Ollie's Bargain Outlet Holdings, Inc. (NASDAQ:OLLI) reported in-line earnings for the fourth quarter on Wednesday.

The company reported fourth-quarter adjusted earnings per share of $1.19, in line with the analyst consensus estimate. Quarterly sales of $667.1 million (up 2.8% year over year) missed the analyst consensus estimate of $674.5 million.

Comparable store sales increased 2.8% from the prior year's increase of 3.9%.

"With so many retailers closing stores or going bankrupt in the past year, there are a considerable number of abandoned customers, merchandise, real estate, and talent in the marketplace," said Eric van der Valk, President and Chief Executive Officer.

In a separate release, Ollie's Bargain Outlet announced a new $300 million share repurchase authorization through March 31, 2029.

The company is accelerating new store openings during fiscal 2025 to 75 stores from 50 in fiscal 2024. Comparable store sales is expected to increase 1% to 2%.

Ollie's Bargain outlet sees FY25 sales of $2.564 billion – $2.586 billion versus the $2.572 billion estimate. The company projects adjusted EPS of $3.65 to $3.75 versus the $3.78 estimate.

Ollie's Bargain shares gained 1.5% to trade at $109.50 on Thursday.

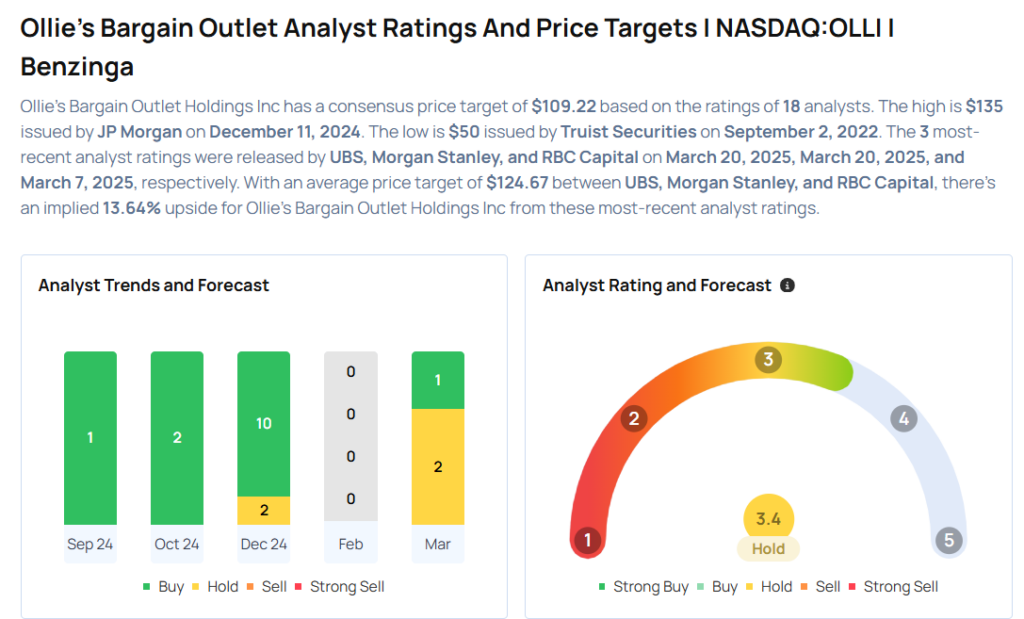

These analysts made changes to their price targets on Ollie's Bargain following earnings announcement.

- Morgan Stanley analyst Simeon Gutman maintained Ollie’s Bargain Outlet with an Equal-Weight rating and raised the price target from $108 to $118.

- UBS analyst Mark Carden maintained the stock with a Neutral and raised the price target from $117 to $123.

Considering buying OLLI stock? Here’s what analysts think:

Read This Next:

- Jim Cramer Says TJX Is ‘Terrific,’ Recommends Buying These Stocks