MARA Holdings (NasdaqCM:MARA) Sees 13% Rise Following New Auditor Appointment

MARA Holdings (NasdaqCM:MARA) experienced a significant share price movement, rising 13% over the last week. This increase came on the heels of MARA Holdings announcing the appointment of PricewaterhouseCoopers LLP as its new independent registered public accounting firm, succeeding Marcum LLP. Despite the market's modest 1.8% rise during the same period, MARA's performance seems particularly strong, potentially reflecting investor confidence following recent notable earnings growth. This collective set of events aligns with broader market optimism, as indices like the S&P 500 and Nasdaq showed slight gains, continuing their rebound from recent downturns.

Every company has risks, and we've spotted 5 risks for MARA Holdings (of which 3 are concerning!) you should know about.

We've found 19 US stocks that are forecast to pay a dividend yeild of over 6% next year. See the full list for free.

The last five years have seen MARA Holdings deliver a very large total shareholder return of 2881.63%, reflecting significant strides in transforming its business strategy. This impressive growth rate towers over industry norms, capturing investor attention even as recent performance has lagged the U.S. Software sector. Key milestones include the strategic expansion into AI and energy solutions, effectively lowering operational costs and boosting profitability. The acquisition of data centers in Ohio, which added 372 megawatts to its compute capacity, has bolstered its infrastructure capabilities. This forward-thinking expansion, compounded by the profitability boost from energy asset ownership, undeniably contributed to its long-term share performance.

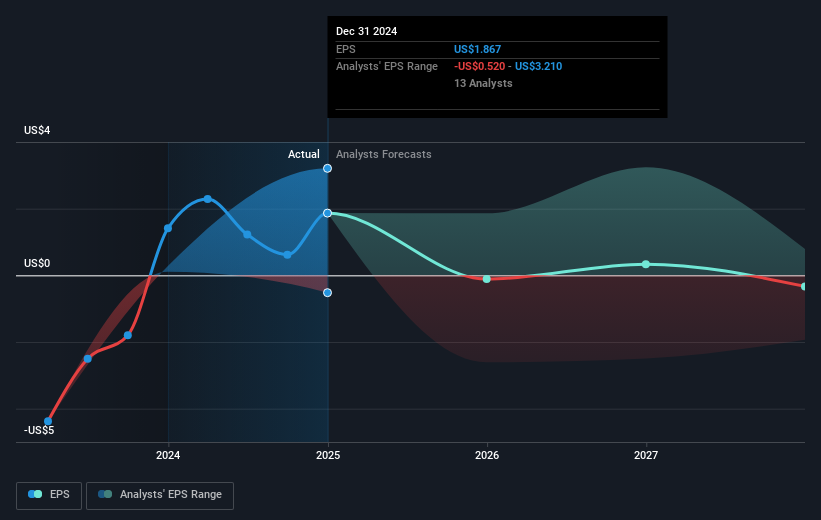

Further contributing to this upward trajectory was MARA's impressive earnings growth, with the company's 2024 net income climbing to US$541.25 million, up significantly year-on-year. Additionally, the successful launch of new technologies, such as the MARA 2PIC700 cooling system, paved the way for operational efficiency improvements. Despite these advancements, shareholders have seen dilution, as evidenced by increased authorized shares. The company's addition to indices like S&P 600 in mid-2024 also enhanced its market presence, fostering increased investor interest and confidence in its growth strategy.

Explore historical data to track MARA Holdings' performance over time in our past results report.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency• Be alerted to new Warning Signs or Risks via email or mobile• Track the Fair Value of your stocks

Try a Demo Portfolio for FreeHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

免责声明:投资有风险,本文并非投资建议,以上内容不应被视为任何金融产品的购买或出售要约、建议或邀请,作者或其他用户的任何相关讨论、评论或帖子也不应被视为此类内容。本文仅供一般参考,不考虑您的个人投资目标、财务状况或需求。TTM对信息的准确性和完整性不承担任何责任或保证,投资者应自行研究并在投资前寻求专业建议。

热议股票

- 1

- 2

- 3

- 4

- 5

- 6

- 7

- 8

- 9

- 10