Merck (NYSE:MRK) Unveils New Data On Cardiovascular Advances At ACC.25 Annual Conference

Merck (NYSE:MRK) experienced a 13% increase in its stock price over the last month, aided by several significant developments. The company's upcoming presentations at the American College of Cardiology's Annual Scientific Session, particularly the announcement of Phase 3 results for WINREVAIR™ targeting pulmonary arterial hypertension, highlight ongoing advancements in cardiovascular research. Additionally, positive Phase 3 trial results for the HIV-1 treatment DOR/ISL further underscore Merck's progress in drug development. Strategic efforts like the FDA's priority review for KEYTRUDA® and European approval for WELIREG® strengthen its oncology portfolio. Meanwhile, a collaboration with Sierra Space points to innovative biopharmaceutical research pursuits. Despite a mixed market performance, with major indices showing fluctuations amid economic uncertainties, Merck's innovations and market positioning have propelled its share value, aligning with broader market uptrend over the year. This combination of clinical achievements and strategic initiatives likely contributed to Merck's recent stock price rise.

Buy, Hold or Sell Merck? View our complete analysis and fair value estimate and you decide.

These 14 companies survived and thrived after COVID and have the right ingredients to survive Trump's tariffs. Discover why before your portfolio feels the trade war pinch.

The last five years have showcased substantial growth for Merck, achieving a total shareholder return of 68.51%. During this period, the company's advancements, particularly with the KEYTRUDA drug, have been significant. Noteworthy approvals and expanded indications for KEYTRUDA—such as the monotherapy for metastatic cancers—have consistently strengthened Merck's oncology portfolio. Additionally, the launch of a US$1 billion vaccine manufacturing facility as part of a US$20 billion investment plan underscores the company's commitment to growth and innovation in the healthcare sector.

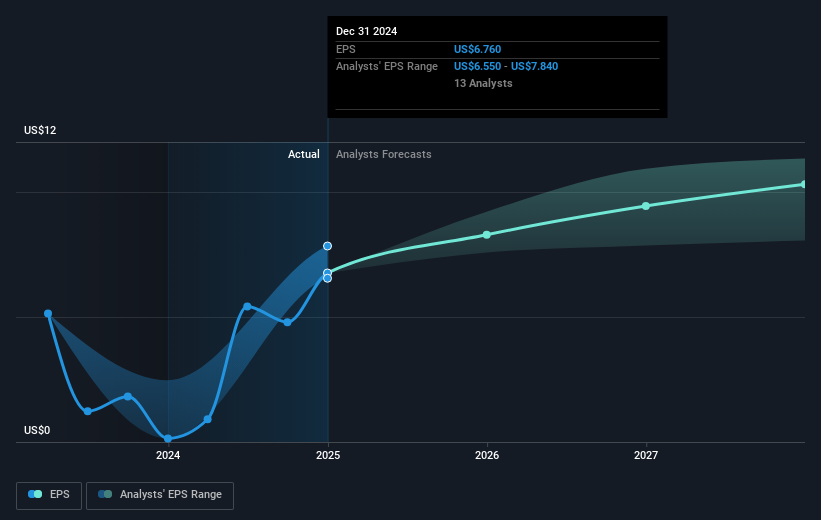

Financially, Merck's strong earnings growth, with recent net income results reaching US$17.12 billion for 2024, highlight significant profitability advancements. The company's share repurchase program, resulting in the buyback of 84 million shares for US$7.55 billion, reflects confidence in its market positioning. Despite underperforming the US Pharmaceuticals industry over the past year, Merck's substantial efforts in drug development and strategic partnerships have positioned it well over the longer term.

Gain insights into Merck's historical outcomes by reviewing our past performance report.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

If you're looking to trade Merck, open an account with the lowest-cost platform trusted by professionals, Interactive Brokers.

With clients in over 200 countries and territories, and access to 160 markets, IBKR lets you trade stocks, options, futures, forex, bonds and funds from a single integrated account.

Enjoy no hidden fees, no account minimums, and FX conversion rates as low as 0.03%, far better than what most brokers offer.

Sponsored ContentNew: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency• Be alerted to new Warning Signs or Risks via email or mobile• Track the Fair Value of your stocks

Try a Demo Portfolio for FreeHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

免责声明:投资有风险,本文并非投资建议,以上内容不应被视为任何金融产品的购买或出售要约、建议或邀请,作者或其他用户的任何相关讨论、评论或帖子也不应被视为此类内容。本文仅供一般参考,不考虑您的个人投资目标、财务状况或需求。TTM对信息的准确性和完整性不承担任何责任或保证,投资者应自行研究并在投资前寻求专业建议。

热议股票

- 1

- 2

- 3

- 4

- 5

- 6

- 7

- 8

- 9

- 10