Independent Director of IonQ William Scannell Buys 222% More Shares

IonQ, Inc. (NYSE:IONQ) shareholders (or potential shareholders) will be happy to see that the Independent Director, William Scannell, recently bought a whopping US$2.0m worth of stock, at a price of US$21.81. That increased their holding by a full 222%, which arguably implies the sort of confidence required for a shy sweet-natured nerd to ask the most popular kid in the school to go out on a date.

View our latest analysis for IonQ

The Last 12 Months Of Insider Transactions At IonQ

In fact, the recent purchase by William Scannell was the biggest purchase of IonQ shares made by an insider individual in the last twelve months, according to our records. Even though the purchase was made at a significantly lower price than the recent price (US$25.00), we still think insider buying is a positive. Because it occurred at a lower valuation, it doesn't tell us much about whether insiders might find today's price attractive.

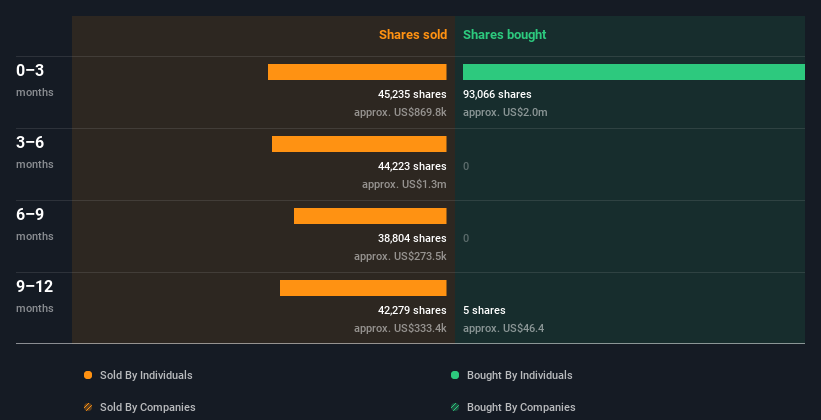

In the last twelve months insiders purchased 93.07k shares for US$2.0m. On the other hand they divested 170.54k shares, for US$2.8m. All up, insiders sold more shares in IonQ than they bought, over the last year. The chart below shows insider transactions (by companies and individuals) over the last year. If you want to know exactly who sold, for how much, and when, simply click on the graph below!

I will like IonQ better if I see some big insider buys. While we wait, check out this free list of undervalued and small cap stocks with considerable, recent, insider buying.

Insider Ownership

I like to look at how many shares insiders own in a company, to help inform my view of how aligned they are with insiders. We usually like to see fairly high levels of insider ownership. It's great to see that IonQ insiders own 8.5% of the company, worth about US$474m. This kind of significant ownership by insiders does generally increase the chance that the company is run in the interest of all shareholders.

What Might The Insider Transactions At IonQ Tell Us?

It's certainly positive to see the recent insider purchase. However, the longer term transactions are not so encouraging. The recent buying by an insider , along with high insider ownership, suggest that IonQ insiders are fairly aligned, and optimistic. In addition to knowing about insider transactions going on, it's beneficial to identify the risks facing IonQ. Be aware that IonQ is showing 2 warning signs in our investment analysis, and 1 of those doesn't sit too well with us...

Of course IonQ may not be the best stock to buy. So you may wish to see this free collection of high quality companies.

For the purposes of this article, insiders are those individuals who report their transactions to the relevant regulatory body. We currently account for open market transactions and private dispositions of direct interests only, but not derivative transactions or indirect interests.

If you're looking to trade IonQ, open an account with the lowest-cost platform trusted by professionals, Interactive Brokers.

With clients in over 200 countries and territories, and access to 160 markets, IBKR lets you trade stocks, options, futures, forex, bonds and funds from a single integrated account.

Enjoy no hidden fees, no account minimums, and FX conversion rates as low as 0.03%, far better than what most brokers offer.

Sponsored ContentNew: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)• Undervalued Small Caps with Insider Buying• High growth Tech and AI CompaniesOr build your own from over 50 metrics.

Explore Now for FreeHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

免责声明:投资有风险,本文并非投资建议,以上内容不应被视为任何金融产品的购买或出售要约、建议或邀请,作者或其他用户的任何相关讨论、评论或帖子也不应被视为此类内容。本文仅供一般参考,不考虑您的个人投资目标、财务状况或需求。TTM对信息的准确性和完整性不承担任何责任或保证,投资者应自行研究并在投资前寻求专业建议。

热议股票

- 1

- 2

- 3

- 4

- 5

- 6

- 7

- 8

- 9

- 10