With Tarsus Pharmaceuticals, Inc. (NASDAQ:TARS) It Looks Like You'll Get What You Pay For

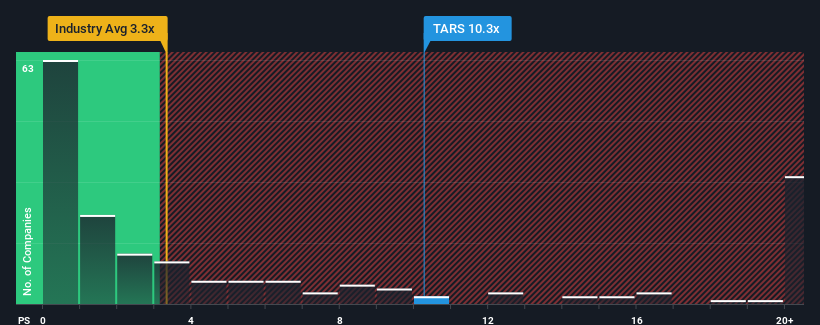

Tarsus Pharmaceuticals, Inc.'s (NASDAQ:TARS) price-to-sales (or "P/S") ratio of 10.3x might make it look like a strong sell right now compared to the Pharmaceuticals industry in the United States, where around half of the companies have P/S ratios below 3.3x and even P/S below 1x are quite common. However, the P/S might be quite high for a reason and it requires further investigation to determine if it's justified.

Trump has pledged to "unleash" American oil and gas and these 15 US stocks have developments that are poised to benefit.

View our latest analysis for Tarsus Pharmaceuticals

How Has Tarsus Pharmaceuticals Performed Recently?

Tarsus Pharmaceuticals certainly has been doing a good job lately as it's been growing revenue more than most other companies. It seems that many are expecting the strong revenue performance to persist, which has raised the P/S. However, if this isn't the case, investors might get caught out paying too much for the stock.

Keen to find out how analysts think Tarsus Pharmaceuticals' future stacks up against the industry? In that case, our free report is a great place to start.What Are Revenue Growth Metrics Telling Us About The High P/S?

In order to justify its P/S ratio, Tarsus Pharmaceuticals would need to produce outstanding growth that's well in excess of the industry.

Retrospectively, the last year delivered an explosive gain to the company's top line. The amazing performance means it was also able to grow revenue by 221% in total over the last three years. So we can start by confirming that the company has done a great job of growing revenue over that time.

Turning to the outlook, the next three years should generate growth of 57% each year as estimated by the seven analysts watching the company. That's shaping up to be materially higher than the 20% per annum growth forecast for the broader industry.

With this in mind, it's not hard to understand why Tarsus Pharmaceuticals' P/S is high relative to its industry peers. Apparently shareholders aren't keen to offload something that is potentially eyeing a more prosperous future.

What We Can Learn From Tarsus Pharmaceuticals' P/S?

Using the price-to-sales ratio alone to determine if you should sell your stock isn't sensible, however it can be a practical guide to the company's future prospects.

As we suspected, our examination of Tarsus Pharmaceuticals' analyst forecasts revealed that its superior revenue outlook is contributing to its high P/S. At this stage investors feel the potential for a deterioration in revenues is quite remote, justifying the elevated P/S ratio. Unless these conditions change, they will continue to provide strong support to the share price.

It is also worth noting that we have found 1 warning sign for Tarsus Pharmaceuticals that you need to take into consideration.

If these risks are making you reconsider your opinion on Tarsus Pharmaceuticals, explore our interactive list of high quality stocks to get an idea of what else is out there.

Valuation is complex, but we're here to simplify it.

Discover if Tarsus Pharmaceuticals might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

免责声明:投资有风险,本文并非投资建议,以上内容不应被视为任何金融产品的购买或出售要约、建议或邀请,作者或其他用户的任何相关讨论、评论或帖子也不应被视为此类内容。本文仅供一般参考,不考虑您的个人投资目标、财务状况或需求。TTM对信息的准确性和完整性不承担任何责任或保证,投资者应自行研究并在投资前寻求专业建议。

热议股票

- 1

- 2

- 3

- 4

- 5

- 6

- 7

- 8

- 9

- 10