purchased at a lower price, this particular buy doesn't tell us much about how insiders feel about the current share price.

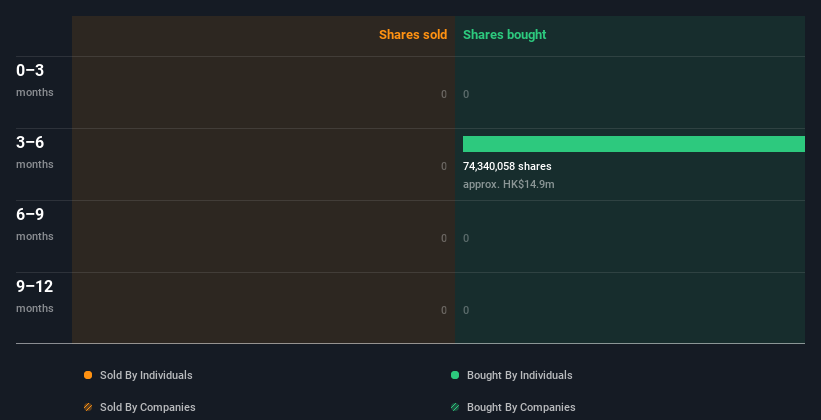

You can see a visual depiction of insider transactions (by companies and individuals) over the last 12 months, below. If you want to know exactly who sold, for how much, and when, simply click on the graph below!

Roma (meta) Group is not the only stock insiders are buying. So take a peek at this free list of under-the-radar companies with insider buying.

Insider Ownership

For a common shareholder, it is worth checking how many shares are held by company insiders. Usually, the higher the insider ownership, the more likely it is that insiders will be incentivised to build the company for the long term. Roma (meta) Group insiders own about HK$28m worth of shares (which is 48% of the company). Most shareholders would be happy to see this sort of insider ownership, since it suggests that management incentives are well aligned with other shareholders.

So What Do The Roma (meta) Group Insider Transactions Indicate?

It doesn't really mean much that no insider has traded Roma (meta) Group shares in the last quarter. However, our analysis of transactions over the last year is heartening. Judging from their transactions, and high insider ownership, Roma (meta) Group insiders feel good about the company's future. While it's good to be aware of what's going on with the insider's ownership and transactions, we make sure to also consider what risks are facing a stock before making any investment decision. You'd be interested to know, that we found 2 warning signs for Roma (meta) Group and we suggest you have a look.

Of course Roma (meta) Group may not be the best stock to buy. So you may wish to see this free collection of high quality companies.

For the purposes of this article, insiders are those individuals who report their transactions to the relevant regulatory body. We currently account for open market transactions and private dispositions of direct interests only, but not derivative transactions or indirect interests.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)• Undervalued Small Caps with Insider Buying• High growth Tech and AI CompaniesOr build your own from over 50 metrics.

Explore Now for FreeHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

免责声明:投资有风险,本文并非投资建议,以上内容不应被视为任何金融产品的购买或出售要约、建议或邀请,作者或其他用户的任何相关讨论、评论或帖子也不应被视为此类内容。本文仅供一般参考,不考虑您的个人投资目标、财务状况或需求。TTM对信息的准确性和完整性不承担任何责任或保证,投资者应自行研究并在投资前寻求专业建议。

热议股票

- 1

- 2

- 3

- 4

- 5

- 6

- 7

- 8

- 9

- 10